Porsche AG - Research Report - Part 3

Porsche's financials, valuation, risks, and opportunities

“Driven by Dreams”

Porsche AG

This research report is divided into three sections. This is Part 3 of 3. In this segment, we will explore:

The financials

Financial performance

Debts

KPI’s

The valuation

Scenario analysis

Risks and opportunities

Risks

Opportunities

Conclusion

Conclusion on Porsche

Score

5) The financials

Good driving performance, but how about finances?

5.1 Financial performance

Porsche generated €40.5 billion in revenue in 2023, reflecting a 7.7% increase from the previous year. Over the past five years, Porsche has seen consistent growth, achieving a compound annual growth rate (CAGR) of 7.1%.

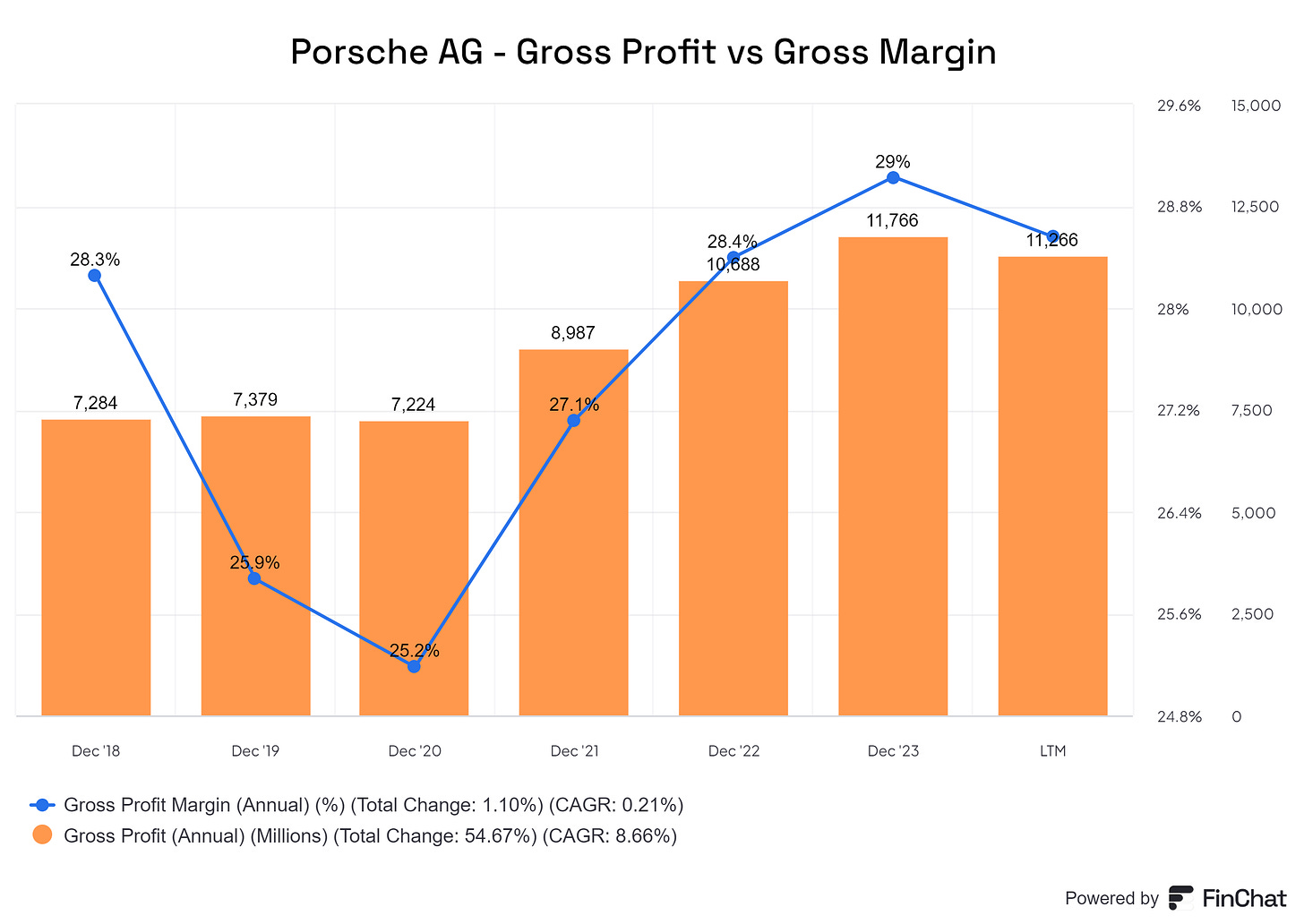

To me, gross profit is a key indicator of a company's competitive advantage because it reveals the gap between what customers are willing to pay and the actual value of the product. For Porsche, gross profit increased by 10% year-on-year, surpassing revenue growth and bringing the 2023 gross profit margin to 28.6%. It's encouraging to see that Porsche has improved its gross profit margin over the last five years. Gross profit has grown faster than revenue in that period, as shown in the graph below. For comparison, Ferrari's gross profit margin is 49.8%, BMW's is 17.6%, and Mercedes' is 22.4%.

