The hard truth about "Top stocks for 2025"

It needs to be said. Avoid those clickbait "Top stocks to buy in 2025" articles. Here's why.

As the new year approaches, you’ve probably already come across (or will soon) countless posts about “the best stocks to own for 2025.” Let’s be honest, those lists rarely make sense. Perhaps even better to avoid those articles altogether.

Let me start by saying that we don’t intend to attack anyone personally with this article, but sometimes the truth needs to be said. A quick Google search will show you that even the largest finance companies engage in this practice. Plenty of Substack writers, X (formerly Twitter) accounts, and Reddit users do it too. And while it’s complete nonsense (yes, let’s just call it what it is), we do understand why. Why is that?

Titles like: “The Best Stocks to Own for 2025” or “These Stocks Will Explode in 2025” attract a ton of views, likes, and engagement. Does it work? Heck yes, it works. Most people are fooled easily and are too short-term focused. Who wants to make money over 30 years? Most people want it today or next year.

So, are these articles nonsense? We think so. But we get it. This strategy drives more followers, broader reach, and, inevitably, more opportunities for monetization, ads, and so on.

We founded The Dutch Investors with a focus on long-term, disciplined investing and sustainable wealth building, each of us guided by our own personal goals. Our motivation comes from passion, and we’re excited to share our lessons and journey with like-minded individuals.

If you have any questions, related to The Dutch Investors, your investing journey or just want to share something with us, we’ll make sure to reply to each and every one.

However, let’s be honest: from a financial or viewer-count perspective, this isn’t exactly the most strategic approach. But to be honest, we don’t care. Don’t count the people you reach; reach the people who count.

We’re not here to tell you what you should or shouldn’t do. We simply want to caution you against putting too much faith in these kinds of (often short-term) clickbaity articles. So we’re not hating on them. We get it. We honestly do. It’s just not something we stand by.

Thinking just one year ahead is risky

Investing isn’t about predicting next year’s winners. It’s about thinking which companies have a high probability of outperforming in the long term. This mindset will help you find stocks that don’t just outperform one year, but every year.

Remember Warren Buffett’s wisdom:

“In the short term, the stock market is a voting machine; in the long term, it’s a weighing machine.”

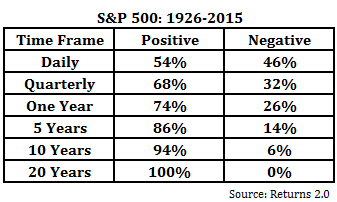

The table below shows something important: your odds of achieving positive returns increase significantly with a longer holding period.

The problem with predictions

In the graph below, you see the actual return (light green) versus the predicted returns. Ouch…

As you can see, analysts’ predictions are often wrong. Besides that, popular stocks often tend to have higher valuations, often widely covered and popular stocks. They tend to have a higher valuation (=higher expectations) which increases the chances of these stocks underperforming.

Not the mindset you want to have

In our view, people / platforms that pick stocks with the mindset to “have a blowout year”, won’t choose the best stocks to invest in for you. Not only that, you cannot cover the required research needed to analyze three stocks in one article. Thereby making these top 3 (or even top 10) articles quite useless for serious investors.

Of course, we wish you great success in 2025.

However, remember this: a single year’s performance rarely paints the whole picture. Just look at 2022 and 2023, for example. The market plummeted in December 2022, making that year’s returns look terrible. In 2023 the market rebounded, creating an illusion of extraordinary gains. The real picture becomes clear only when you zoom out.

The best investments aren’t chosen with next year in mind, they’re chosen with the next decade in mind. We think it’s a good idea to keep that in mind as we head into 2025!

Want to expand your investing universe? Join TDI!

Rather than simply handing you a top three list of stocks to own in 2025, we see ourselves as explorers. Our team of four takes a deep dive into one stock per person each month, thereby analyzing 52 stocks per year. This approach allows us to rapidly expand our investing universe while upholding the highest standards of research.

By joining us on this journey, you’ll receive an in-depth analysis every Friday. Available as a podcast on-the-go or as a fully written report for our avid readers.

If you'd like to be part of this exclusive experience, make sure to do so today. There are only 24 hours left before the price of TDI-Premium increases.

*The price for current members will remain unchanged.

We wish you a healthy and happy 2025. See you next year.

The Dutch Investors team - Siem, Luuk, Mathijs and Bouke

I completely agree that long-term focus is important.

Only the video titles are clickbaity for some content creators on YouTube while their content is okay. At least that is the case for Joseph (first snapshot). His approach is long-term and focused on quality growth.

I wish analysts stopped making themselves look silly with those price targets. It would do more justice to their work if they stuck to the company-level research only. Their research can be very useful, especially as a consensus.