Unknown to many, used by millions | A French small-cap

This French small-cap has customers like LVMH, Dior and Danone.

In February 2025, our analyst Siem analyzed French small-cap Robertet, after my interest was sparked through conversations with

, who holds this stock as a meaningful part of his portfolio.Luckily, the founder of

was kind enough to record the fundamental analysis of Robertet with us. It is now available to our premium members over on www.thedutchinvestors.com. Both as a podcast and written report.About Robertet

If you've ever enjoyed the delicate aroma of a fine perfume, the rich taste of a natural vanilla extract, or the soothing scent of a luxury skincare product, chances are you've encountered Robertet, whether you realized it or not.

Founded in 1850 in Grasse, France, the heartland of perfumery, Robertet has spent the last 170 years perfecting the art and science of natural ingredients. Today, it stands as a world leader in flavors, fragrances, and active ingredients, working with some of the most prestigious brands in food, beverages, and cosmetics.

But what makes Robertet truly special? Unlike many competitors that rely on synthetic ingredients, Robertet is obsessed with nature. They source, cultivate, and transform plant materials into high-quality natural extracts, ensuring the purity and sustainability of their products. With an extensive catalog of over 1700 natural raw materials, they are the go-to supplier for companies that prioritize authenticity and craftsmanship.

How do they make money?

Family-owned business; Robertet generates revenue by developing, producing, and selling natural ingredients used in perfumes, food flavors, and active components for health and beauty products. It serves industries such as food & beverages, cosmetics, and personal care.

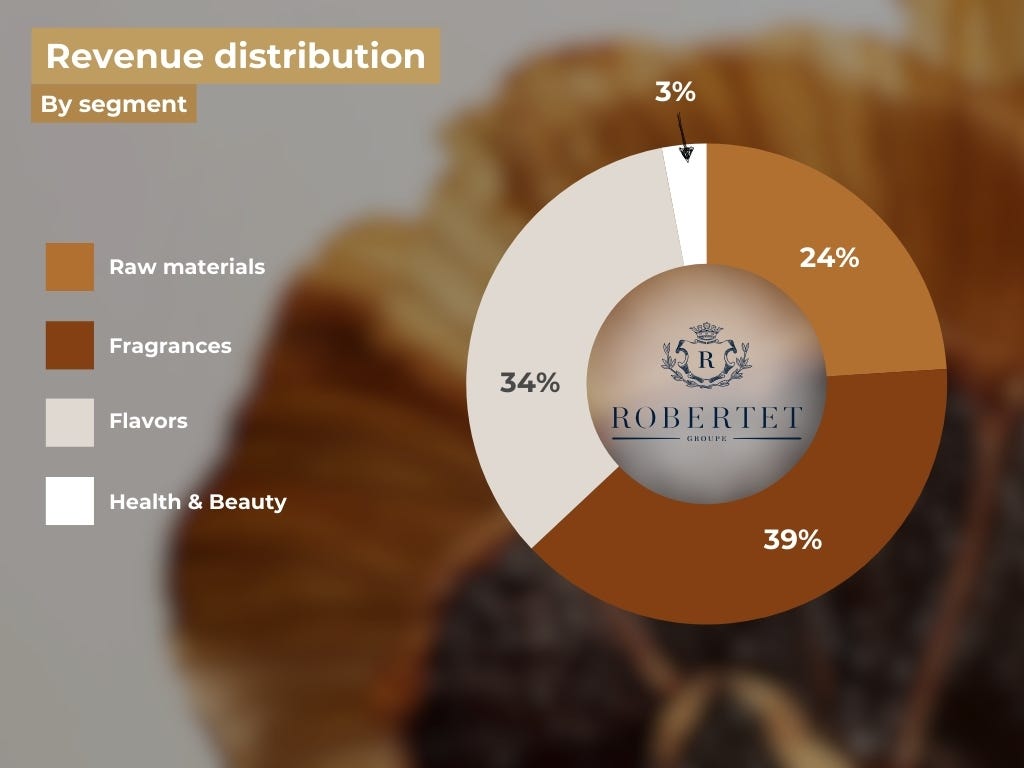

Revenue is divided into four main segments:

Fragrances: Robertet creates scents that are used in perfumes, skincare, and home products. Like lavender in lotion or jasmine in perfume.

Flavors: They develop flavors that make food and drinks taste better. Like real citrus in soda or vanilla in baked goods.

Raw materials: They turn plants into oils and extracts, like rose oil or peppermint extract.

Health & beauty: Think, cosmetics. Like aloe vera in creams or plant extracts in serums.

In FY2024, Robertet earned €807.6 million in revenue. Up 12%, or, on a like-for-like basis (LFL) up 9.6% The difference is mostly currency and acquisitions. The cost of goods sold has increased by a similar growth rate.