Due to rising distribution and administrative costs, the net profit margin did not grow as quickly as revenue. Operating profit increased by 7.6%, aligning with the achieved growth in revenue. The operating profit margin remained at 18%, identical to 2022. By comparison, Ferrari achieved a 27% margin, BMW 10%, and Mercedes 11.9%.

The same trend can be observed in both gross and operating profit margins. While Porsche isn't Ferrari, it's also distinct from BMW or Mercedes.

However, when we examine the free cash flows generated, the three German car manufacturers are becoming more comparable. Porsche achieved a free cash flow margin of 7.4%, Mercedes 7%, and BMW 9.8% over the last 12 months. Ferrari, however, remains dominant, with a 22.4% margin.

A key financial metric for Porsche is ROS (return on sales), which represents operating profit as a percentage of revenue. As previously mentioned, this stood at 18% for the second consecutive year. Porsche targets a long-term ROS of 20% through its "Road to 20" program, implementing 150 out of 600 measures to reach this goal.

CEO Blume stated in the recent investor call that operating profit may slightly decline in 2024 due to the launch of four new models, which will incur temporary additional operational costs, such as logistics and distribution. By 2025, the company expects a solid foundation, allowing the margin to rise again toward the ultimate goal of 20% ROS.

Below is a comparison of key financial ratios across the discussed car brands.

Let's revisit free cash flow. It's relatively low, with net profit converting to free cash flow at just 60%. In 2021, free cash flow at 10.1% was fairly close to net profit at 12.2%, but in 2022 and 2023, significantly less cash was collected compared to reported profit. Porsche said, "The Porsche AG Group continued to invest in various vehicle projects, the electrification and digitalization of products, and production sites." It's important to keep an eye on this spending in the coming years, as capital expenditures will eventually need to stabilize.

In 2023, Porsche will pay out a dividend of €2.30 per share, resulting in a 2.5% yield. The dividend has more than doubled since 2022, when shareholders received €1.01 per share. With 911.000 shares outstanding, it's logical that Porsche prefers paying dividends over repurchasing shares.

This is a substantial dividend increase, in my opinion. Capital expenditure will remain high in 2024, and this doubling means that dividends will consume more than twice the free cash flow. Once companies commit to a certain dividend level, it's tough to scale back. Ideally, Porsche will have made its largest investments by 2024 and won't need to borrow more to cover dividends.

5.2 Debts

Porsche's balance sheet looks solid. The company has around €10.4 billion in debt and €5.8 billion in cash. Adding annual profit to the cash balance, Porsche could pay off all its debt within a year. With a current ratio of 1.5, the company is liquid and able to cover its short-term obligations.

5.3 Key Performance Indicators

Gross profit margin: This key indicator shows a competitive advantage, and Porsche's margin has improved in recent years. They should aim to maintain or slightly increase it each year.

ROS (operating margin): Porsche aims to hit a 20% ROS (Return on Sales), a good indicator of profitability and whether operating costs can be controlled while sales increase.

FCF margin: This represents what ultimately remains for shareholders. This ratio needs to return to normal compared to profit once significant investments from 2022 to 2024 are complete.

6) The Valuation

The cars may be expensive, but what about the shares?

6.1 Scenario Analysis

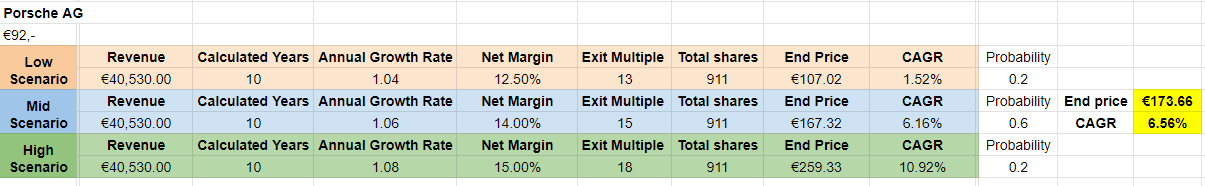

In my view, Porsche is a remarkably strong company. The question that often arises is: "Is it also fairly valued?" I initially looked into Porsche due to its seemingly low valuation at around €70. But is that still true? To investigate, I've created a scenario analysis.

