Teqnion - Not so Deep Dive

Swedish serial acquirer with Berkshire traits

Rather listen to the article?

“Empowering Imagination”

Several months ago, I started reading "The Outsiders" by William Thorndike and was quickly captivated (highly recommend it!). During my reading, one company particularly came to mind because its management reminded me of so

me of the CEOs featured in the book. That company is Teqnion AB, listed on the Swedish stock exchange. I first noticed Teqnion months ago when I learned that Chris Mayer, author of "100-baggers," owns shares. I researched and was initially impressed, though my attention drifted until "The Outsiders" spurred me to conduct a thorough analysis.

1) Business model

Simply put, Teqnion buys other companies. More specifically, it targets profitable and growing private companies that hold leading positions in industrial niche markets, primarily in Sweden. In 2022, Teqnion made its first acquisitions outside Sweden, in England and Ireland. Teqnion describes it as follows;

“Teqnion's subsidiaries operate within narrow technology niches, with moats and to specific niche competence being found in the subsidiaries, both in terms of business model, the products and their applications. Teqnion's philosophy therefore focuses on decentralized subsidiary management, where development is based on the subsidiaries' individual strategies, rather than through the parent company's central management function.”

The cash flows from these businesses are used to acquire other companies. Daniel Zhang, who oversees M&A at Teqnion, calls it a 'Twin-engine growth machine'; Teqnion earns from its current companies and reinvests those profits into new acquisitions to create more value. As CEO Johan Steene says, "It may seem simple at first glance, but the process we've practiced for a long time, making mistakes and adjusting to improve. And we never finish, but of course, we have fun along the way."

The business model of Teqnion is decentralized. All subsidiaries operate independently to maintain their competitive position, responsibility, and genuine care for their employees. Teqnion supports as needed, for instance, in strategizing or financial resources. Knowing that the headquarters itself doesn’t generate revenue, Teqnion keeps this unit as lean as possible to minimize costs.

Teqnion is very picky about where it invests. Teqnion looks for the following qualities when investing:

Leadership and culture: Companies run by reliable people who lead with passion and integrity, and are motivated to continue developing the business and the organization.

Profitability and financial health: Businesses that have a track record of profitability, solid financials, good cash flows and support development and integration. Profitability has to be above their financial target.

Niche market presence: Companies operating in unique niches with limited competition and have built strong competitive barriers over the years. They have to be market leaders in their specific niche.

Employee dedication: Businesses with employees who are proud of their work and committed to their company.

Seller relationships: Potential for long-term relationships with sellers after acquisition.

Investment size: Companies with stable revenue between SEK 25 million and SEK 150 million (roughly $2.4 - $14.5 million).

Sustainability: Ability to withstand restructuring or integration and maintain profitability.

Teqnion aims to grow with a CAGR of 15% per year, planning to double its earnings per share every five years and targets three to five acquisitions per year for the next few years, then, possibly, accelerating.

2) Management

There's much to discuss about the management team at Teqnion. I want to focus on two key individuals: Johan Steene, the founder and CEO, and Daniel Zhang, the CXO (and deputy CEO), responsible for acquisitions.

Johan Steene co-founded Teqnion with Erik Surén, who is now on the company’s board. As CEO, Steene spends most of his time talking to potential acquisition targets, handling acquisitions, and leading the management team. He really enjoys his work, often laughing in interviews and sharing how much he loves his job.

Apart from his business achievements, Steene is known in Sweden as an ultra-marathon runner. In 2018, he set a record at the Big Dog’s Backyard Ultra by running 455 kilometers in about 68 hours, proving his incredible endurance.

The culture at Teqnion is notably casual. Steene regularly appears in interviews and important acquisition discussions wearing just a T-shirt, reflecting the their informal atmosphere. Regarding stock ownership, Steene holds 861.471 shares, valued at around $16 .6 million, representing about 4.5% of Teqnion. I love the fact they display the holdings on the “management” page of Teqnion IR! He does not take a salary for his board position, which demonstrates his commitment.

Steene and his co-founder ran the company together for 11 years, emphasizing a culture of minimizing unnecessary expenses and maximizing efficiency with minimal staff. In June 2023, just seven people work at the headquarters, which Steene believes is sufficient for the foreseeable future.

While at a trade show in LA for a significant subsidiary, Steene stayed in a motel outside the city, always opting for budget-friendly choices, avoiding expensive dinners, accommodations, or business class flights. Furthermore, their investor calls are organized in-house without a hosting party, with questions taken via email, Twitter, or live, using a studio they access at no cost.

