🚨 Dino Polska has just released its Q1 2024 earnings! As $DNP.WA shareholders, here's a quick rundown so you don't miss a thing!

📊 General information

Dino Polska is a rapidly growing network of medium-sized grocery stores across Poland, close to residential areas. By March 31, 2024, the network expanded to 2438 stores, covering almost 961.000 square meters. Over the last three years, it has grown its store count by 59%.

Dino’s scalable model relies on centralized management, a logistics network of nine distribution centers, and direct sourcing from producers to optimize costs through economies of scale. Each store features around 5000 products.

The company focuses on rapid organic growth, increasing store density, expanding geographically, and driving more traffic to existing stores. It has also embraced sustainability by installing solar panels on 2210 stores to meet its energy needs, reducing its environmental impact while pursuing its long-term profitability goals.

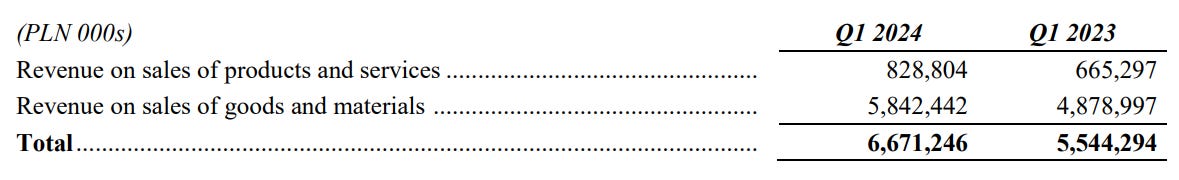

Year-over-year sales jumped by 20.3%, and like-for-like sales rose by 11.9%. This growth helped the company achieve a net profit of PLN 225 million (around $56 million). Fresh products, such as meat and poultry, accounted for 41.1% of total sales.

Financials & Capital Allocation

The company added 32 new stores this quarter, which was fewer than the 54 stores opened last year. Dino improved its net debt-to-EBITDA ratio to 0.4. Something I appreciate as a shareholder. I’d start to worry if it went above 2.5.

The DINO POLSKA S.A. Group operates in one business sector with a single operating and reporting segment focused on retail sales. Although the Management Board can categorize revenue by product group, it does not analyze the results by allocating direct or indirect costs to each group. As profitability is assessed for the entire group, only one operating segment is identified (see figure 2). Goods and materials account for roughly 88% of revenue.

Planned capital spending for 2024 is expected to be between PLN 1.5 and 1.6 billion ($355-$379 million) to support more store openings and other investments.

Outlook

Competition in Poland is intensifying. Dino's EBITDA margin has declined because the cost of sales is rising faster than revenue, partly due to increasing price competition in the retail grocery market.

Dino anticipates its store count to increase by a low double-digit percentage this year. It also expects operating expenses to rise due to low unemployment and higher salaries in Poland.

It recently bought a 72% stake in eZebra.pl, an online cosmetics store, to expand into the beauty and health sectors.

Key Takeaways

Operating cash flow: In Q1 2024, Dino's net cash flow from operating activities rose to PLN 435.7 million (about $109 million), indicating solid financial performance. Net cash flow from investing activities, primarily allocated for expanding the store network and building new distribution centers, stood at PLN (327.8) million (around $82 million). The ninth distribution center was launched in Bolewicko, Greater Poland, at the start of Q2.

EBITDA growth: EBITDA increased by 7.4%, despite ongoing pressure on margins due to rising costs.

Non-food market share: Dino's market share in non-food items is expanding, showing a shift in consumer behavior toward a wider product range.

Ownership: Founder Tomasz Biernacki remains a significant shareholder, holding 50.1 million shares worth approximately $5 billion.

Conclusion

Dino Polska’s Q1 results reflect a company adapting well to market challenges. With strategic investments and good financial management, Dino is positioned for continued growth. The outlook is positive, and the company remains focused on expanding its presence and product offerings in this competitive market.

Dislcaimer: This is a quick earnings update. I might have missed a thing or two. Make sure to always do your own research!

I linked to this post in my links post for today: Emerging Market Links + The Week Ahead (May 13, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-may-13-2024

#1) I NOTED THIS ARTICLE IN MY POST FOR TODAY:

Poland's Pledge To Repatriate Conscription-Age Men To Ukraine Could Have Economic Costs (Forbes)

- Beyond ethical considerations, the move could have a significant knock-on effect on the Polish economy as thousands of Ukrainian citizens residing in the country might be forced to leave their jobs and join the army.

- Additionally, there are mounting concerns that a sizable number of them will seek to leave Poland to avoid draft.

- A report by Deloitte for UNHCR, the UN Refugee Agency, found that Ukrainian refugees contributed 0.7-1.1% to Poland’s GDP in 2023 and estimated the effect would grow to 0.9-1.35% in the long term.

- Most Ukrainians in Poland are employed in sectors such as industrial manufacturing, transport services, and construction, with nearly half of them holding roles that fall below their qualifications.

#2) THESE ARE CONCERNS I HAVE POSTED AS COMMENTS ON OTHER SUBSTACKS COVERING THE STOCK 1) The funds got into Dino Polska early and lately they have been profit taking... 2) Alot of podcasters and Substackers etc have been talking about the stock compared to other so-called EM stocks just as the "smart money" is getting out or taking profits... 3) Its not clear where future growth will come from. At some point, they will have Poland saturated - if not already as they already have one store for every so many Poles (sorry, can't remember the figures I have seen...). Expansion eastward to Russia and Belarus is probably out along with Ukraine given its a war zone rapidly loosing population.... Germany, Czech, Slovakia etc would be completely new markets with probably different retail laws even though they are EU... 4) At some point, the stores will need to be remodelled by somebody e.g. landlord, tenant or Dino if they are the owner... Same with any refrigeration etc equipment as it will need to be replaced - not sure the lifespan of such equipment...

With that said, they do have the right business model when it comes to format size. Here in Malaysia, Speedmart and K.K. no frills smaller format chain stores have saturated every neighbourhood and housing estate selling mostly the shelf stable basics (and it seems like at higher prices than supermarkets!) while Indomaret and Alphamart have done the same in Indonesia (albeit there is still room for growth there given Indonesia's size and they have multiple formats + the latter expanded into the Philippines)... And of course, the USA has its dollar store chains...