What we can learn from the Wright brother's building the first flying aircraft ✈️

The most valuable investing secret is not a secret at all. It's something we can all apply - tomorrow.

A couple weeks ago, we shared a piece on what politics don’t teach you about investing. Since many of you enjoyed it, we’ve decided to keep the series going, turning real-life stories into timeless investing lessons. Today’s edition is again inspired by one of our favorite financial writers, Morgan Housel.

Let's start with a story. A true one. It begins on a cold morning in December, 1903, with two brothers from Dayton, Ohio, who ran a small bicycle shop. On a remote beach in Kitty Hawk, North Carolina, Orville and Wilbur Wright were about to attempt something humanity had only dreamed of: a man-made machine flying under its own power.

What this story can teach you about investing is profound.

It's hard to overstate what a monumental event this was. The airplane fundamentally changed how we fight wars, how we do business, and how we connect with one another. It's no exaggeration to say that this one invention played a massive role in creating the returns we’ve seen in the stock market over the last century.

Without a doubt, the airplane belongs in the conversation for the most important invention of all time, right alongside the wheel, printing press, electricity, or the internet. And yet, for all its revolutionary power and potential, the world barely reacted.

The world ignored the future

You would think the news of the first controlled flight would send shockwaves across the globe. After all, two men just did something humanity had dreamed of for millennia. But the world barely noticed.

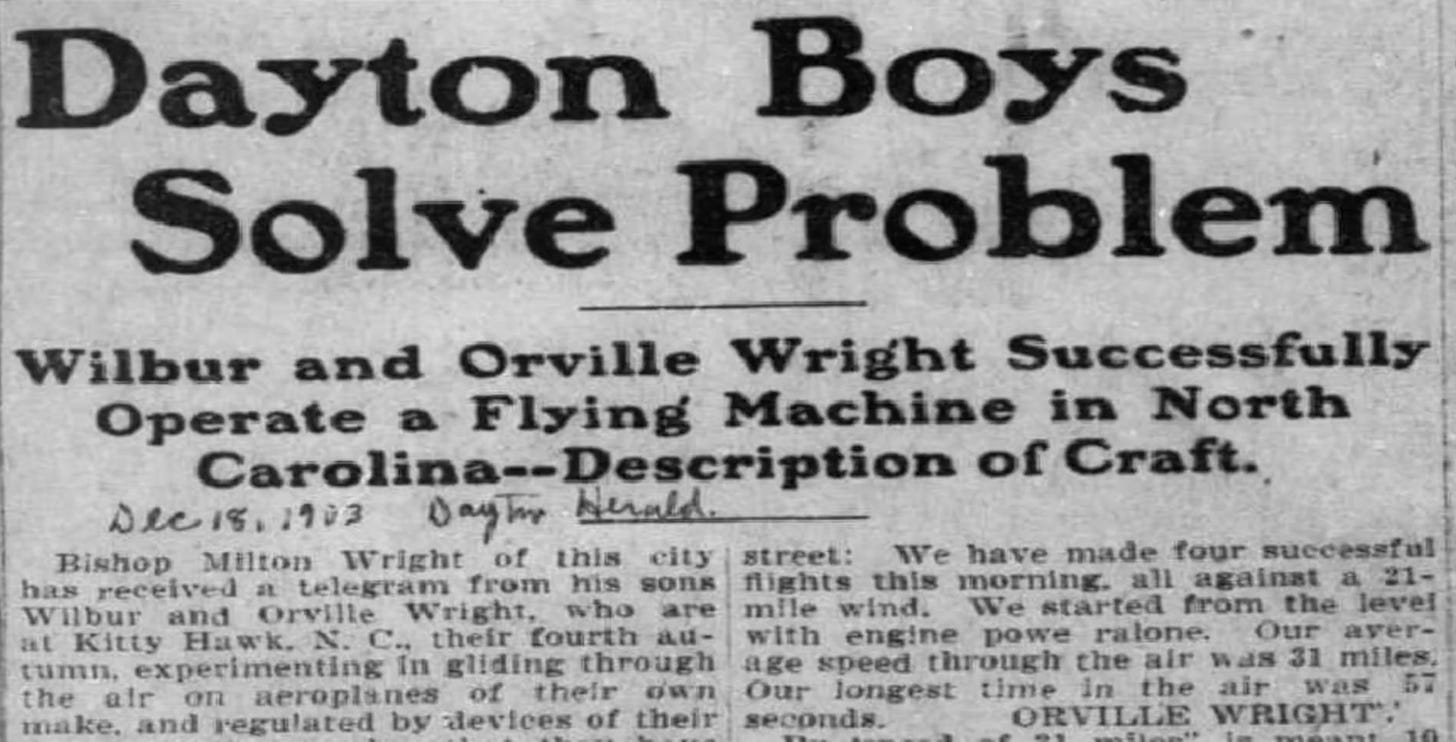

The New York Times made no mention of the event on December 17th. Or the 18th. Or the 19th, 20th, 21st… By December 22nd, the Wright brothers had already completed 19 successful flights, yet the newspapers still hadn’t said a word.