Daniel Zhang is deeply involved in acquisitions and greatly admires Warren Buffett and Charlie Munger, even displaying a large poster of them in Teqnion’s office. Zhang's journey included stints at McKinsey and Bain & Company before he reached out to Steene with the aspiration of building his own version of Berkshire Hathaway, inspired by Teqnion’s approach. The day after their meeting, Steene offered him a job, and Zhang has been with the company since 2021. During his tenure, he has purchased 108.000 shares (worth roughly $2.1 million) in the open market and continues to buy more.

Dividend policy

Steene and Zhang have made it clear they aren't big fans of dividends. But in May 2022, Teqnion paid a small dividend of 0.50 SEK per share because high market prices limited acquisition opportunities. Although buying back shares isn't possible right now due to stock exchange rules, management remains focused on avoiding overpriced deals and learning from every opportunity. As a result, similar dividends probably won't happen again soon.

3) Investment philosophy and moat

Teqnion’s moat

One of Teqnion's main strengths is its management team. Their integrity, awareness, and rational approach are remarkable. Out of the 100–150 companies they assess annually, only a few make it through to acquisition. From September 2022 to June 2023, they made no acquisitions, showing how selective they are. They only proceed when everything is just right.

The management doesn't oversell themselves and clearly states what Teqnion can and can't offer. This honesty helps unsuitable candidates self-select out of the process. Entrepreneurs who approach Teqnion often see their business as their "baby." Teqnion keeps interference with operations to a minimum, avoiding forced layoffs, mergers, or significant changes, which reassures business owners.

Another strength is the technical expertise of the management team. Many members studied mechanical or chemical engineering, allowing them to understand the challenges industrial companies face. Their experience with running smaller companies also helps them relate to business owners and tailor their approach.

Finally, each of Teqnion's subsidiaries tends to have its own moat or competitive advantage, which is a key factor in their acquisition criteria. Though investors can't always quickly assess the moats of these companies, they trust Teqnion’s management and acquisition process.

4) Financials

Teqnion's success as a serial acquirer heavily relies on the quality of the companies it buys. Their ongoing financial targets are clear:

keep net debt under 2.5 times EBITDA;

maintain an EBITDA margin above 9%;

and double earnings per share (EPS) at least every five years.

They only publish reports and figures in Swedish, so any awkward English translations are due to automated tools like Google Translate.

