Netflix - Premium Research Report - Sneak Peek

Our fundamental analysis of Netflix. Which streaming platform will reign supreme?

“To entertain the world”

Netflix

This research report is a sneak peek of the entire fundamental analysis. If you want to read the entire research report, check out our premium research reports.

In this sneak peek, we will dive into competitive advantages, risks, and opportunities.

IntroductionBusiness model

Competitive advantageManagementFinancial analysisRisks and opportunities

ValuationClosing thoughts

2) Business model

Behind the scenes

2.1 The revenue model

Nowadays, all revenue comes from streaming services. Netflix completely stopped renting and sending DVDs in September 2023, which amounted to around 3% of its turnover in 2022. Many streaming services, including Netflix, originally started by offering films and series from other companies by purchasing licenses, allowing them to show the films or series on the platform for a certain period. After a few years, they began making their own series and films. Around 2013, Netflix started investing serious money into its own productions.

In 2018, self-made content accounted for about 30% of their total content value (the estimated value of the entire film offering). By 2023, this value had grown to $20 billion of the total $30 billion in content, representing approximately 60%. This shows a significant increase in investment in original content.

Under Hastings' leadership, Netflix has undergone four major changes:

From DVD rental to streaming: Netflix started as a service that rented DVDs by mail, but changed to a streaming service.

International expansion: After establishing a strong foothold in the US, Netflix expanded to other countries, starting with Canada.

Switch to own productions: Netflix started to invest more in producing content itself, with series such as "House of Cards" as an example.

Introducing an advertising subscription: Netflix recently added a cheaper option with ads in addition to the usual subscription options.

Although Netflix has been in business for a long time and has a large customer base, there is still significant growth potential. In 2022, Australia, the UK, and the US had 65%, 57%, and 53% penetration, respectively. Growth in these regions will mainly come from price increases. However, Netflix still sees significant opportunities in prosperous European countries, Japan, and South Korea, with the greatest growth potential in less developed countries. New subscribers will primarily come from the international segment, where Netflix aims to enter low-income countries through cheaper subscriptions, including an advertising subscription. Profit margins in these regions will be lower than in Western countries.

In Q1 2024, Netflix had more than 260 million paying subscribers (see Figure 3). Subscription prices range from $1 to $28 per month, depending on the plan and country. Additional accounts for family members cost between $2 and $8 per month. Netflix prices its subscriptions differently around the world, with the average subscription costing $11.79. Ultimately, a larger share of revenue will likely come from advertising. Currently, advertising is not available in many territories and therefore only accounts for $50 million of total sales—a negligible amount. However, Netflix expects to grow rapidly in the coming years.

The figure below shows the distribution of turnover per region in FY23. It can be seen that UCAN (the United States and Canada) currently accounts for almost 43% of total turnover. EMEA (Europe, the Middle East, and Africa) accounts for roughly 32% of sales, while Latin America and Asia each account for just over 10%.

Percentage growth does appear to be decreasing due to the law of large numbers. Below is a brief overview of the number of added subscribers in 2023 per region:

UCAN: +8.3 million subscribers (worth $1.6 billion annually)

EMEA: +14.4 million subscribers (worth $848 million annually)

LATAM: +6.5 million subscribers (worth $675 million annually)

APAC: +8 million subscribers (worth $733 million annually)

What you see is that EMEA (especially Africa and the Middle East) is not the most profitable market. The high profit margins are mainly achieved in UCAN (and Europe). If you exclude Europe from EMEA, profits will be much lower. EMEA (especially Europe) and UCAN are the most profitable markets (see figure below). This is also reflected in the FY23 annual report. Below are the average Netflix subscription costs in FY23 by region:

UCAN → $16.28

EMEA → $10.87

LATAM → $8.66

APAC → $7.64

Netflix has recently focused more on live events and games to increase engagement with their platform. They now organize live sporting events, such as a golf tournament between F1 drivers and professional golfers, a tennis match between Nadal and Alcaraz, and a boxing match between Jake Paul and Mike Tyson. They also made a significant deal to air WWE shows.

Since November 2023, Netflix has offered a cheaper subscription that includes commercials. This subscription costs $6.99 per month and includes 5 minutes of advertising every hour. Despite the lower price, Netflix earns more from this plan than from the regular subscription priced at $15.49, thanks to the additional income from advertisements.

Growth is promising: the number of people opting for this advertising-supported subscription has increased by 65% compared to the previous quarter. This plan already accounts for 40% of all new subscriptions in the countries where it is available. The real revenue from advertising still needs to grow, as Netflix is still working on improving their sales department. This new subscription could play a major role in attracting more people to Netflix in the future, as it is cheaper and can ultimately generate more money per user.

