Ulta Beauty has been on our watchlist for over three years. It has many traits of a high-quality business that knows how to compound over time.

Ulta operates in an industry that’s not easily disrupted

Ulta boasts a strong moat with over 44 million loyalty members

Ulta delivers a >25% return on invested capital every year

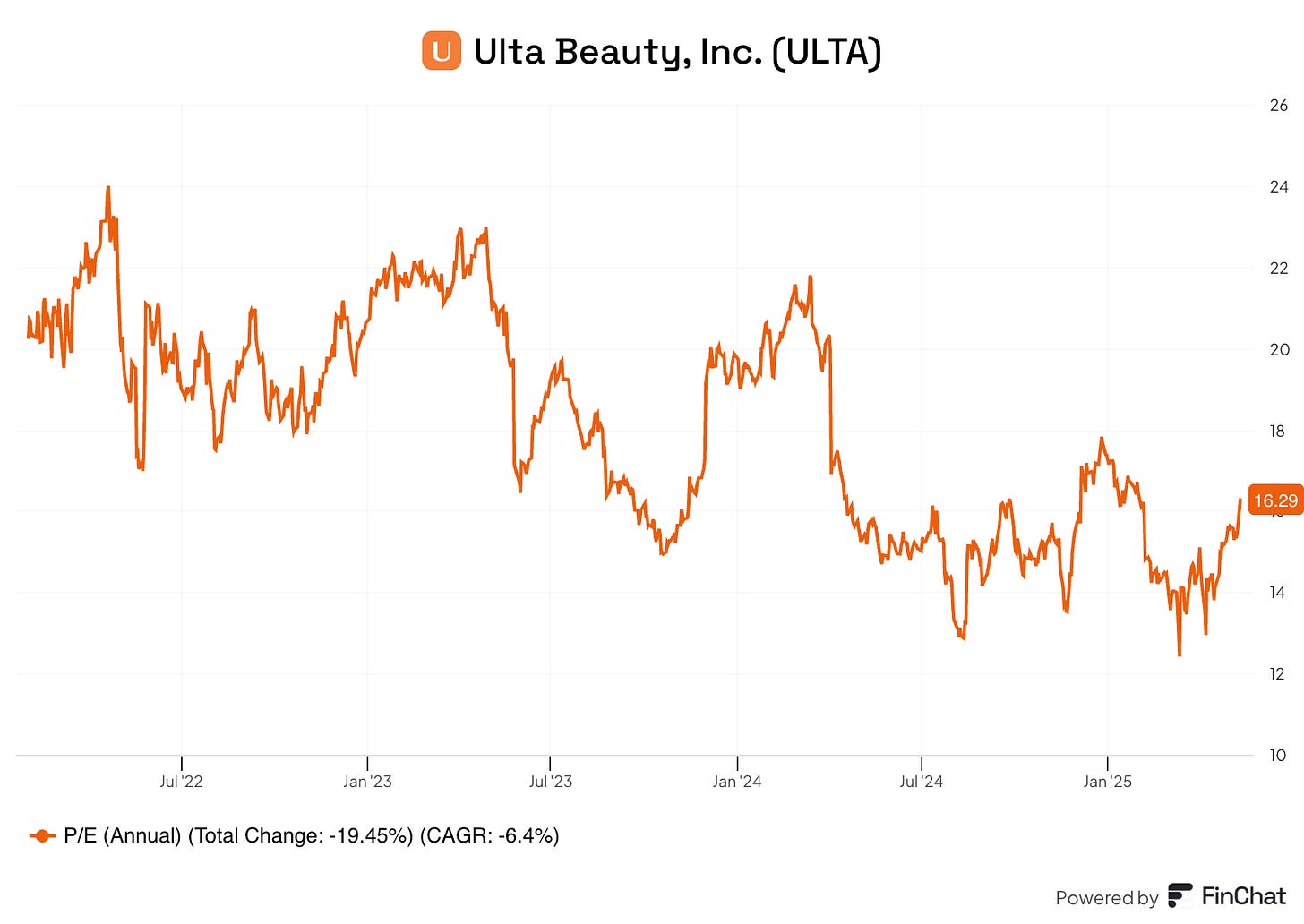

That said, growth slowed over the past year, and the stock price has been stagnant for the last five. The P/E ratio even dropped from 23 to just 16. If these issues turn out to be short-term, this could be a compelling investment case.

Reason enough to take a closer look at Ulta Beauty, and that’s exactly what we did over the past month.

As you probably know by now, we’re often intrigued by companies facing temporary setbacks. But the key questions are: Is Ulta really a quality company? And are the problems truly short term? We have our doubts.

Where is the moat?