While I believe Porsche will maintain its strong brand, this isn't guaranteed. I also can't be sure if Porsche will be distinctive enough to consistently achieve a 20% operating margin. The shift to electric vehicles and new models over the next few years adds some uncertainty.

I've provided the scenario analysis above, and here's a summary of the assumptions made for the expected scenario (marked in blue).

Porsche's sales have historically grown at a CAGR of 7.1%, and I predict a minimum of 6% annual growth over the next decade, due to price increases and steady sales growth.

I've estimated a net profit margin of 14% over the next 10 years, up from the current 12.7%, which should be achievable through the "Road to 20" strategy. After 10 years, growth may become more challenging, but given the company's strength, a price-to-earnings ratio of 15 seems reasonable.

With these assumptions, the expected annual return (CAGR) would be 6.2%, excluding dividends, leading to an approximate total annual return of 8.5%.

Bearish Scenario

Disappointing new models

Deterioration of the luxury/premium brand (due to overproduction or low pricing)

There is less differentiation in the electric vehicle market

Bullish Scenario

Positive reception of new models

Strengthened brand value

Ability to further increase prices

Improved performance of Bugatti/Rimac investments

Some scenarios are more probable than others, so I applied probabilities. This results in a projected price gain of around 6.6%, excluding dividends.

6) Risks and Opportunities

Sport Mode or Reverse

6.1 Risks

In the past, Porsche almost went bankrupt because it couldn't produce enough cars to meet demand. To achieve its ambitious goal of 80% electric vehicles by 2030, Porsche needs to ensure its electric car production capacity is up to standard. Fortunately, it has the support of its parent company, Volkswagen.

Porsche must strike a careful balance between supply and demand while preserving its image as a luxury sports car brand. This balance requires constant monitoring, and while there's no evidence of brand damage yet, it's a potential risk. If the brand's image declines, the premium revenue Porsche currently enjoys could shrink.

This risk is especially relevant for a company that earns a large share of its revenue from China. Tensions between the West and China continue, and there's always a chance that China could restrict the sale of foreign-made vehicles.

7.2 Opportunities

With the Taycan, Porsche has shown it can develop electric cars that deliver a distinctive Porsche experience. Electric vehicles have made rapid acceleration simpler and cheaper, so Porsche emphasizes other features like tuning, chassis design, suspension, and steering. Buyers have confidence in the brand, with 10,000 pre-orders for the electric Macan, despite no one having physically tested the car yet. In fact, 60% of Taycan buyers are new to the Porsche brand, showing that electric vehicles attract a fresh demographic. As other automakers struggle with the transition to electric vehicles, Porsche is well-positioned to emerge even stronger. By 2030, more than 80% of its cars should be electric.

Porsche could potentially achieve growth exceeding the projected 6% per year due to long-term expectations in the high-end market. With an average sales price of €115,000, McKinsey estimates the expected compound annual growth rate (CAGR) to be 8%.

7) Conclusion

Patience is a virtue

7.1 Conclusion on Porsche AG

Writing this analysis of Porsche has been a delight. The brand's history is fascinating, and its cars are truly beautiful. Porsche has established itself as a luxury sports brand that people of all ages adore thanks to its history, reputation, and consistent quality. Porsche stands out from other brands in many ways, making it a unique entity. It successfully charges premium prices, maintains its image, and benefits from strategic partnerships within the Volkswagen Group. Despite being a luxury car manufacturer, it has no annual production cap.

Even when Porsche pivoted to focus on SUVs and family cars in the early 2000s, the brand maintained its strong reputation. This resilience is a powerful sign. Financially, Porsche enjoys good profit margins, its revenue continues to grow, and expectations for future growth remain positive. Its balance sheet appears solid, with a manageable level of debt. In terms of valuation, Porsche seems fairly priced at its current level of €92 per share. Assuming 6% annual growth over the next decade and a final price-to-earnings ratio of 15, shareholders can anticipate an approximate 8.5% return.

While I think Porsche is a strong, remarkable company, I'd prefer to see the stock price drop further before considering investing. As it stands, there's no margin of safety, so everything needs to unfold as predicted.