What Evolution, Adyen, and Netflix have in common

Discover why Evolution AB thrives like Adyen and Netflix with minimal marketing and maximum profit. Evolution is a must-watch for investors because of the secrets behind its success.

If there is only one key point you should take away from this article, it’s this:

Evolution AB dominates the live casino industry by offering an innovative, high-margin platform for online casinos. Like Adyen and Netflix, its scalable business model ensures that as its clients grow, Evolution thrives—without needing heavy marketing or customer acquisition costs.

Want to know more? Keep reading, then.

Evolution AB is an online B2B (business-to-business) casino supplier with more than 300 customers (like DraftKings or 888 Casino) around the world. The company is engaged in the development, production, marketing, and licensing of fully integrated Live Casino solutions for gaming operators. Evolution AB has about 70% market share in the Live Casino segment.

Evolution AB earns the majority of their money from commissions, a percentage of the profit an operator gets from using Evolution's casino games. EVO is particularly dominant in the Live Casino segment. Evolution has been named Live Casino Supplier of the Year for 10 consecutive years.

What is Live Casino?

As a user, you have contact through a live stream with a real person, a so-called ‘dealer’, while playing your favorite casino games. Think about poker, Lighting Strike, Monopoly Live or roulette.

Random Number Generators (RNG) are software that is incorporated into the game element to display random numbers. A die is also an example of an RNG, which displays numbers involuntarily. This is also a component of Evolution's business model, although they are less focused on this particular segment.

One thing that stood out to me in our premium fundamental analysis of Evolution AB was the similarity between Evolution, Adyen and Netflix.

Similarity 1: aligned incentives

How? Evolution reminds me of Adyen because of the way it operates. Just like Adyen, Evolution's customers are only businesses. And just like Adyen, Evolution grows when the customer grows. This is something we like to see. The incentives are the same.

Why is this important? This allows them to have a relentless focus on what the customer actually wants and keep them happy. And happy customers tend to stay.

Similarity 2: sales and marketing

Another wonderful thing about this business model is that they don’t have to spend too much on sales and marketing. While the online casinos have to fight to get as many customers as possible, Evolution operates in the background and provides the (fighting) customers with the software they want and need.

This is one of the reasons why Evolution has net margins exceeding 50%

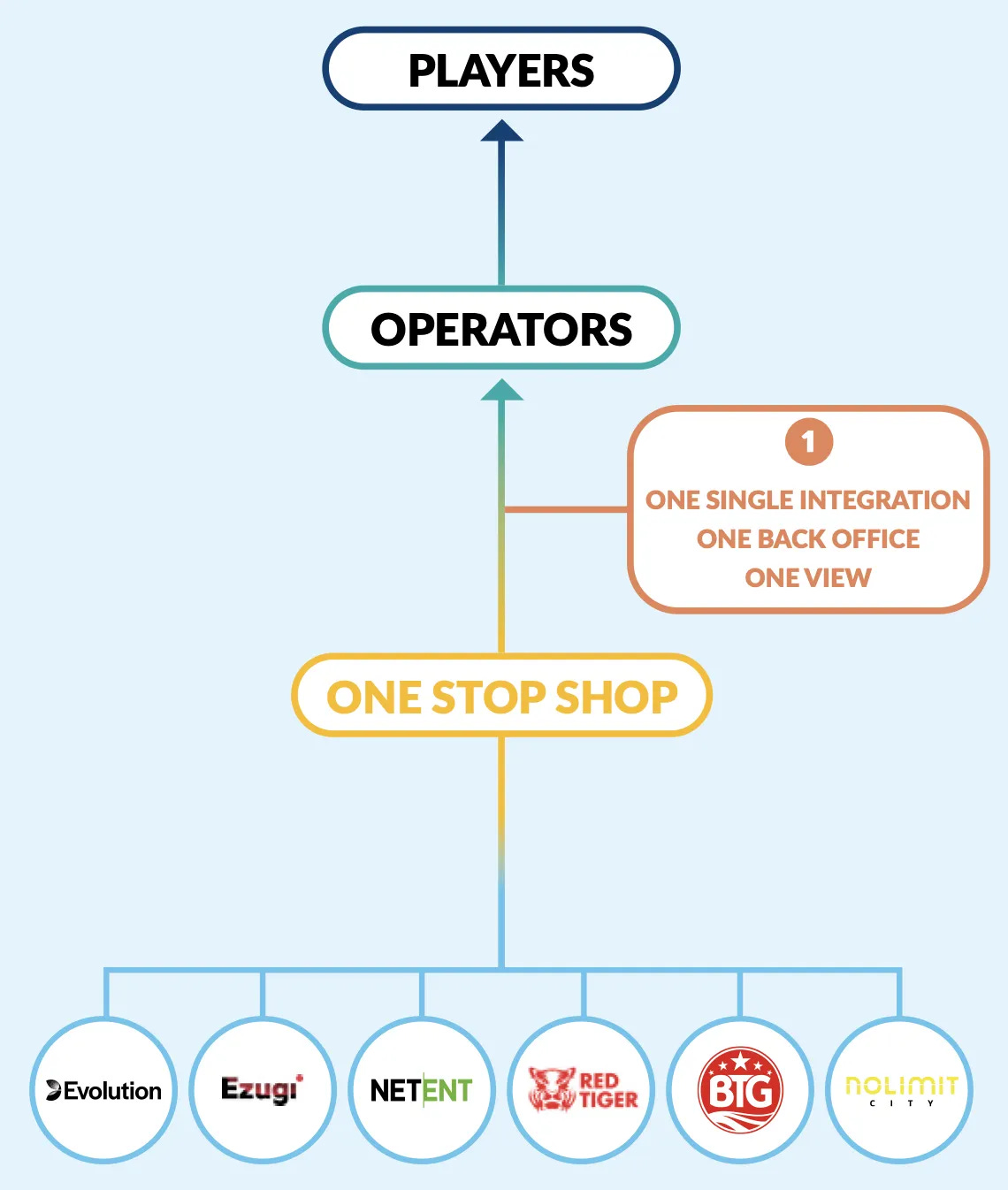

Another company that comes to mind is Netflix. Evolution has established a single channel through which customers (operators) can select which games they wish to implement on their website and which ones they do not. All on a single platform. This is the reason, the acquisitions of NetEnt or Red Tiger make sense to me, despite the high price paid for their acquisition.

The One-Stop Shop

You now know a few basics about Evolution AB. I must admit, I am very enthusiastic about the company. Bouke has made EVO a small part of its portfolio.

Are you interested in learning more about Evolution's business, leadership, impressive profit margins, and market value? Consider becoming premium before our prices increase significantly.

Have a splendid day ahead, and we wish you all the best in your investment journey