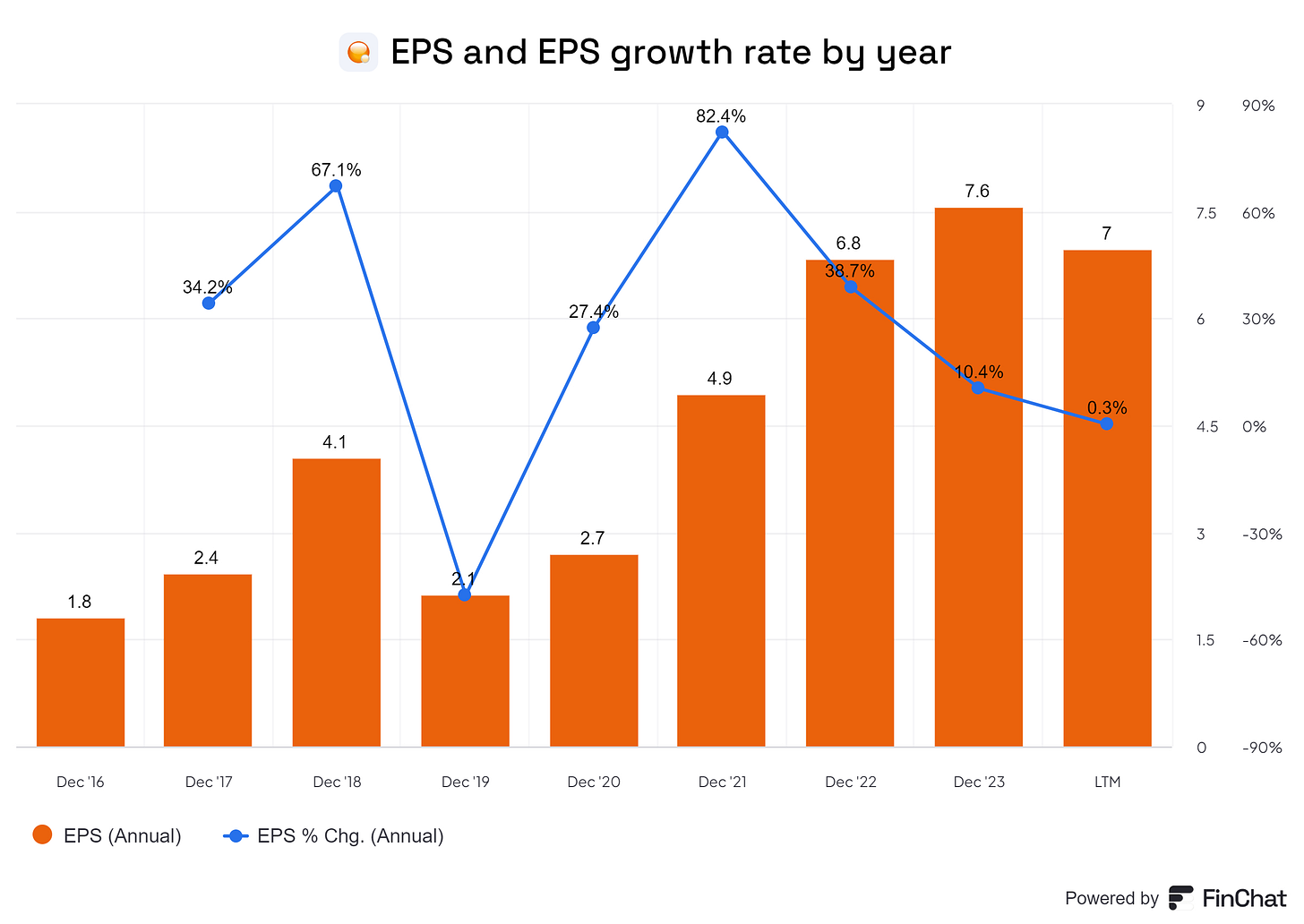

Currently, Teqnion is easily meeting its goals. Since going public in 2019, they've achieved an EPS compound annual growth rate (CAGR) of 33.5%, and free cash flow per share growth of almost 60%. The target of doubling EPS every five years requires about 15% annual growth, a target they’ve easily surpassed. Although their history is still relatively short, it's highly likely that Teqnion will continue to grow by at least 15% annually in the coming years.

Their net debt position can be cleared with a year or two with just free cash flow. They can pay it off in a year if they take their current cash position into consideration.

