Today, Adyen held its Annual Meeting for shareholders. Bouke, co-founder and analyst at The Dutch Investors, hold shares of the company and attended the meeting for the fourth time. Here are some unique insights you won’t get from just reading the annual report.

1. “It’s still early days”

Growth, that’s the key-word for Adyen. Adyen guides for 20-30% revenue growth up and till 2026. I’ve asked what the expectations were for the growth trajectory beyond 2026. Although they didn’t give exact figures, CFO Ethan Tandowsky said that he has a good feeling for beyond 2026, and they stay long-term focused. As a matter of fact, Tandowsky said, “In Europe, we don’t see any signs of saturation”. Europe is their largest market, contributing to over half of their net revenues and growing 26% last year.

Complementary to that, they don’t pay a dividend and don’t do share buybacks. They invest in future growth and upcoming markets, such as India, a new office in Chicago and hiring engineering and sales employees. The retained earnings go to strengthening the balance sheet. This leads to a strong A- S&P rating, winning trust of regulators.

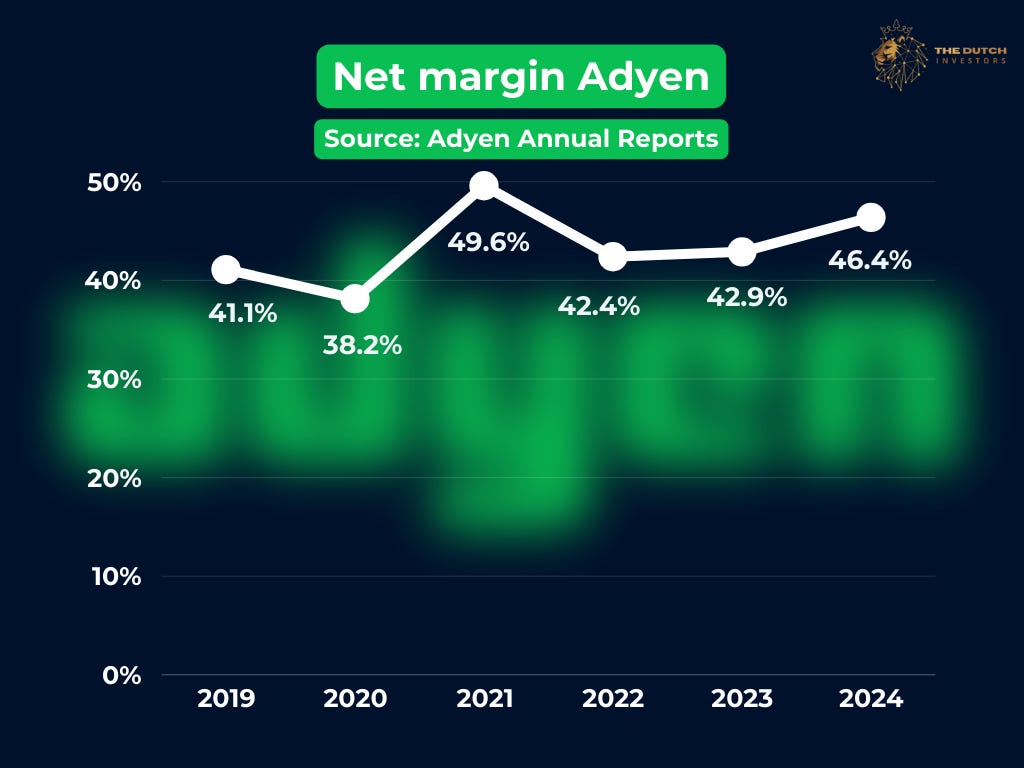

Our expectations are that Adyen will keep growing net revenues over 20% for the coming next year, like we explained in our over 30-page analysis. Although they are focused on growth, doesn’t mean they aren’t profitable. Due to operational leverage and the highly scalable business model, Adyen might see net margins of above 50% in the future.

2. “Tariffs”

The only way Adyen is directly hit by the tariffs, is through their terminal imports, to also help merchant process in-store payments. In the Q1 2025 earnings call, some doubt was raised about Adyen’s ability to accelerate revenue growth to the high twenties. Merchants observed that their customers might become more cost-conscious, potentially limiting transaction volumes processed by Adyen. “So far, this hasn’t been the case”, said Tandowsky about this subject.

Management did underline that the “uncertainty in the macro-environment has increased”.

3. A new supervisory board member and a fun fact

Steve van Wyk will join the supervisory board as an independent member. He has plenty of experience in roles as Chief Information Officer and Chief Operations Officer at large corporations such as ING and HSBC.

I spoke to him personally, and he’s a very approachable person. He said that it was a privilege to work at Adyen and that he’s impressed by the quality of the supervisory and executive board.

Besides van Wyk, I’ve had conversations with Tom Adams (CTO), Mariëtte Swart (CRCO), Ethan Tandowsky (CFO) and Ingo Uytdehaage (Co-CEO). Pieter van der Does did not attend the annual meeting, but I’ve been told he was working at their Rokin office.

During my conversation with Ingo Uytdehaage, I’ve asked him for any book tips (I’m a vivid reader). He just finished reading the book “Never Split The Difference”, about negotiation tactics, and he truly enjoyed it.

Besides the board, I also spoke to several individual shareholders. As always, it’s amazing to hear/learn from other people’s investing journeys and have a nice chat.

For now, I’ll return to the North of the Netherlands to go back to work. Let me know what your thoughts are about Adyen or attending annual meetings.

Have a wonderful day and happy investing.

The Dutch Investors.