Revenue is well diversified, they’re not too reliant on a single segment. Great. Health & beauty is quite new and still unprofitable, but a potential growth driver.

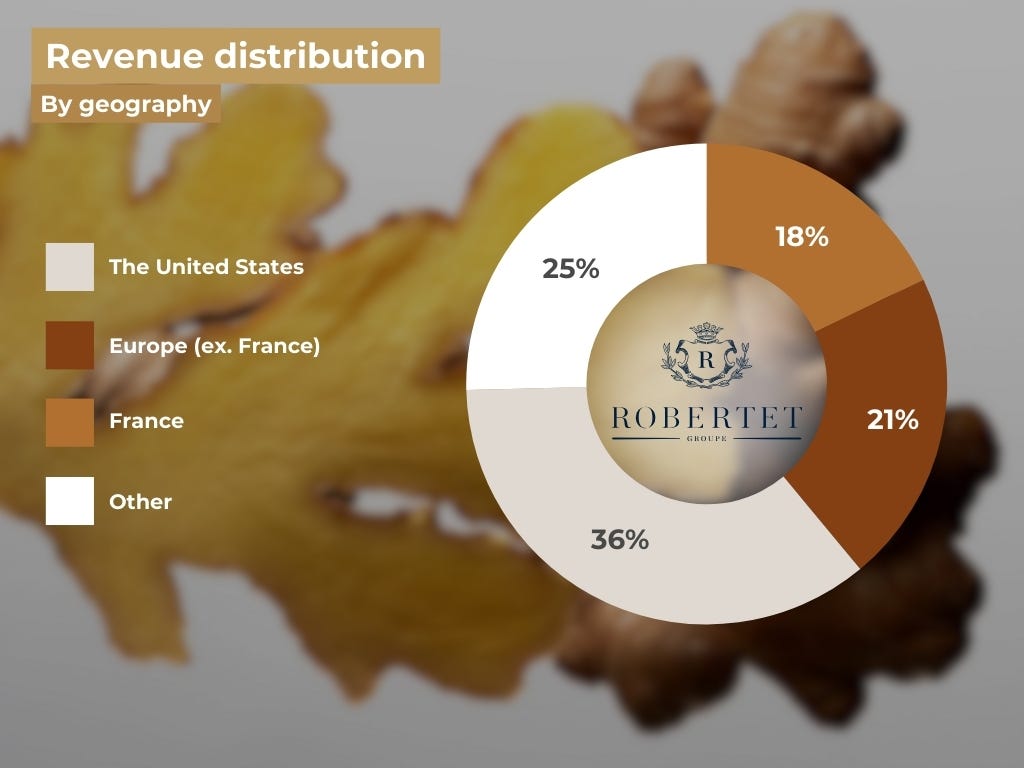

Just as revenue is well diversified for different segments, they are also well diversified geographically. So far, there's a lot to like about their business model and finances.

They have 9 natural raw material sites (places where Robertet grows, harvests, or sources natural ingredients like flowers, herbs, fruits, and spices), 14 creation and research centers (labs and innovation hubs where scientists and perfumers develop new scents, flavors, and ingredients) and 31 industrial sites worldwide (factories and production facilities where Robertet manufactures and processes its products).