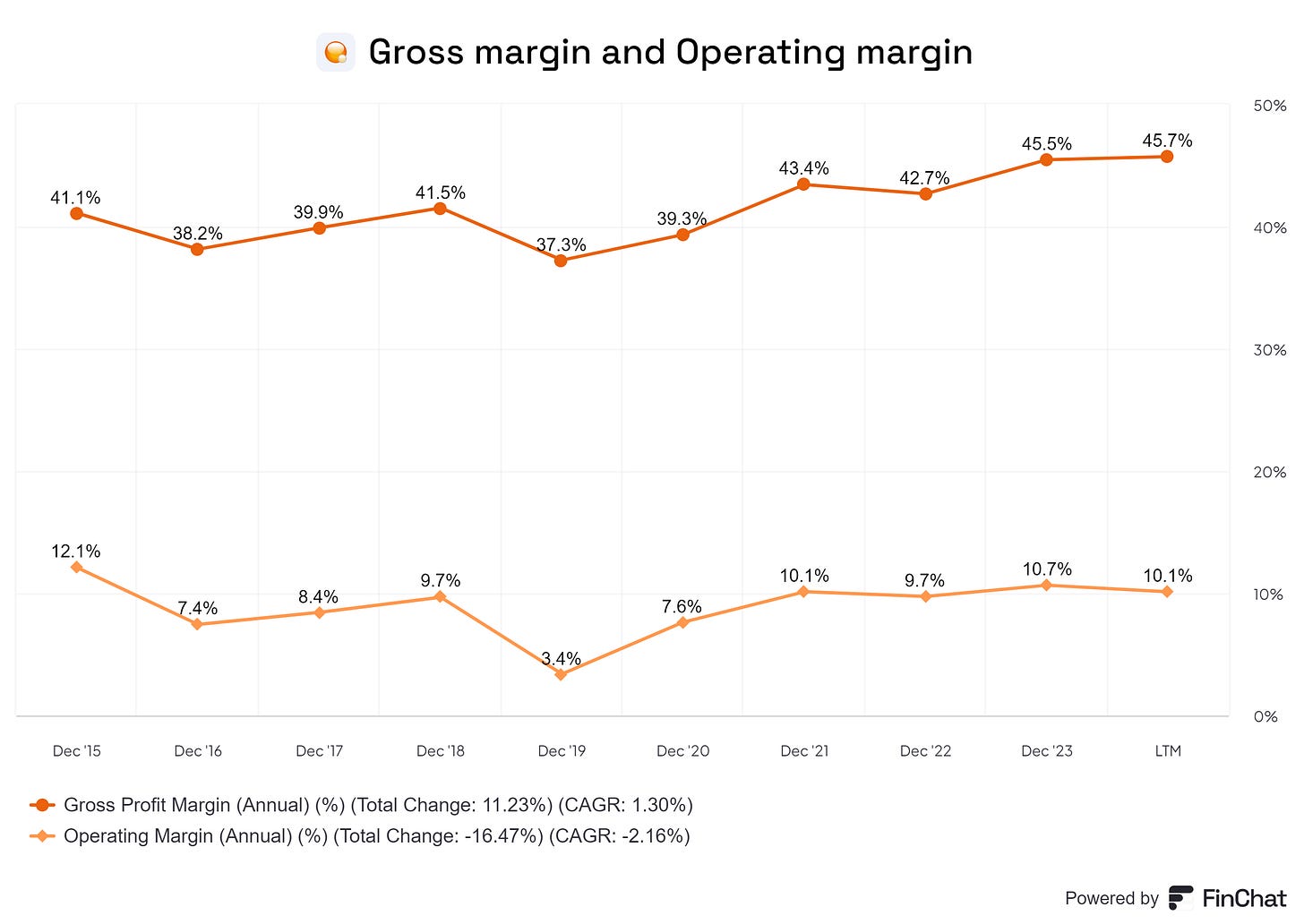

Despite recent inflation impacting many businesses, Teqnion has maintained strong margins. In 2021, they saw a significant margin increase compared to 2020, with a slight dip in 2022. Currently, their gross profit margin is around 46%, and their operating profit margin is just over 10%.

5) Teqnion’s valuation

A Discounted Cash Flow (DCF) analysis is appropriate for Teqnion because free cash flow roughly matches EPS. If EPS grows by 15% annually, free cash flow should also increase by 15% each year. This growth target set by management seems realistic, so that's the percentage used in the calculation.

The following assumptions were made for the DCF:

Growth rate (Years 1-10): 15%

Discount rate: 10%

Terminal growth rate: 4%

Margin of safety:10%

Although a terminal growth rate of 4% might seem high, there’s no reason to believe Teqnion won't continue double-digit growth beyond 10 years. At this rate, Teqnion could reach a market value of €1.08 billion in 10 years while keeping its valuation and currency stable. This value is still relatively small for a company, so further growth is definitely possible. This calculation estimates a fair value of 210 SEK, making it fairly valued at 210.50 SEK.

Ultimately, it all depends on the acquisition opportunities Teqnion finds. Different scenarios are possible, but even with a 12% growth rate and an 8% free cash flow margin, a solid expected return of 9% is achievable. If Teqnion surpasses the 15% growth target, the returns could be even more impressive, though it's wise not to assume this scenario automatically.

Risks and opportunities

Opportunities

Teqnion, a relatively small company, has plenty of room to grow both in Sweden and internationally. If acquisition opportunities dry up, the company can shift its focus to improving operational efficiency, achieving economies of scale, and pursuing vertical integration.

Risks

Sweden has many "serial acquirers" competing for acquisitions, leading to potential overcrowding in this market. However, Teqnion has the advantage of focusing on smaller companies that larger competitors might overlook. A business with just 10 million SEK in revenue may be too small for a company like Lifco but could be a valuable addition for Teqnion.

Teqnion's moat depends heavily on its management and the culture they've created. Any changes in management pose a risk, though leadership has repeatedly expressed their love for the job and intention to stay long-term. Another risk is rising interest rates, which could negatively impact Teqnion since many acquisitions are financed half with equity and half with debt.

Conclusion on Teqnion

Teqnion operates in a market often overlooked by investors, but its strong management team and strict acquisition criteria have helped it thrive. There's still ample room for growth both in Sweden and abroad due to the company's small size. Teqnion maintains healthy margins and pricing power despite inflation, making it a fair investment. Even if the company falls short of its growth and acquisition goals, it should still deliver a solid return. This belief is why I've taken an initial position in Teqnion, marking my first purchase of 2023.

MC 3.710M SEK

Equity 773M SEK

Tangible value 773M equity -/- 688M goodwill and other intangibles = 85M SEK

MC is 44 times the tangible value?

Net income trailing 117M SEK > P/E: 32?