3 Undervalued European Stocks

3 European businesses we believe will outperform the broader market

Why on earth should you be looking at European stocks right now?

The Euro Stoxx 50, which tracks the 50 largest European companies, has delivered a disappointing 70% return for investors since 1998 (excluding dividends).

In contrast, the S&P 500 soared more than 500% during the same period. So it’s no surprise that many investors focus exclusively on US-listed companies and overlook opportunities in Europe. It’s also the reason many American stocks trade at lofty valuations.

But that’s precisely why European stocks deserve our attention. Compared to the US, Europe is filled with bargains. After analyzing dozens of European businesses, we handpicked three European stocks that we believe are undervalued.

Already subscribed? Request the analysis here.

Now it’s time to turn our attention to Adyen, Nedap and Evolution.

European stock 1: Adyen

💰 Market cap: €41 billion

🏢 Sector: Financial Services

⚙️ Founded: 2006

🌍 Country: The Netherlands

What does Adyen do?

Adyen is a global payment service provider that enables merchants to process fast, secure transactions across nearly 100 payment methods. It competes with the likes of Stripe, Braintree (PayPal), and Chase Paymenttech (J.P. Morgan).

Adyen’s revenue is split into three segments. The company has a strong position in all of them, with ‘Platforms’ being the fastest growing segment.

Digital (60% of volume): Adyen serves digital-first businesses like Netflix and Spotify.

Unified commerce (25% of volume): Merchants that operate both online and offline. Think of international retail chains like Nike and Prada. Adyen’s technology enables customers to gain in-depth insights into consumer spending, connecting the physical to the online world.

Platforms (15% of volume): Platforms hold the greatest growth potential. It supports businesses like Uber and Vinted, where switching costs are higher due to the complexity of migrating platforms and integrated systems.

Why we like Adyen

Roughly 80% of Adyen’s revenue comes from settlement and processing fees, a highly scalable model. As transaction volumes rise, so does revenue. Moreover, Adyen grows by capturing more business from existing customers.

Adyen has a clean balance sheet, with a net cash position. It receives interest from the cash it holds for customers. Adyen’s founder is still managing the company and has a high ownership stake in the company.

Net profit margins are stunning, with structural percentages of over 40%, underscoring their leading market position. We believe that Adyen is possible to grow for a long period of time, pushing many competitors out of the market. The long-term growth options are often overseen by investors.

Despite the quality of the business, the stock price hasn’t moved in five years, while operating revenue more than doubled.

Today, you're getting a business growing over 20% annually for just 45x earnings. If you believe, as we do, that Adyen and Stripe will dominate global payments for decades, that multiple starts to look attractive.

European Stock 2: Nedap

💰 Market cap: €420 million

🏢 Sector: Technology

⚙️ Founded: 1929

🌍 Country: The Netherlands

If you are reading this and having a flashback, you are right. Nedap was also included in our three undervalued Small Caps article.

While that article explained the business model of Nedap, in this article we will discuss why we believe the market misunderstands the company.

Why Nedap is misunderstood

Nedap was known as a hardware company for decades. That’s how the business started and how it’s still perceived by some. But over the past five years, Nedap transitioned from a hardware to a software-driven company, prioritizing recurring revenue.

To give you an example: Nedap offers security software for buildings like offices and airports. Included in the sales are RFID scanners, which enable cards to be read and validated. These hardware products are now being outsourced while Nedap now concentrates on the high-margin software.

Now you know that Nedap is a pure software play, let’s explain what that means for Nedap’s business model:

For most of Nedap’s solutions, the company is using recurring subscription models. More recurring revenue means more reliable income streams and higher profit margins in potential. Nedap’s recurring revenue is increasing with a CAGR of 17% since 2019.

In the full year of 2024, Nedap surpassed the €100 million in recurring revenue. This implies a recurring percentage of the total revenue of almost 40%.

Growth is being driven by a pipeline of solutions that are yet to be scaled. Currently, many developers are working on improving software and making it ready to roll-out for mass usage. Especially Nedap’s ‘Ons’ healthcare platform, offers high potential due to high switching costs and market leadership.

Nedap is aiming for 15% operating margins within five years and targets high single-digit revenue growth for the coming years. If they can achieve that, the returns will be great!

Do you want access to our full research report on Nedap?

Already subscribed? Request the analysis here. Enjoy the Nedap analysis!

European Stock 3: Evolution AB

💰 Market cap: €14 billion

🏢 Sector: Gambling software

⚙️ Founded: 2006

🌍 Country: Sweden

Why we like Evolution AB

Who wants to invest in gambling-related businesses? Certainly, not big institutional investors with “ESG” criteria. Evolution’s share price has dropped significantly over the past couple of months, but the company still performs well and is expected to continue growing in the coming years.

Evolution AB provides online gaming software for casino operators, such as DraftKings and Unibet, which then offer the games to their customers (the players). Evolution designs the games, trains the dealers, builds the studios, and manages regulatory compliance. In return for these services, it charges operators a commission; around 10-20% of the casinos’ profits flow to Evolution.

In addition to this commission, Evolution earns a setup fee of approximately $50,000 for creating the digital environment or table for each client. The company's primary revenue driver is its Live segment, which accounts for 85% of total earnings, while the RNG (Random Number Generator) segment contributes just 15%.