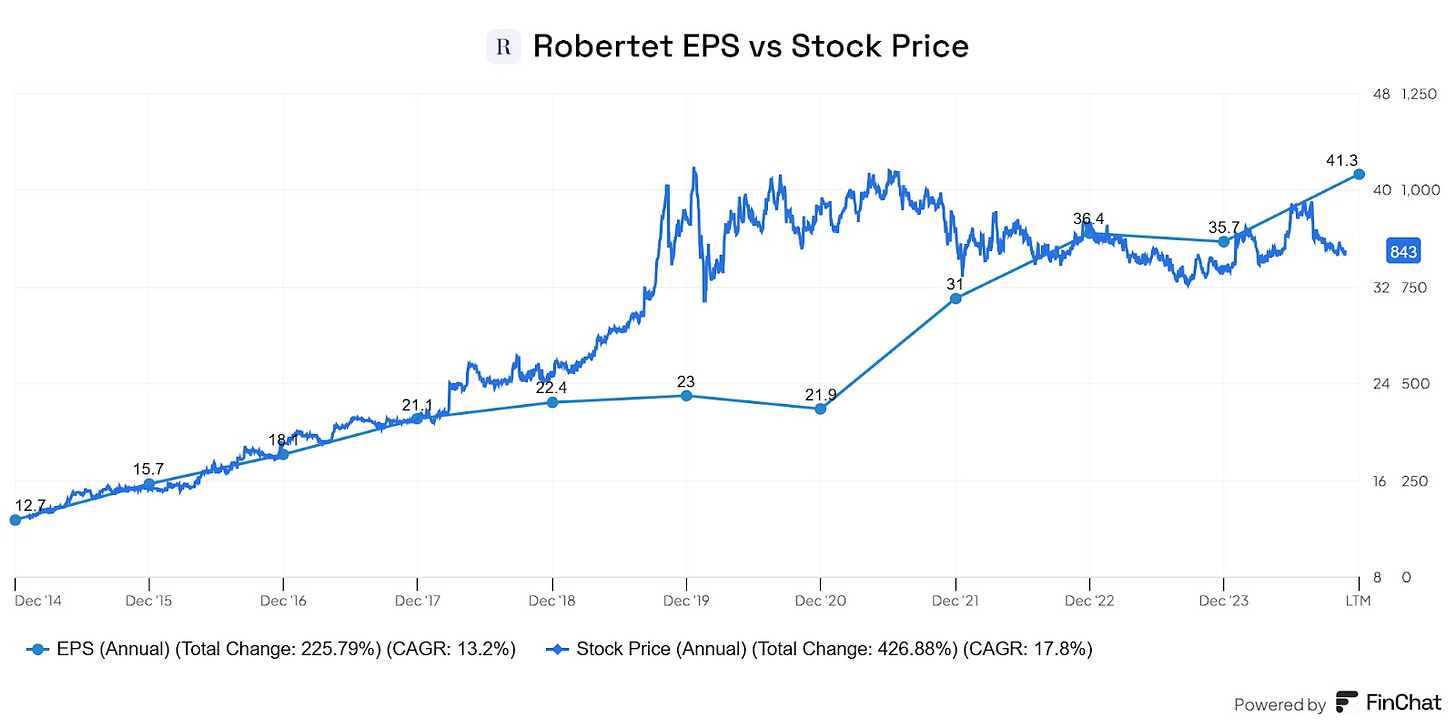

Scientific research has shown that, eventually, EPS (Earnings Per Share) and stock price (valuation) tend to move in the same direction. There are periods when certain companies are overvalued or undervalued, and Robertet is no exception.

Currently, we see that EPS is growing slightly faster than the stock price, which could indicate that the valuation has become cheaper compared to performance. Overall, EPS seems to be a strong indicator of Robertet’s stock performance.

Robertet is a wonderful company, family led, deeply entrenched in a must-have industries, and uniquely positioned within the natural flavors and fragrances market. It operates in a unique niche that prioritizes quality, sustainability, and control. The company’s "Seed to Scent" approach and control over rare raw materials give it a significant edge that competitors struggle to replicate.

The company has high margins, a disciplined capital allocation strategy, and a debt level well under control. The company is not chasing aggressive M&A but rather focuses on steady, organic growth with occasional strategic acquisitions. Management has significant skin in the game, with the Maubert family controlling over 60% of voting rights.

In our premium fundamental analysis of Robertet, we go much more in-depth. Here is what the average analysis covers, in this case, Robertet.

The analysis is available as a podcast, readable as PDF and natively on our TDI-Dashboard.

In case you missed it…

A quality company from Japan

For cyclists and fishermen, Shimano is a household name. For investors? Not so much. This while Shimano is a near-monopoly and does multiple things better than the competition. Its balance sheet is rock solid!

A company more luxurious than Ferrari & Hermes

Luxury is a relative concept. A $50.000 Hermès Birkin bag is expensive, but in the world of ultra-high-net-worth individuals (UHNWI), it barely scratches the surface of true exclusivity. If you really want to understand extreme wealth, you need to look at some of the rarest and most exclusive assets’ money can buy; (custom)

We found a promising Polish compounder

We just released our premium fundamental analysis of Text S.A in both audio and text on www.thedutchinvestors.com. And what a promising and interesting company!

Since January 1st we released the following premium reports for members. (You can click on the company name to go directly to the report and podcast).

Nedap | Dutch software company operating as a leader in niche markets.

Text S.A. | A fast-growing Polish software company with ROIC over 100%.

Advanced Drainage Systems | An essential water management company.

TSMC | The largest and most advanced chip manufacturer in the world.

Geberit | A Swiss leader in innovative sanitary systems.

The Italian Sea Group | An Italian luxury yacht manufacturer.

MSCI | A global provider of investment indices and analytics.

Shimano | A Japanese pioneer in cycling and fishing gear.

Robertet | A French expert in natural flavors and fragrances.

Thank you for having me on the podcast, it was a blast :)

It’s a very interesting one, especially given the valuation discount to Givaudan/Symrise or DSM-Firmenich. However the lack of liquidity and family ownership have really not helped. After the bump during covid, the stock has meaningfully under-performed being down -12% over the last five years while GIVN is up almost 40%.