This dismissal wasn’t just a one-off. Two years later, the NY Times even quoted a leading German aviation expert who confidently declared:

"In the very, very, very far future, there may be flying machines, but not now.”

The incredible part? The quote was published after the Wright brothers had already completed dozens of public flights, circling in plain sight over Dayton, Ohio! When a local paper eventually covered the story, it got a dismissive headline saying ‘Dayton Boys Solve Problem’. A world-changing invention was dismissed as little more than a science fair project.

The only editor who gave the brothers any attention later admitted it was out of pity. He simply felt sorry for the two men, convinced they were wasting their lives on what he called a ‘ridiculous toy.’

The secret weapon

The Wright brothers weren’t the richest inventors. They weren’t even the most qualified. But they had one secret weapon that changed everything: patience.

They simply outlasted everyone else, spending years testing, failing, and adjusting. While we're all familiar with the final image of their flight, we often forget that failure isn't a dead end; it's a necessary part of growth and learning. The most successful people have failed a million times, but we only see their single success. The Wright brothers understood this, and even after their initial success, they kept going when the world ignored them.

We like to think innovation is about a stroke of genius or a brilliant idea. But more often than not, it’s about grit, the ability to keep going long after others have given up. This is a timeless lesson that applies to more than just aviation.

Because if you think about it, this is the exact same path to success in investing. It’s not about finding a single ‘hot stock’ but about enduring drawdowns, navigating market cycles, and staying committed to your process and conviction. And just like with flying, even after you've found success, it's important to avoid deadly mistakes that could bring you back to the ground.

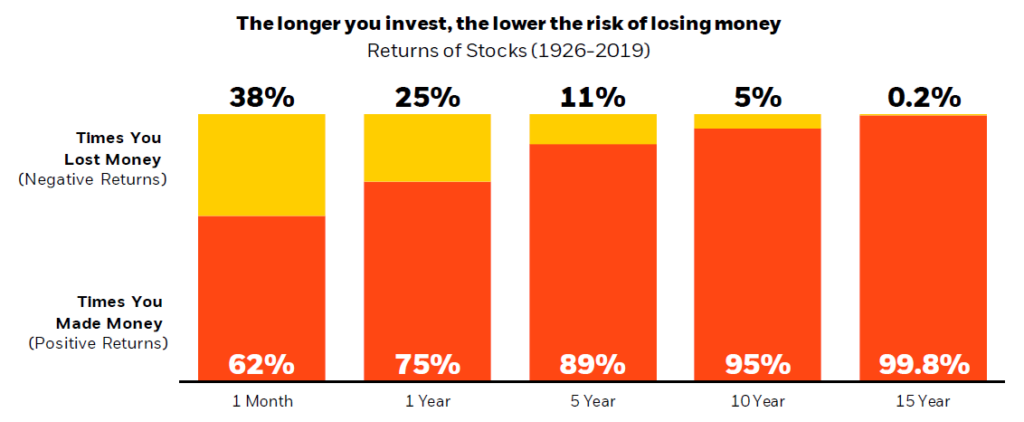

Many investors love to call themselves long-term thinkers, but when pressed, they often mean just a few years. History says that’s still a short-term gamble. A look at the S&P 500 proves that if you only hold for a couple of years, your outcomes are essentially a coin toss. True long-term investing doesn’t begin until you’ve held for 10, 20, or even 30 years. That’s when the odds truly swing in your favor.

The real risk

We often think the greatest risks in investing come from somewhere else, from the economy, central banks, management making stupid decsions, debt, or an unexpected black swan event. We spend so much time worrying about things we can’t control, we forget that the real risk is closer to home.

The single greatest risk to your investing success isn't the market; it's your own behavior’ - Morgan Housel

That’s actually the most empowering truth in investing. While you can’t stop the next recession, you have complete control over your own patience, your discipline, and your ability to stay the course. As the story of the Wright brothers shows, that one factor you can control happens to be the only one that truly matters.

The Wright brothers weren’t taken seriously for years after solving one of history’s greatest problems. But they understood a truth that few others did: greatness compounds slowly.

So, when you’ve done your homework and believe you’re right about a stock that’s out of favor, remember their lesson. Your job is to stay patient and sit tight.

Warm regards,

The Dutch Investors