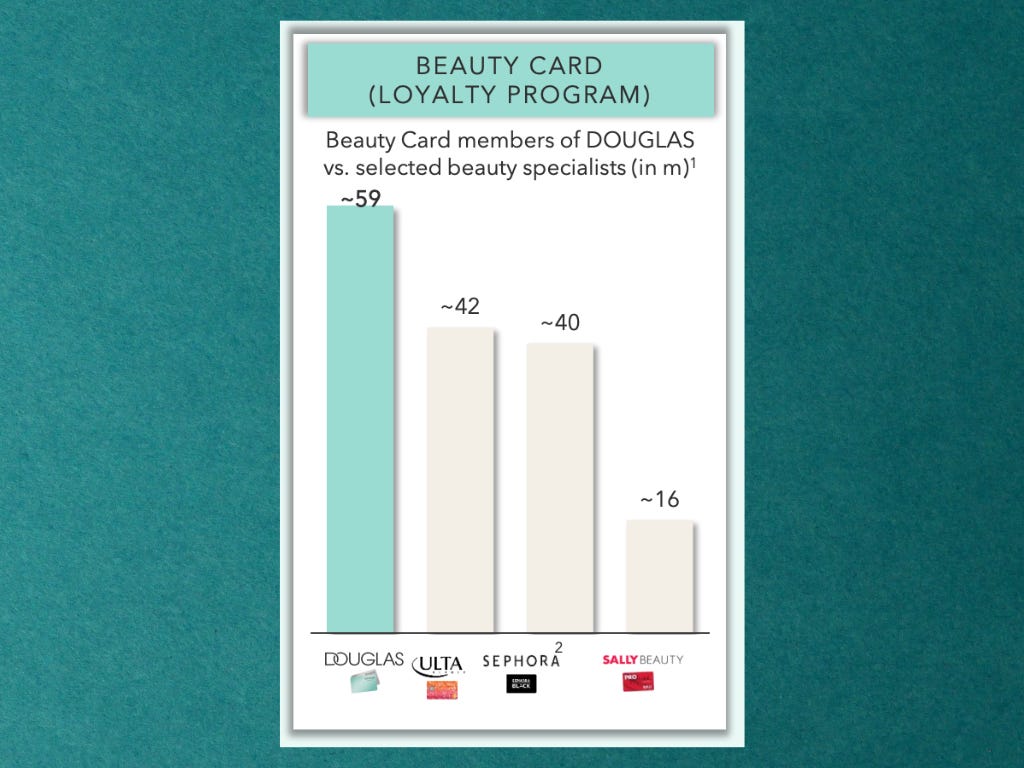

Most Ulta bulls point to the impressive 44 million-member loyalty program as the company’s key advantage. And yes, it’s a strength, but not an impenetrable moat.

Take Douglas, Ulta’s European counterpart. It has an even larger loyalty base and still struggles to become profitable. To Ulta’s credit, it has nearly twice as many loyalty members per store compared to Sephora (31,000 vs. 15,000). But we wouldn’t be surprised if Sephora narrows that gap as its U.S. footprint continues to grow.

Competition is catching up

We appreciate when CEOs are candid. But we’d be hesitant to invest in a company whose newly appointed CEO Kecia Steelman admitted:

“The competitive environment in beauty has never been more intense. For the first time, we lost market share in the beauty category in 2024.”

That share loss came at the hands of Sephora, which is backed by luxury powerhouse LVMH. So, if you're wondering whether Ulta’s moat lies in scale advantages… probably not.

The numbers reflect this too. Ulta’s sales were flat in 2024, while Sephora posted double-digit growth. Sure, they’re at different stages of maturity, so it’s not a direct comparison. But it feels inevitable that Sephora will keep gaining ground in the U.S.

There’s room for both players in the market, but from where we stand, the risk of margin pressure looks much higher than the potential for margin expansion. We already see the first signs of decreasing margins.

Retail will always be retail

Consumer tastes, especially in beauty, change fast. If your stores feel outdated, customers will notice. And once preferences shift, it’s hard to win them back.

The numbers suggest Ulta underinvested in its stores: just 2% of 2024 revenue went toward remodeling, relocating, and refreshing locations. For a struggling company that still want to grow, this is too low in our opinion.

CEO Kecia Steelman acknowledged this:

“Our in-store presentation and guest experience today are not as strong as we would like.”

She also announced a major restructuring and transformation plan for 2025.

We agree it’s the right move, but reinventing a simple business model rarely works. Companies like Microsoft have plenty of options to pivot or reinvent themselves. Ulta doesn’t. It runs a straightforward model, and radically changing it rarely ends well.

Isn’t it cheap?

Yes, the P/E ratio has come down significantly since 2022. But the narrative around Ulta has changed too.

So ask yourself: would you rather pay 23x earnings for a business expected to grow at 12%, or 15x for one growing at 6%?

In our view, Ulta was a more attractive opportunity three years ago than it is today. Of course, that’s not taking into account knowing Ulta’s growth would slow down.

This analysis reminded us why deep research matters. You need to look under the hood to truly understand what you're dealing with.

And that's exactly what we help over a hundred investors do through TDI-Premium.

» Discover which 60+ companies we already analyzed

Let us end this article off with the wise words of Seth Klarman:

“The avoidance of loss is the surest way to ensure a profitable outcome.”

Have a wonderful day and happy investing.

The Dutch Investors.

Some companies we analyzed already:

a >25% return on invested capital every year is still not a stock to hold for LT ?