What enabled Evolution AB’s massive growth?

Evolution’s revenue has grown with a 24.5% CAGR since 2021, which is very impressive.

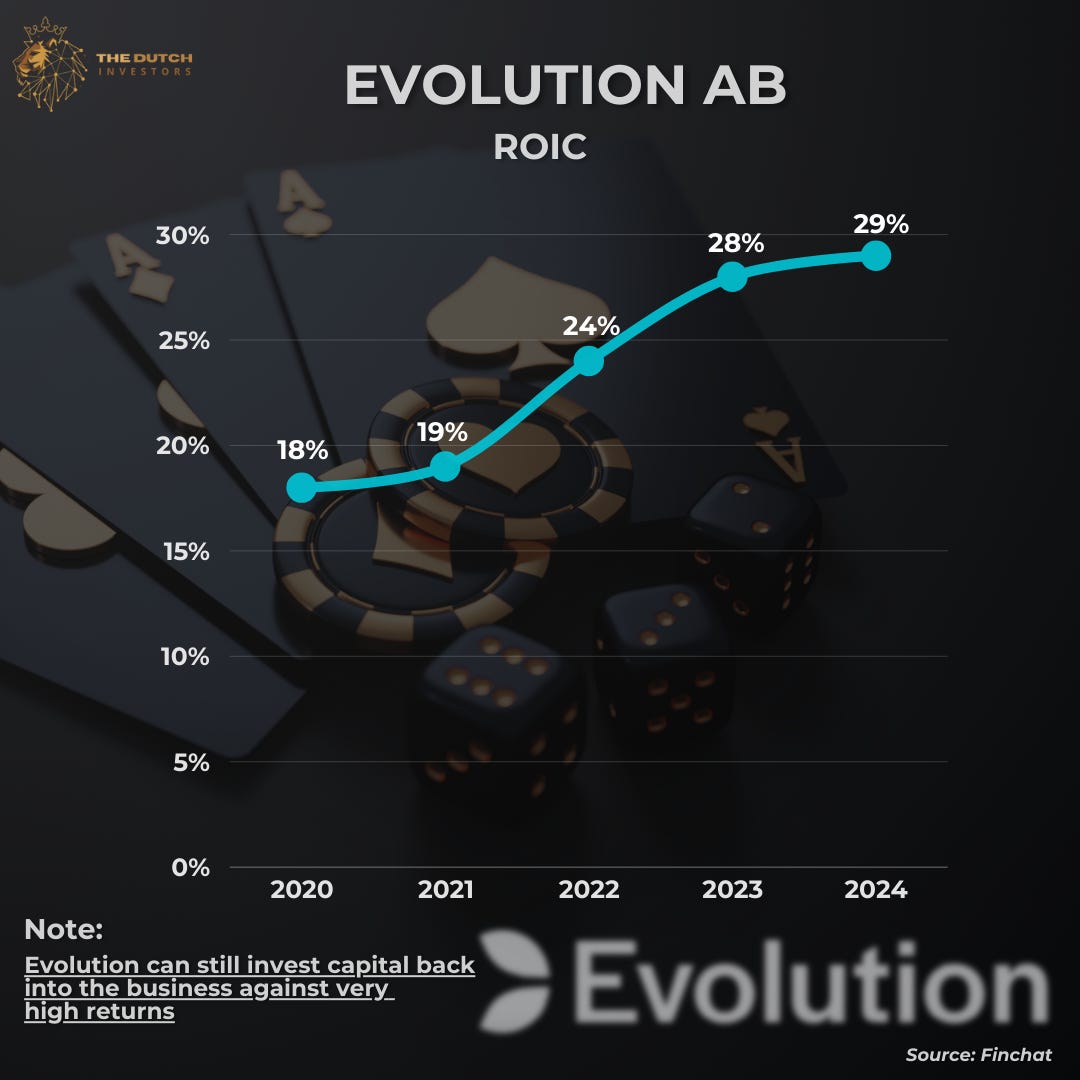

Not only, their growth is growing exponentially. The return they’re making on their investments are growing rapidly as well, as illustrated by the below graph. Evolution has a clean balance sheet, with ignorable debt levels.

The competitive advantage does not come from high barriers to entry. In fact, Evolution’s CEO himself acknowledges that these are relatively low. Instead, the company's moat is built on its intellectual property, which includes a world-class game development and design team led by Todd Haushalter, as well as a portfolio of patented games.

Additionally, operators have little incentive to switch providers. Evolution is the largest player in the industry, allowing it to invest more heavily, and it is the only company with an extreme focus on the live gaming segment.

All of these factors combined, make that we believe the potential and strength of Evolution significantly outweighs the current valuation of just 12 times its earnings.

Final thoughts

Because most investors are solely focused on US-based companies, we sincerely hope we were able to introduce you to three undervalued European companies in this article.

Of course, you can’t blindly invest in these companies based on this article. You always need to do your own research.

We look forward to continuing our hunt for similar undervalued companies and share them with you.

Have a wonderful day and happy investing.

The Dutch Investors.

These are good companies but they are far away from being undervalued. How much years Adyen need to grow in the current pace to reach P/E ratio of 10? Assuming no competition and pressure on margins

Very interesting selection! Did not know Nedap! I also like Knorr Bremse in Europe in the undervalued camp which has a nice self help story and defensive positioning given the context!