We found a promising Polish compounder

After Dino Polska and Auto Partner, we might have found another fast-growing Polish businesses with net margins of over 50% and ROIC of over 100%.

We just released our premium fundamental analysis of Text S.A in both audio and text on www.thedutchinvestors.com. And what a promising and interesting company!

Text S.A. is a Polish small-cap operating in the live chat technology industry. The company is led by its three original founders, who remain actively involved. The company has returned a solid 13% CAGR since it’s IPO back in 2014.

To give you an idea of what they do. You’ll find a 'Chat with us' icon on almost every website these days. It was designed to enhance the customer experience and improve customer service. This is partly what Text SA offers as well.

Text SA basically (tries) to provide software that allows for better customer service through text. They used to offer single products with licenses, but are now moving to an 'ecosystem' or, as they like to call it; suite. They develop and sell customer service software as a subscription model (SaaS).

The platforms they currently offer are:

LiveChat: A platform for text communication and the primary platform for text-based interactions at the moment. It lets businesses (IKEA for example) connect with customers (you and me).

ChatBot: A platform for creating and managing chatbots. It automates customers service with AI.

HelpDesk: An automated ticketing system to help customers.

KnowledgeBase: An application for creating and sharing a knowledge base. It provides guides and educates customers.

OpenWidget: A solution for easily integrating widgets into websites.

They sell these services to businesses (B2B).

Competitive Advantage

After more than 50 hours of research on Text, we realized that maintaining a sustainable competitive advantage in their specific niche market is extremely challenging. The market is constantly evolving, with significant investments in R&D required to stay ahead of the competition.

The first moat that comes to mind is economies of scale. Their solutions are used by thousands of companies and hundreds of millions of end-users (consumers, like you and me). This gives Text an enormous amount of data and experience they can use for further growth and development. It's also one of the 'newer' moats where having better and more data becomes a moat on its own. Think of Google's search data or user behavior on Instagram. This focus on data strategy can become very powerful, if utilized effective. It remains to be seen if Text can fully capitalize on their economies of scale, since they're still relatively small (<$500 million). Even though they have been going at it for 20 years. However, they are not the biggest player, which is Tawk.to (>20% market share in Live Chat) so perhaps this moat is obsolete, since others have access to more data...

IR said the following about their moat:

The company's moat is in the data we possess and can analyze, and we will be further investing in this, including data on our customers. The product also has great user experience and customer support, which is not that easy to copy as there are more than 200 products in the live chat space, but we continuously manage to provide a superb product here. - Text SA

