⚔️Your biggest enemy - A must read

Helping you stay optimistic, even when the world seems dark

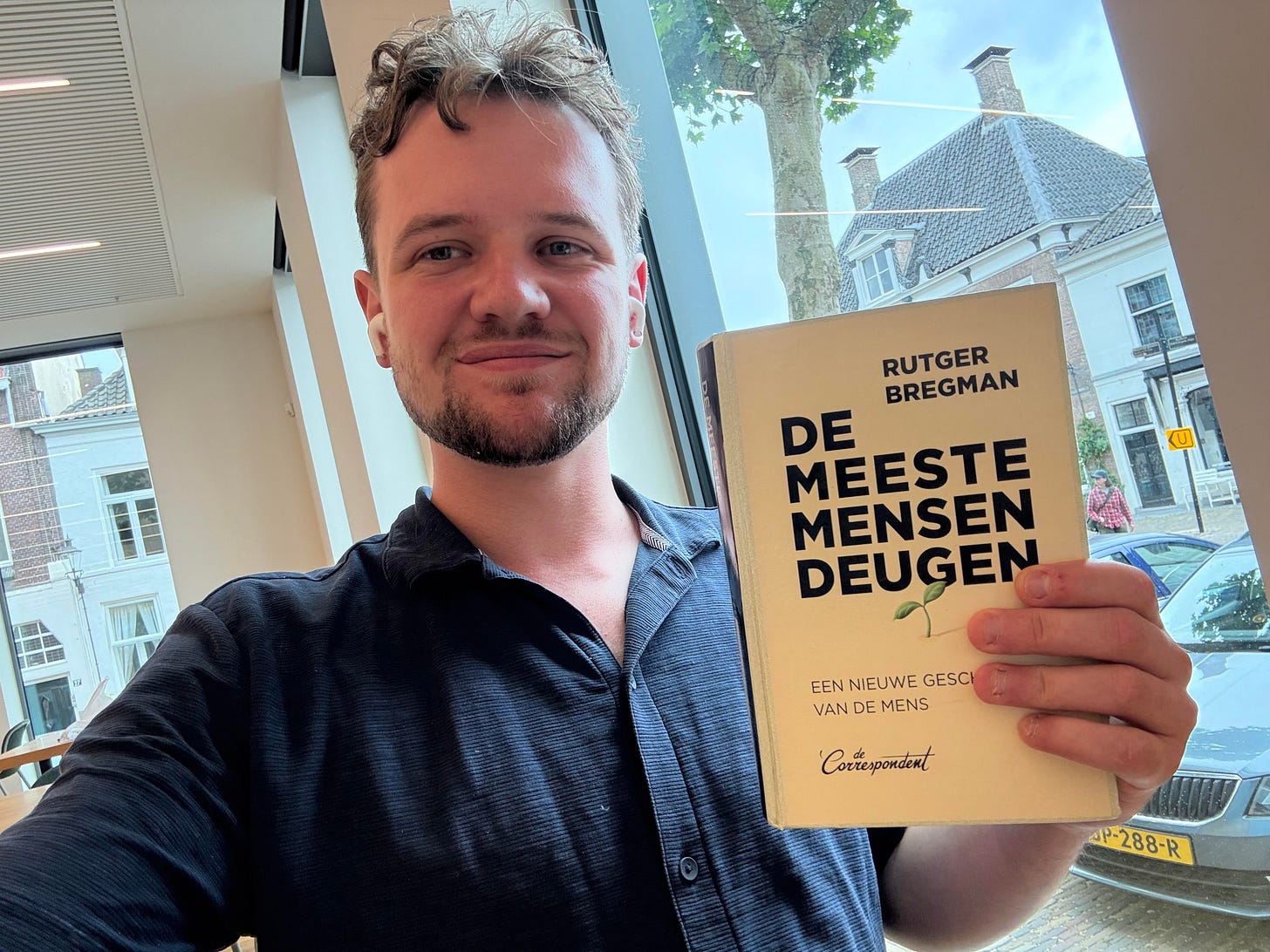

I was at the library today and found one of my favorite non-investing books. It inspired me to share a fantastic story from it with you and connect it to investing.