At first glance, Netflix's revenue model seems quite future-proof. Netflix is known for its adaptability and ability to follow trends. While the revenue model currently consists of almost 100% subscriptions, they have already started exploring new markets, namely the advertising and gaming markets. We will discuss this in more detail in Chapter 2.2.

2.2 Sector & industry

“Netflix is a focused passion brand, not a do-everything brand: We are like Starbucks, not 7-Eleven; Southwest, not United; HBO, not Dish.” - Netflix

Netflix is available in almost all countries, with the exception of China and Russia. Netflix operates in the (streaming) entertainment market, where the key metric is 'viewing time'. While one might think that Netflix only competes with other streaming services such as HBO Max, Apple TV, YouTube, or Disney+, the reality is broader. According to Netflix's long-term vision, they compete with all possible forms of leisure activities that can influence the viewing time of their potential users. This includes not only watching content on other streaming services, linear television, or renting/purchasing series and films, but also activities such as reading a book, surfing YouTube, playing video games, using social media, eating out with friends. Netflix currently captures only a small portion of total consumer time.

The TAM for streaming and gaming

According to Indiewire the total addressable market (TAM) for Netflix can be between 700 million and 1 billion households, excluding China. Experts consider this estimate technically correct, though perhaps a bit too optimistic. A more realistic estimate of the TAM is between 400 million (the low number of broadband subscribers) and 1.1 billion (the highest number of broadband plus mobile subscribers). Hastings believes Netflix can reach 80% of all American households.

Major players such as Netflix, Amazon Prime Video, and Disney+ are expected to continue expanding their customer bases. It is virtually impossible for an investor to account for all these moving parts, and in my opinion, this is not necessary. In this analysis, we focus on Netflix's main market—the streaming market—and also devote a portion to the growing and emerging gaming industry.

We will keep it brief regarding the TAM of gaming, as it does not currently contribute to Netflix's revenue. By 2024, the video game market is expected to reach $282 billion in revenue. The CAGR between 2024 and 2027 is estimated at 8.8%. The number of gamers is expected to grow to 1.47 billion, with a penetration rate of around 19% by 2027. The average revenue per user (ARPU) in the video game market is estimated at $215 in 2024. It seems logical that Netflix wants to venture into this market.

The streaming market

“The goal is to become HBO faster than HBO can become us.” - Ted Sarandos

To understand who Netflix is competing with, it's important to define the streaming market. This market consists of digital services that provide media content over the Internet, such as Netflix, Disney+, YouTube and Amazon Prime Video, but excludes traditional cable TV and physical media such as cinemas and theaters. These streaming services compete not only with each other, but also with other markets and companies. Each of these companies is competing for your viewing time, because viewing time means money.