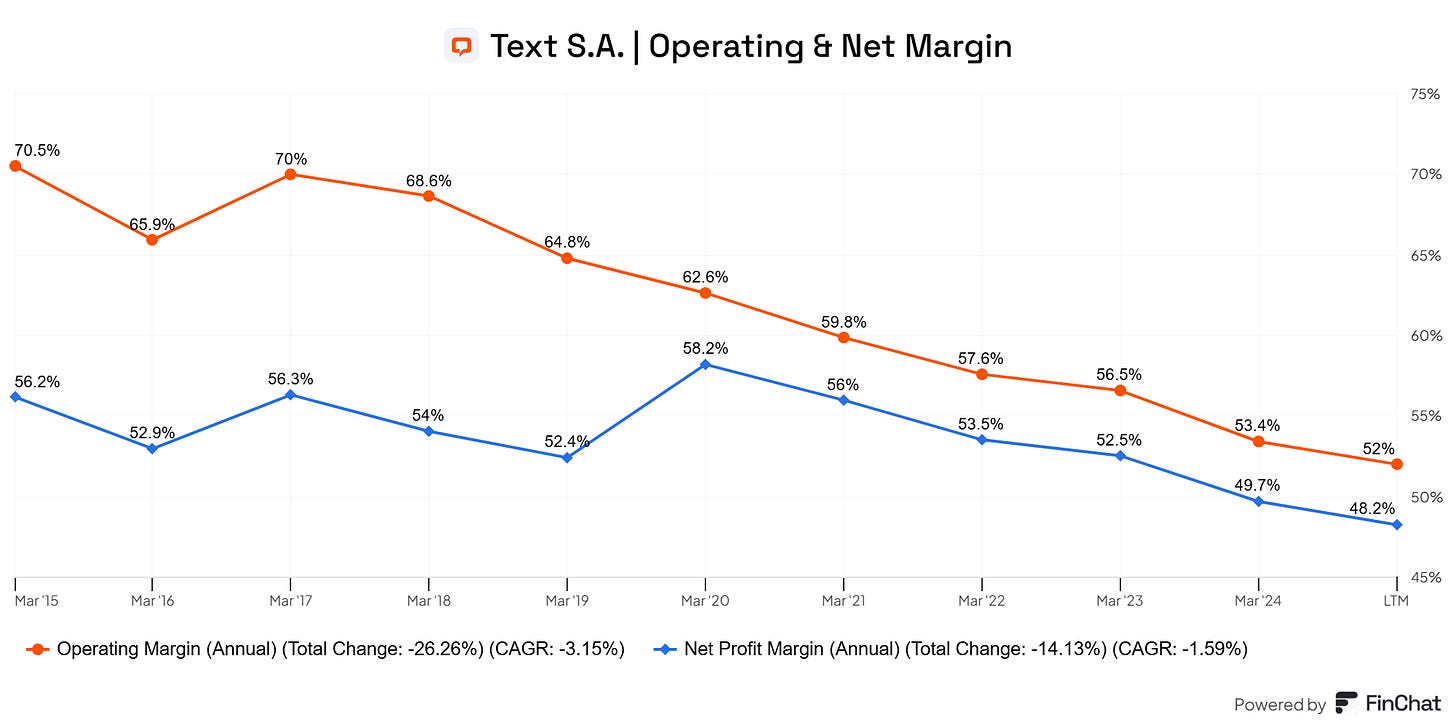

One of the key advantages (though I wouldn’t call it a durable advantage) of Text SA is their effective, automated sales process for small and medium-sized businesses, the (niche) segment they are currently biggest in. This allows Text SA to acquire and retain customers in a cost-efficient way. Text is also trying to reach larger customers. Currently, they have just 25 larger clients (Fortune 500), like PayPal, IKEA, Atlassian, McDonald's and Ryanair. But they're also trying to enter that market. This efficiency is evident in their operating margin of 52% and net profit margin of 48%.

All the products are becoming part of an ecosystem (they call it a 'suite'). As a result, their users can integrate them to enhance team productivity and effectiveness, address business needs, and improve customer experiences. I believe that if they manage to establish the "Text suite", their moat will become considerably stronger. Still not unbreakable, but definitely stronger.

IR said the following about building an ecosystem (suite):

Many investors looking at our company see LiveChat as a simple, easy-to-copy solution. Of course, if someone needs a live chat solution only as an additional communication channel, this may be the case. However, over the years of development, our LiveChat has become a platform that offers a lot of functionalities, integrations, tools supporting monetization, reporting, team management, etc. Transforming our product portfolio into a suite should strengthen this effect. Additionally, we provide data security and privacy, compliance with key legal regulations, etc. At the end of the day, our platform processes millions of interactions per day. This is not something you can copy overnight. - Text SA

I (Siem) find Text to be an extremely interesting company that is very attractively valued. It’s a SaaS company transitioning from standalone solutions to a suite. Below are some points I find positive.

Positives about Text:

The founder is still at the helm.

While it represents a small part of a company’s operations, it is an essential function and unlikely to face budget cuts.

B2B is generally a stronger and stickier business model.

It’s an extremely capital-light business model with very high margins.

They have many customers and low churn, which suggests they offer a high-quality product at a reasonable price.

If you’re interested in gaining access to our entire fundamental report on Text, either in audio or ‘text’ (pun intended), head on over to www.thedutchinvestors.com. Our team of analysts deliver a new company deep dive to our members every single week.

This way, we can expand your investing universe and save you a lot of time!

So happy to see a Polish company mentioned

Hey man researched this before. Gpt integrations and llm chat bots Will kill their business. Literally no moat