The book that inspired me is (translated) Most People Are Good by Rutger Bregman. The story I borrowed is called The Soldiers Who Didn’t Fire.

Your biggest enemy

Today, and at almost any point in history, it’s easy to believe the world is full of cruelty. It isn’t tied to any single era, ideology, or culture. It adapts and persists. Denying the endless list of atrocities humans have committed is impossible.

Across centuries and continents, history is saturated with examples of human cruelty. So, it's easy to think that people are inherently bad or evil.

But this idea carries a risk, for you as a person, and especially for you as an investor: becoming (too) pessimistic.

Yes, everyone should care. That’s the only way things get better. But please, don't become a pessimist, if only for the benefit of your investment account.

Pessimism is the enemy of every investor. Despite all the things in this world that make you wonder “why on earth would anyone do this?”, our passion and our hope for building long-term wealth is based on a single historical truth:

The world will be economically better off 100 years from now than it is today.

That belief requires optimism. So allow me to try to make you just a little more optimistic.

The soldiers who didn’t fire

It’s the night of November 22 to 23, 1943. The Battle of Makin Island in the middle of the Pacific Ocean has begun. American troops are about to land and fight the Japanese.

But the day after the battle, Colonel Samuel Marshall makes an unusual discovery by doing something no one had done before. He gathers American soldiers into groups and interviews them, all at once. Everyone, regardless of rank, is allowed to speak freely.

Marshall holds one group interview after another. And he discovers something remarkable: only 15 to 25 percent of the soldiers had actually fired their weapons.

He publishes his findings in the book Men Against Fire (1947), which is still required reading at many military academies.

In the book, he writes:

“The average and healthy individual has such an inner and usually unconscious resistance to killing a fellow human being that he will not take another life of his own free will.”

Could this have been a one-off? Sure, but Rutger Bregman collected more evidence. Several other officers had made the same observation as Colonel Marshall.

The most striking example comes from the Battle of Gettysburg (1863), during the American Civil War. After the battle, 27,574 muskets were recovered. 90% of them were loaded. That’s strange because back then, soldiers spent 95% of their time loading their weapons. You’d expect more unloaded guns.

But it gets even stranger: 12,000 muskets were double-loaded, and half of those triple-loaded. One musket was found with 23 bullets stuffed into it. Loading turned out to be a great excuse not to shoot. Just maybe, people aren't as ‘evil’ by nature as we sometimes think.

I often come back to this story, especially when I’m feeling down or pessimistic. It makes me a little more optimistic. It forces me take just take a step back and think. And that also makes me a better investor.

Every investor has thought to himself, especially when the headlines are filled with doom, “Maybe I should just take everything off the table.” In moments like that, stories like this keep me grounded. As a human and as an investor.

Is there more to learn?

Yes. Think again about those soldiers who spent 95% of their time loading their weapons. As an investor, you want to be that soldier.

You want to spend 95% of your time researching interesting companies. Only 5% should be making actual decisions. The good news for you as an investor is that 95% also makes your shots more accurate. Soldiers didn’t have that luxury. But you do.

The final lesson

This is a lesson that applies just as much to life as it does to investing: Don’t shoot.

If you have the option not to shoot, don’t shoot. You don’t have to act all the time. Often, patience and sitting still, is the best decision you can make.

Thank You

Thank you for reading this random article. Thanks for giving us the freedom to write about more than just P/E ratios and profit margins. We genuinely believe stories like this are just as essential for becoming a successful investor.

We’ll see you again in the next article.

Until then, stay optimistic, stay patient, be kind, and happy investing.

The Dutch Investors

Good piece. I love history!

Thanks for restacking Joe!