Couche-Tard | It's all or nothing

Is Couche-Tard on the brink of becoming a global giant, or is it driving headfirst into financial peril? Discover the stakes of this beautiful, risky company.

If there’s one key takeaway from this article, it’s this:

The investment case for Couche-Tard is extreme. The company will either consolidate the market and emerge as a dominant leader, or it faces a significant risk of bankruptcy.

Keep reading and decide for yourself.

Let’s start with a brief introduction about Couche-Tard.

"Food for those who stay up late". In French, this translates to "Couche-Tard" (from now on, CT). Coincidentally, that's also the name of the company you'll be learning all about today. CT operates convenience stores worldwide, and its mission is simple:

"to make our customers’ lives a little easier every day."

This probably sounds familiar: you’re on the road for a while, you need to stop for gas, and you’re feeling hungry. Even though you know you’re paying more than you would at a supermarket, you still grab a snack. After all, there aren’t many other options nearby. This is exactly how CT makes its money.

The gas stations attract customers, and the convenience stores sell the usual products you’d expect to find at an (American) gas station: coffee, soft drinks, alcohol, cigarettes, and snacks.

💡 80% of the products sold are consumed within an hour of purchase.

A typical CT location in the U.S. looks like this:

The extreme business case of Couche-Tard

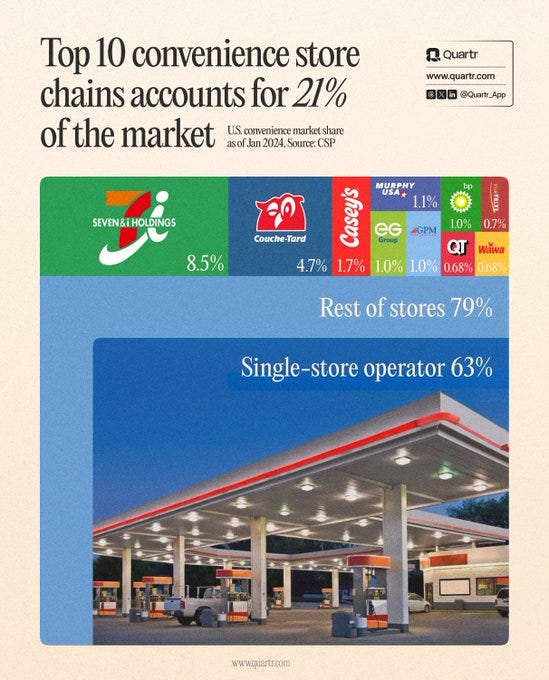

Couche-Tard operates around 16.000 convenience stores and gas stations worldwide. In the U.S., this market is highly fragmented.

This fragmentation is surprising because industries with low margins typically consolidate, as economies of scale make a huge difference, just look at Walmart and Costco. If it’s up to Couche-Tard the convenience store sector will consolidate as well. And they don’t plan to be the one being acquired. They are the acquirer!

In August, Couche-Tard made a $38.5 billion offer for Seven-Eleven, which is a subsidiary of Japan's Seven & i Holdings. Although the bid was declined, this is likely not the end of their pursuit.

Couche-Tard has a strong track record of successful acquisitions, and their economies of scale continue to grow. Meanwhile, their competitors are struggling with inflation and, more importantly, the transition to renewable fuels.

However, this doesn’t guarantee Couche-Tard’s success in adapting to renewable fuels. As you can see below, they are highly dependent on selling fuel.

Is selling electricity as profitable as selling gasoline? Will a new competitor emerge to take market share? As electric vehicle ranges increase, will people charge more at home and stop less during their travels, leading to decreased foot traffic in Couche-Tard’s stores?

If Couche-Tard fails to adapt its business model and overextends itself with debt-fueled acquisitions, these changes could push the company towards bankruptcy.

On the other hand, if Couche-Tard can acquire struggling competitors at bargain prices while successfully transforming its business model, it could continue compounding.

One thing is certain: this will be a rollercoaster ride. There will likely be many opportunities on the downside (if they survive), and at some point, it’s bound to become overvalued.

With a P/E ratio of 20 today, the margin of safety is slim.

Massive update announcement!

Our premium analyses are now also recorded as audio-analyses for TDI members! So you can listen to your favorite analyses anywhere you go!

Not only that, we’ve also added our live personal investment portfolio’s! You can now track all our holdings, live buy & sell alerts, and stay up-to-date on anything we do in our personal portfolio’s, at all times!

Our prices will increase by over 100% in a few weeks. If you’ve been considering joining, now is the perfect time to take advantage of our current rates and secure significant savings. Don’t miss out on this opportunity to get exceptional value before the changes take effect. Check it out on www.thedutchinvestors.com

Just finished reading your in depth analysis on $ATD. I really enjoyed your assessment on the risks of this investment. Just one comment on the valuation that you performed. I beleive the valuation exercise is a bit incomplete if you dont consider the cannibalization of shares over the long term. $ATD has really been juicing up the buy backs recently and by the looks of it may continue to do so in future.

I'm also working on this industry. Do you have any opinion about the sustainability of fuel contribution?? (which has skyrocketed during the last years within the industry)