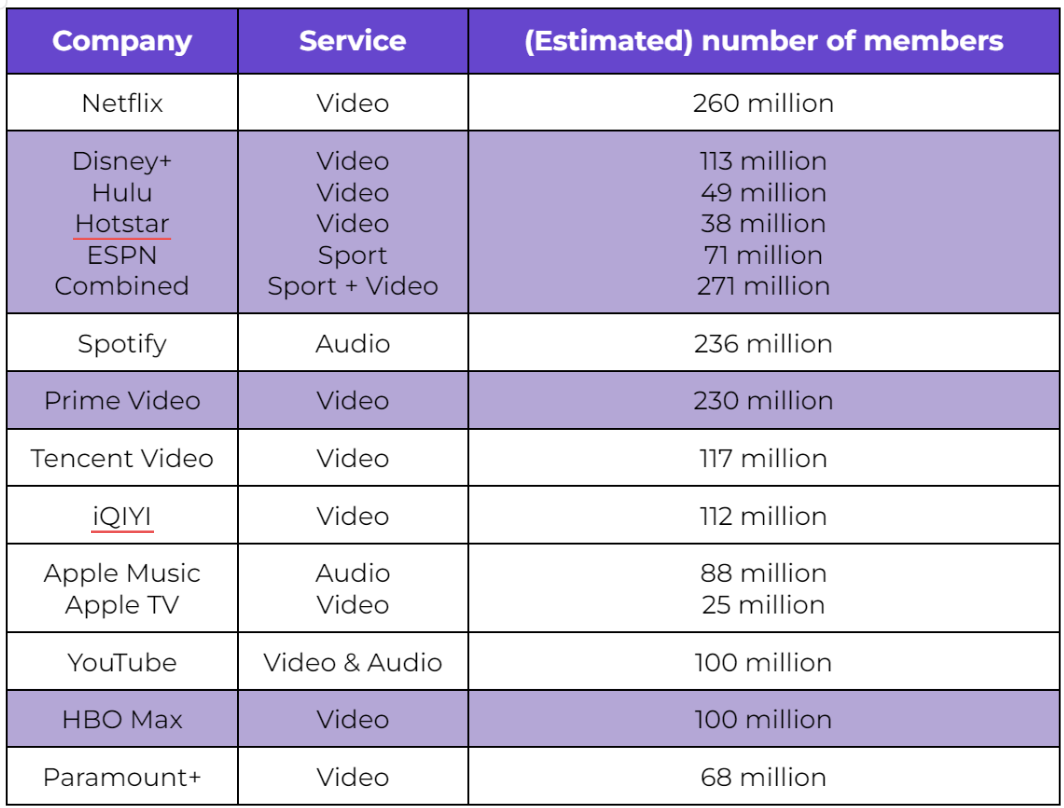

But which competitors are there, actually? There are too many to cover them all. In the table below, you will find all the services that Netflix competes with and their membership numbers. The data from some platforms is a bit outdated or are rough estimates. Please note that this data quickly becomes outdated and may no longer be correct when you read the analysis. The estimates are based on recent information from 2023. The purple colored platforms are, as far as I'm concerned, the main competitors to keep an eye on.

It is virtually impossible to calculate an accurate global market share for Netflix. The number of subscribers and revenue varies widely by country, meaning the market leader can differ significantly across regions. Many subscribers have multiple streaming subscriptions, which complicates the calculation of market share based on subscribers alone. For instance, Amazon Prime Video has over 200 million members, but these members pay not just for Prime Video but also for benefits like free and faster delivery. Additionally, many major streaming services operate in China and Russia, where Netflix does not. It's questionable whether these services would have been as successful with Netflix as a competitor.

Calculating market share using turnover also presents challenges, as revenue figures for other streaming services are often not disclosed. Many companies also generate revenue from other sources such as e-commerce, advertising, theme parks, cruises, and licensing, which further distorts the picture.

Many large companies now choose to collaborate and offer their services under a more expensive bundled subscription. This strategy aims to increase scale and reduce customer churn. By bundling services, companies try to retain customers by offering diverse content.

For example, Disney is integrating Hulu and Disney Plus to increase its scale and reduce churn. At the same time, Comcast is introducing a bundle with Netflix, Apple TV, and Peacock, which strengthens competition. This is an interesting development to keep an eye on.

According to Traffic Share, in Q1 2023, Netflix had a 44% market share in the US, Disney+ had 6%, Hulu had 20%, YouTube TV had 5%, and HBO Max had 11%. According to Investing.com, Netflix had a global market share of 44% as of April 2024. This makes Netflix the current absolute market leader in SVOD (Subscription Video On Demand).

To reflect the popularity and scale of Netflix, see Figure 6 below. Video streaming services had 33% of the internet bandwidth. Netflix had a whopping 15% of all search traffic in 2023.

Graph 1 shows how paid subscriptions for various services have developed over the past four years. Some services, such as YouTube Premium, Amazon Prime Video and Apple TV+, do not share their subscriber figures every quarter. Disney will merge its Indian assets with Reliance in 2025. Therefore, Disney+ Hotstar subscribers are not included in Disney+ subscribers.

Streaming services are increasingly gaining ground at the expense of traditional television. YouTube is extremely popular in American living rooms, accounting for almost a quarter of the total streaming time on televisions. Netflix is still considered the top choice among streaming services (SVOD) in the US, with a larger market share than Hulu, Prime Video, and Disney+ combined.

Constantly switching between streaming services has almost become a popular sport. Netflix remains the market leader, partly due to having the lowest churn rate in the industry.

The gaming industry

The traditional gaming industry focuses on designing, developing, and selling video games for platforms such as PCs, consoles (such as PlayStation, Xbox, and Nintendo Switch). In this gaming market, Netflix competes with companies such as: Sony (PlayStation), Microsoft (Xbox), Nintendo, Valve (Steam), Epic Games (Epic Games Store) and Ubisoft.

The mobile gaming industry involves the development, marketing and sales of video games that can be played on smartphones and tablets. Netflix competes in the mobile gaming sector with companies such as: Apple Arcade, Google Play Games, Tencent, Electronic Arts (EA Mobile), Activision Blizzard (King), and Amazon Game Studios. At the end of 2021, they announced their entry into the gaming world. They started with mobile games and hope to expand to other devices, such astelevisions,s in the future. They think they can make games a strong category by using their films and series. Likewise, they mainly want to attract the fans of certain intellectual properties by offering them games that they will love.

