The unknown business model of elevator companies

Discover how this Finnish powerhouse quietly dominates the market, profiting not from selling elevators, but from maintaining and modernizing them.

If there is only one key point you should take away from this article, it’s this:

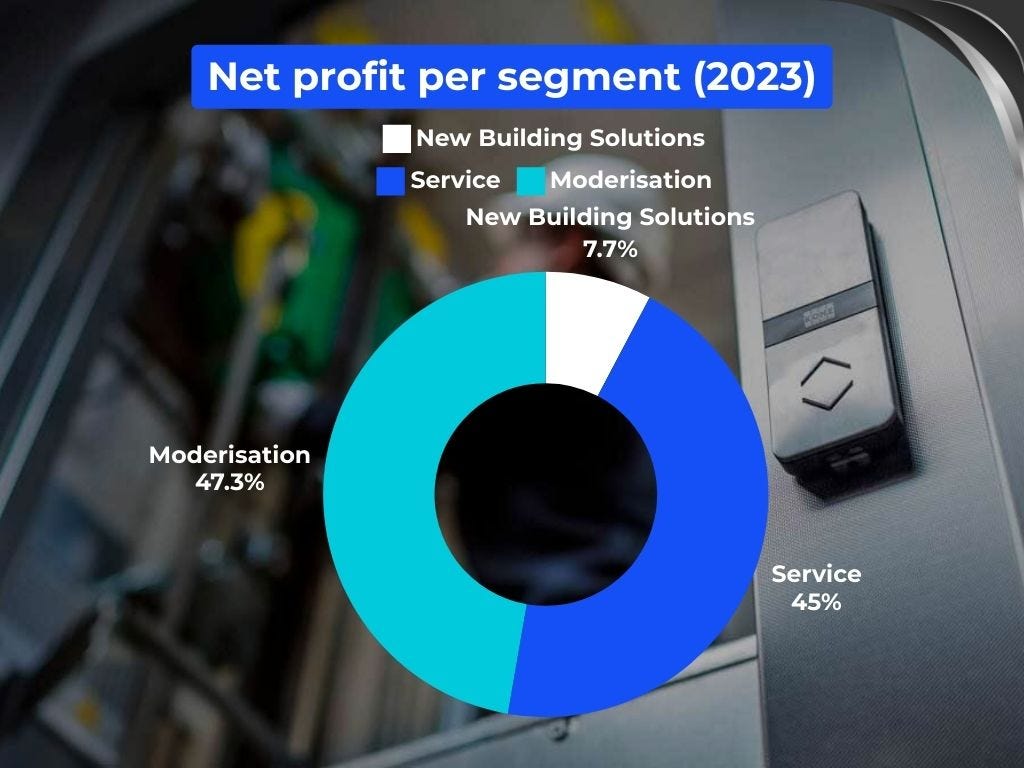

KONE doesn’t make its money selling elevators. Approximately 92% of its profits come from maintaining and modernizing them.

This story is something special. We recommend you read it from start to finish!

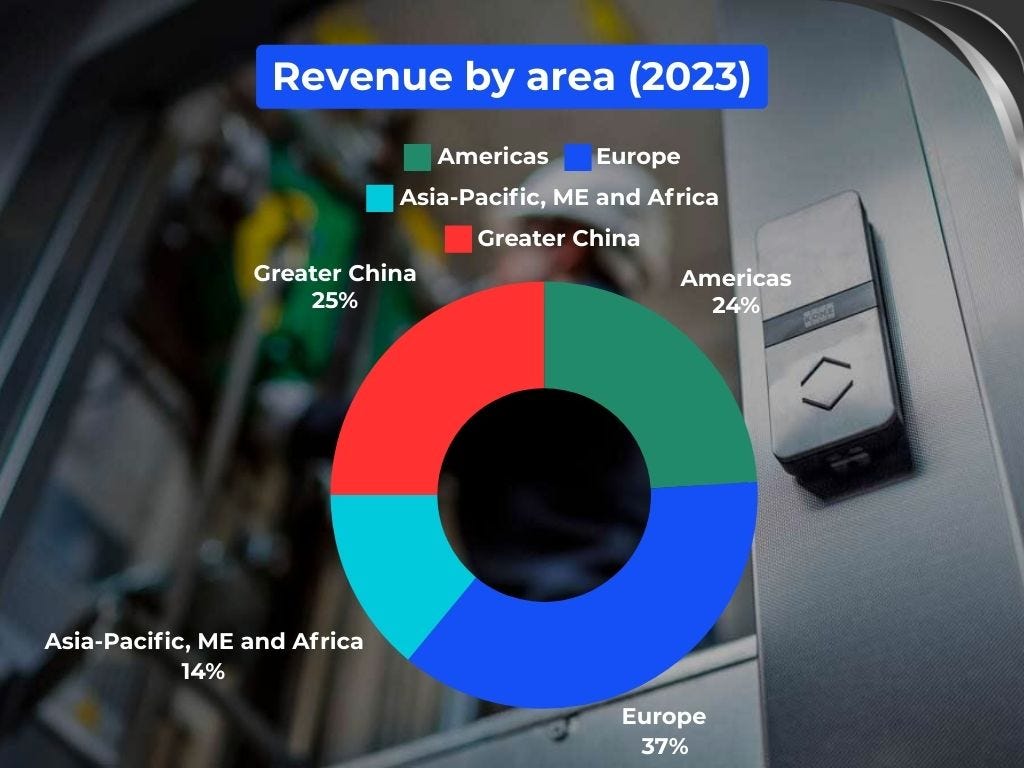

KONE, a leading Finnish company in the elevator and escalator industry, operates globally with a robust and diversified business model. With over 1.6 million elevators under its management, KONE derives its revenue from new installations, maintenance, and modernization services.

At first glance, it seems like a tough business. An 8% margin on a new elevator?

But the real money isn't in selling elevators—it's in servicing them. In Europe and North America, a staggering 90% of customers sign a service contract with the same company that installed their elevator. Here's why that's so profitable:

Service contracts last 10–15 years.

Margins on maintenance range from 20% to 30%.

Contracts have built-in price increases to guard against inflation.

Customers must have a service contract, even though they aren't obligated to choose the installer.

This creates a steady revenue stream, even during crises, making KONE very resilient!

How KONE profits from this

A key reason KONE—and its competitors—hold such a strong position is due to switching costs.

Changing providers is usually too expensive. Elevator maintenance represents just 3% of a building’s budget, so it’s usually not worth the hassle to change. This means that once a company gets a maintenance contract, it’s likely to keep it for years.

This business model is similar to that of coffee machines. They sell the machines at low margins, profit from services.

Next time you see an elevator stock plummet, stay alert. These companies have a strong moat and are built to last.

⚠️ Warning!

China accounts for 25% of KONE's revenue.

Want to know the answers and more about what lies ahead for the elevator industry? Become a premium member today and dive deeper into the hidden opportunities and risks that most investors overlook.

Now available to all premium members!