We can’t help but feel a little bit jealous of the times when quality businesses were selling for less than 15 times earnings. Take Microsoft for example, which was trading at 8x earnings in 2011. Looking back is easy right?

Nowadays, finding a quality company for less than 20 times earnings is hard. But we believe we found one: Belgian small-cap EVS Broadcast Equipment. This company grew its revenue with 25% in 2023, operates in a growing market and is moving towards a software ecosystem. Its PE Ratio? Just 10.

Too good to be true? Maybe. After dedicating 40+ hours of research to this company, I had a couple doubts:

The market opportunity for EVS might be limited.

Do the tailwinds outweigh the headwinds?

Revenue can be unpredictable.

European companies often struggle with innovation.

Just to be clear, this is not a sales pitch. There are serious risks involved with investing in EVS Broadcast Equipment.

What does EVS do?

Remember old sports broadcasts? Just one camera capturing it all. Now, we get wide shots, close-ups, replays, referee reviews, crowd shots, even animations. Take the Champions League final for instance: it’s filmed with 42 cameras, each generating 1 to 10 GB of data per second.

All these recordings, including replays, animations and highlights need to be combined into a single broadcast, and that’s where EVS comes in. Besides ensuring reliable live production, EVS offers content management solutions and routing and infrastructure solutions. Their goal? Creating a unified ecosystem for their customers.

EVS’s customer base

EVS serves a range of clients, including broadcasters, media networks, sports event organizers, and production facilities.

🏰 Is there a moat?

EVS solutions are essential for producing top-quality broadcasts. In sports broadcasting, where rights are worth millions, advertisers invest heavily, and fans are deeply invested, reliability is absolutely a must have. Cutting corners on equipment is not an option, making EVS’s offerings mission-critical. For broadcasting, EVS is the industry standard, which gives them a trustworthy reputation.

Is management reliable?

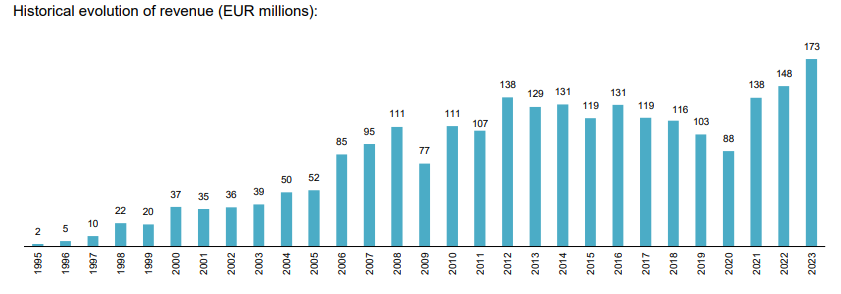

Between 2012 and 2019, EVS's revenue declined from €138 million to €103 million, with margins dropping from 44% to 22%. Unsurprisingly, the stock performed terrible during this period. This is not a big surprise when the CEO comes from outside the company and has no skin in the game.

Fortunately, Van Herck took over in 2019. It’s evident that Van Herck has made a strong impact on EVS. He has introduced a clear, sensible strategy focused on building an ecosystem, aiming for greater vertical integration. Since he joined, EVS has become far more customer-focused.

Why is EVS so cheap?

There are a couple reasons here:

Investors are done with EVS: This is a bit harsh, but until 2019 EVS suffered from mismanagement. To top it off, 2020 was terrible due to covid. It is understandable investors have lost their patience.

The broadcasting market was underperforming: EVS operates in a niche market, which has been slow to innovate. This is not a market that is about to explode. Competitor Evertz Technologies also trades at a valuation of just 14x earnings.

European small caps are cheap: And for good reason to be honest. Europe seems slow to innovate and does not seem to catch up with the US. The key is to find niche players which beat the odds, which EVS might be.

Our conclusion

EVS is cheap in a market full of expensive companies. Especially given their position as one of the global market leaders, a strong moat and a good management team nowadays. There are solid reasons EVS is cheap, and there is no certainty this will change. But trading at a PE Ratio of 10 is too cheap in our opinion.

Don’t base your decision on this article

This article is just an introduction on EVS. Before deciding whether EVS fits your portfolio, consider these key questions:

How does the competitive landscape look like?

Is EVS financially healthy?

Is capital invested efficiently?

How many of the profits are reinvested in the business?

Could AI disrupt their market?

We cover all these questions in our in-depth premium analysis for premium members. Also want to know more about unknown (cheap) companies like EVS? Join TDI Premium for access to the EVS analysis and over 30 other stocks.

Have a wonderful day and happy investing.

The Dutch Investors

Finally some love for this company. It’s really cheap. Just unknown by the broader audience. The bad management until 2018 scared people away. I’ve talked to the CFO twice and it seems that EVS has some good plans to grow again. Would value the company between 40 and 45 euro.

I like Melexis there