Netflix is investing heavily in video games. The company started with interactive games such as "Black Mirror." As of 2021, Netflix has made gaming a core priority. The company hired a former EA executive and offered subscribers the opportunity to play a selection of mobile games for free. Since then, Netflix's gaming division has introduced "gamertags" and started recruiting staff to develop an "AAA PC game." Triple A games are the highest quality games in terms of production and costs, like HALO, Assassin's Creed, and Monument Valley. In August 2023, Netflix launched the first tests of cloud gaming, which allows you to play games without downloading them.

You may wonder why no turnover is yet being achieved from this segment. There are several reasons for this, such as the relatively recent launch, the lack of direct revenue from the games, limited marketing efforts, strong competition, and the need to improve the quality and variety of the game offerings.

Conclusions about the sector & industry

Streaming is a sector where the size of your customer base makes a huge difference. Spreading the cost of a film across 100 million or 500 million customers significantly impacts the per-customer cost. It's quite simple: the more customers, the lower the costs per customer. Consequently, the market tends towards a situation where only a few major players remain, forming an oligopoly. The companies at the top will make substantial profits. Currently, competition in the streaming and gaming markets is fierce, and the question is who will be left standing.

In terms of competitive advantage, we need to determine whether Netflix will win this battle or if the larger 'legacy' companies will ultimately dig deep enough into their pockets to steal market share from Netflix.

6) Risks and opportunites

Cliffhangers ahead

6.1 Risks

The streaming and entertainment market is extremely competitive. All companies with a big bag of money (Apple, Amazon, and Google), can, in theory, attempt to grab some market share. However, I think the following risks are the greatest at the moment:

Piracy and illegal streaming. For companies in the entertainment industry, using user data and preventing piracy has become essential to success in the Internet age. According to Statista, 16% of all consumers stream illegally every week, and it appears to be even worse among the youth. Half of global 16-24-year-olds have streamed music illegally. In 2020, 12.5 billion visits were made to illegal websites in the US alone. The threshold for illegally streaming music, films, or series seems very low. If this trend continues, Netflix could lose many subscribers.

Artificial intelligence. Hollywood's traditional economies of scale, including Netflix's, are under pressure. Major studios had an advantage thanks to their ability to produce high-budget films and series. Generative AI threatens this because everyone can now (or will soon be able to) create 'high-quality' digital content with minimal resources. This increases supply and lowers barriers to entry, leading to more competition and potentially lowering subscription prices and profit margins for established players like Netflix.

Competition. This risk is somewhat related to the above point. There are many large companies with deep pockets, such as Amazon, Apple, and Alphabet. Netflix, Disney+, and Warner Bros Discovery have all indicated that they want to work towards profitable growth. However, companies like Apple and Amazon are less concerned with profits from a streaming service. They aim to attract customers to their platforms (iOS and Prime) by creating an all-in-one environment, which adds enormous value and becomes almost a no-brainer for consumers. If these companies compete aggressively, Netflix will have to invest more money in content, and margins could evaporate.

6.2 Opportunities

Where storms rage, opportunities also bloom.

Content diversification: Netflix can offer more than traditional films and series by exploring new content formats, something they are already doing. They are introducing cheaper subscriptions with ads, which makes Netflix more attractive to a wider audience. They have also acquired game studios and are working on expanding their game catalog. Developing games around their own Netflix Originals offers a unique opportunity: these exclusive games can only be played or potentially licensed from them. They are also exploring live sports, such as their 10-year contract with the WWE and the upcoming live boxing fight between Mike Tyson and Jake Paul, to see if this is an attractive new area. Moreover, they experiment with interactive storytelling, with which they can give a unique twist to the traditional film and series landscape. In this way, they respond to diverse interests and promote global growth.

Artificial intelligence. While AI can be a huge risk, it is also an opportunity if they handle it well. By using AI for more accurate recommendations and interactive stories, Netflix can increase user engagement and provide a more personalized viewing experience, keeping subscribers more loyal (think maintaining a low churn rate). And if a random individual or small start-up can make films with artificial intelligence, then Netflix, with its adaptability and strong culture, should be able to do this too.

International expansion. By entering emerging markets with local content and pricing models, Netflix can achieve significant growth. Mainly due to the new cheaper advertising model, they can enter the lower ARPU countries. They are already doing this very well, they have experience with this and I assume that they will be able to do this well in the future.

Become a premium member and get access to the entire fundamental research report, including:

Chapter 1 - Introduction

Chapter 2 - Business model (free)

Chapter 3 - Competitive advantage

Chapter 4 - Management

Chapter 5 - Financial analysis

Chapter 6 - Risks and opportunities (free)

Chapter 7 - Valuation

Chapter 8 - Conclusion