Tesla - Premium Research Report - Sneak Peek

Our fundamental analysis of Tesla. Car or technology company?

“It’s not like I desperately want this f***ing role. I’m doing this because I believe in the god***n mission, and I think that sustainable energy needs to prosper.”

Tesla

This research report is a sneak peek of the entire fundamental analysis. If you want to read the entire research report, check out our premium research reports.

In this sneak peek, we will dive into competitive advantages, risks, and opportunities.

IntroductionBusiness modelCompetitive advantage

ManagementFinancial analysisRisks and opportunities

ValuationClosing thoughts

3) Tesla’s competitive advantage

“Moats are lame”

Although Musk may find it nonsensical to talk about moats, I still consider it too important to ignore. Musk followed up his statement with:

"If your only defense against invading armies is a moat, you will not last long. What matters is the pace of innovation. That is the fundamental determinant of competitiveness.”

Musk said this after making Tesla's Supercharger network available to electric cars from other brands. There was criticism that this would damage Tesla's moat. Having a large network of Superchargers is something competitors cannot easily replicate.

However, I believe Musk has a valid point. When entering a new industry that is likely to be worth $2100 billion, you must innovate rapidly to keep competitors at bay. Innovation must be at the heart of the company's culture. Hence, Tesla's extreme compensation policy, discussed in Chapter 4.2 (management)_.

Nevertheless, there is a classic moat that the top six car manufacturers below have: a strong brand. The fact that many car manufacturers have a strong brand does not necessarily mean that all of them are successful. When all competitors have strong brands, it is crucial to have a brand stronger than the rest. Fortunately for Tesla, it succeeds in this regard.

Even though Tesla has a more valuable brand than its competitors, according to Brand Finance, in my opinion, the automotive market is not a winner-take-all market. It is a market with an enormous number of competitors, each with a very strong brand serving different segments of the market. This does not mean that all competitors will achieve the same high profits as Tesla, but that’s not necessary. As long as competitors retain customers who are loyal to their brand, there will always be a place for these competitors.

In my view, the automotive market will always be a market where numerous brands serve a large number of consumers. I certainly see Tesla capable of capturing a significant market share. Currently, the two largest players, Toyota and Volkswagen, have market shares of 13.7% and 12.2%, respectively, based on the number of cars sold. Therefore, it seems unlikely to me that more than 20% of the cars sold in ten years will be Tesla’s.

3.1 Tesla had/has a cost advantage

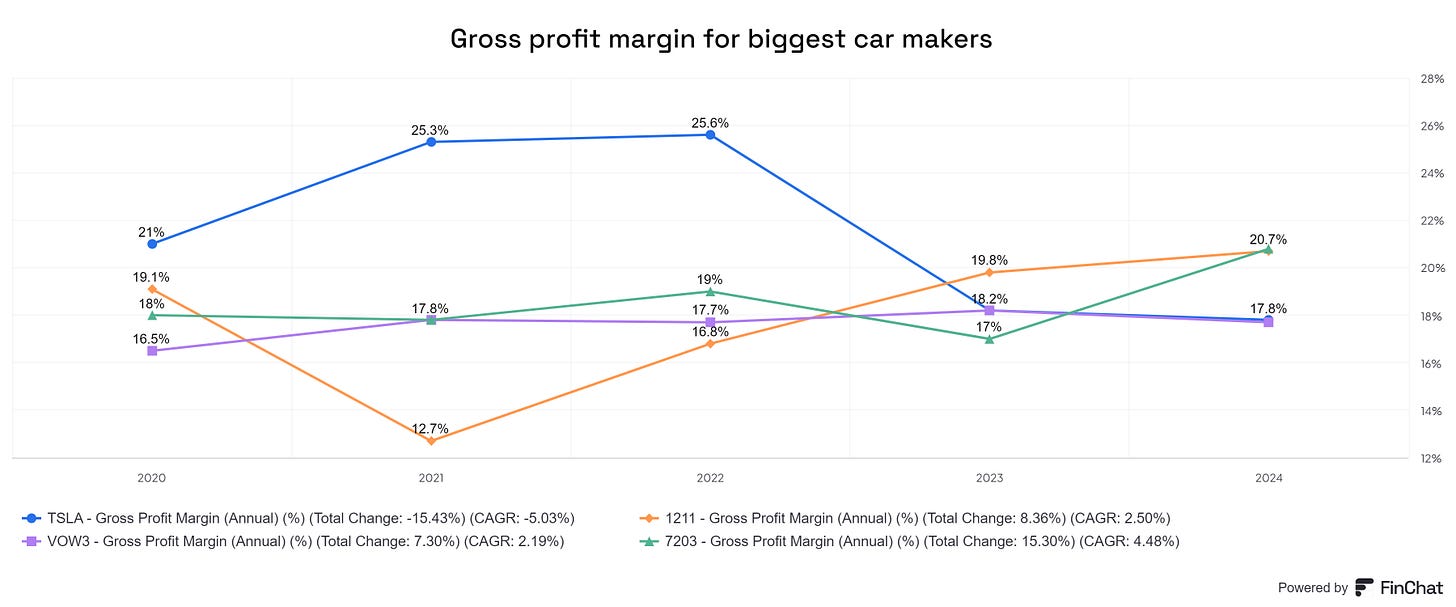

Chart 1 shows that Tesla, due to its unique approach described in Chapter 2.6 (business model), had a cost advantage over its competitors. It is easy to conclude from Chart 1 that Tesla has lost its cost advantage. However, I think this is too simplistic. When Tesla competes in a higher price range, it has certainly proven to have a cost advantage over competitors like BMW and Mercedes. But now that it is clear Tesla aims to become the largest car manufacturer in the world based on volume, this is no longer the case.

Network effects

Tesla benefits from network effects, where its value grows as more people use its products. As a data-driven company, Tesla collects more data the more cars it has on the road. This is similar to how OpenAI and Google operate.

With more Teslas driving around, the company gathers a vast amount of data. This data helps Tesla improve its self-driving technology faster than competitors. Better self-driving features make Tesla cars more appealing, leading to more sales and even more data.

This cycle gives Tesla a strong advantage. More data means better technology, which attracts more customers, creating a loop that keeps enhancing Tesla’s products and market position. This data also helps improve other aspects like battery performance and vehicle design, keeping Tesla ahead in the electric vehicle market.

6) Risks and opportunities

"We are highly dependent on the services of Elon Musk, Technoking of Tesla and our CEO."

Few companies have as promising yet uncertain a future as Tesla. Uncertainty comes with risks, especially for the energy and services and the other segment. Therefore, I have limited this chapter to fundamental risks related to Tesla's current core business.

We can't cover all potential risks. We focus on what we believe are the biggest risks and opportunities. Remember, "the biggest risk is the one you cannot see."

6.1 Risks

Risk 1: The cycle turns

Although Tesla behaves more like a tech company compared to Volkswagen, it is still in the automotive market, which is cyclical. If the market downturns, Tesla will feel the impact. Given its high valuation, this could lead to investor disappointment.

Risk 2: Traditional automakers producing better electric cars

Until 2020, Tesla's electric cars were the best, with superior range, design, and technology. Now, traditional automakers have caught up, increasing the chances that consumers might choose their electric cars over Tesla's.

Risk 3: Chinese competitors

Personally, I am not worried that traditional automakers will surpass Tesla in terms of innovation. Innovation is in Tesla's DNA. The entire culture, supply chain, and incentives are designed for this. Although it is not a classic moat, I do not think traditional automakers will catch up in the coming years. However, these arguments do not apply to BYD and some other Chinese competitors. They seem to be just as innovative. There is a chance that these competitors could surpass Tesla.

Risk 4: Elon Musk

Finally, an unusual risk mentioned by Tesla in its 2023 annual report:

"We are highly dependent on the services of Elon Musk, Technoking of Tesla and our Chief Executive Officer."

Tesla's dependence on Elon Musk is a risk because his leadership and vision have been crucial to the company's success. If he were to leave, it could disrupt operations, lower investor confidence, and impact Tesla's strategic direction and growth. The strange part is, if Musk stays at the company, he is also a risk. His controversial actions and unorthodox methods can sometimes make him a liability. This is something investors should keep in mind.

6.2 Opportunities

There is no shortage of opportunities for Tesla. Personally, I believe the main opportunities lie in the large-scale production and sale of batteries (Powerwalls and Megapacks). These energy storage solutions could revolutionize the energy sector, providing sustainable power for homes, businesses, and utilities.

Additionally, Tesla's ventures into insurance, full self-driving (FSD), Robotaxis, and artificial intelligence (AI) present significant growth prospects. Tesla Insurance could offer competitive rates using vehicle data, while FSD and Robotaxis could transform transportation with safer, more efficient travel and new revenue streams.

AI advancements enhance vehicle capabilities and have broader applications across industries. The potential of these opportunities is enormous, though difficult to quantify due to their innovative nature and evolving markets.

Overall, Tesla's diversified approach positions it well to capitalize on these emerging opportunities, driving future growth and reinforcing its leadership in multiple high-impact sectors.

Become a premium member and get access to the entire fundamental research report, including:

Chapter 1 - Introduction

Chapter 1 - Business model

Chapter 3 - Competitive advantage (free)

Chapter 4 - Management

Chapter 5 - Financial analysis

Chapter 6 - Risks and opportunities (free)

Chapter 7 - Valuation

Chapter 8 - Conclusion