Kering - Brief Breakdown

A brief breakdown into the luxury conglomerate Kering, known for brands such as Gucci and Balenciaga

“Empowering Imagination”

The story of Kering begins in 1963, when François Pinault founded a timber trading company called Établissements Pinault. He made several successful acquisitions, and in 1988, the company was listed on the Paris Stock Exchange.

For diversification purposes, the company acquired retail distribution businesses starting in 1990. The transformation into today's Kering began in 1999 with a 42% stake in Gucci. That same year, Yves Saint Laurent and Boucheron were also acquired. Meanwhile, older businesses were divested to focus solely on luxury fashion. In 2001, Balenciaga and Alexander McQueen were taken over. After various transformations, Kering has emerged as a pure luxury fashion company.

François-Henri Pinault, not to be confused with his father and founder François Pinault, has been involved with the group since 1987. He became chairman and CEO in 2005. The Pinault family owns 42% of Kering in total. You could say that CEO Pinault has a vested interest in leading this company to success.

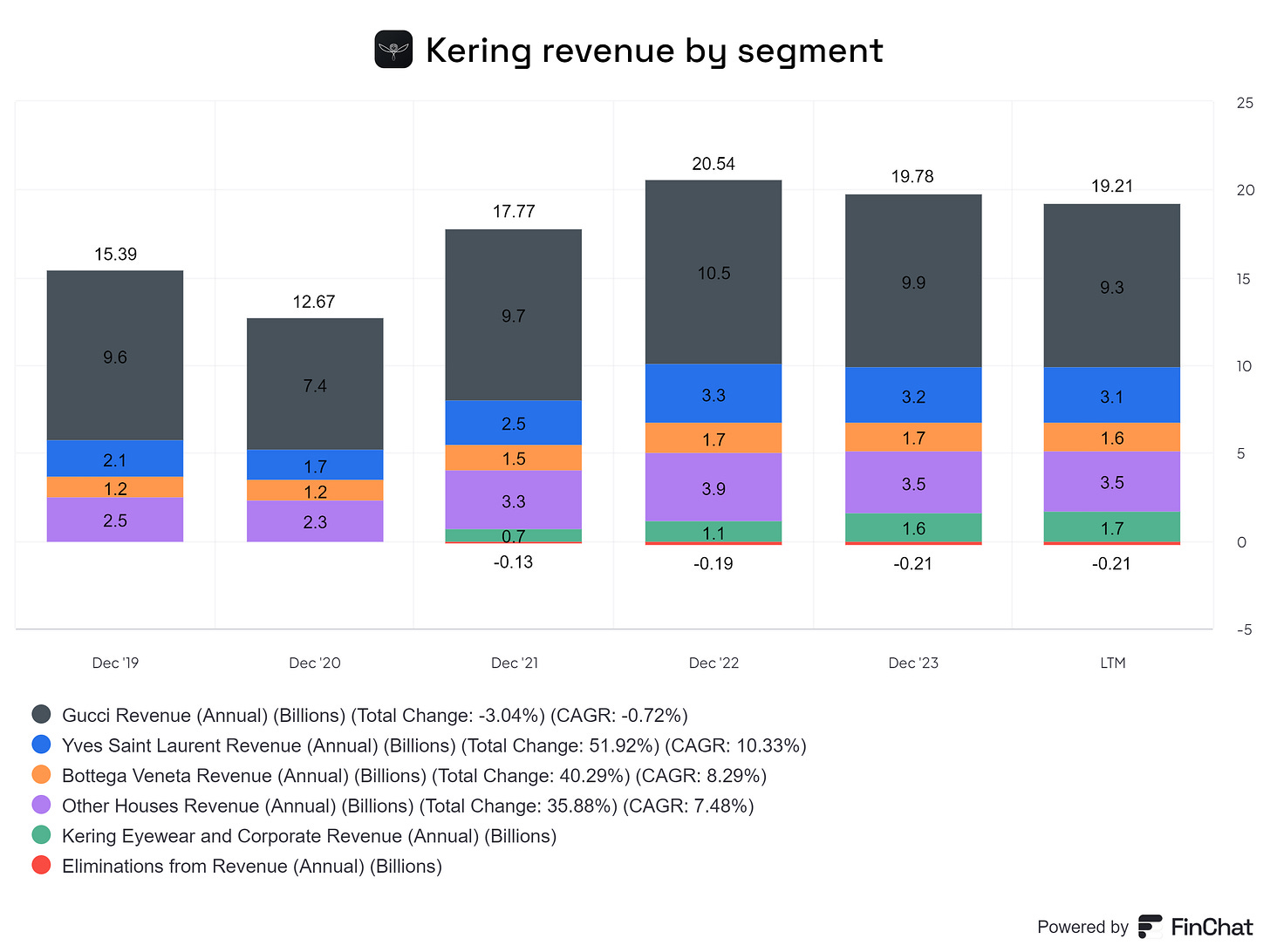

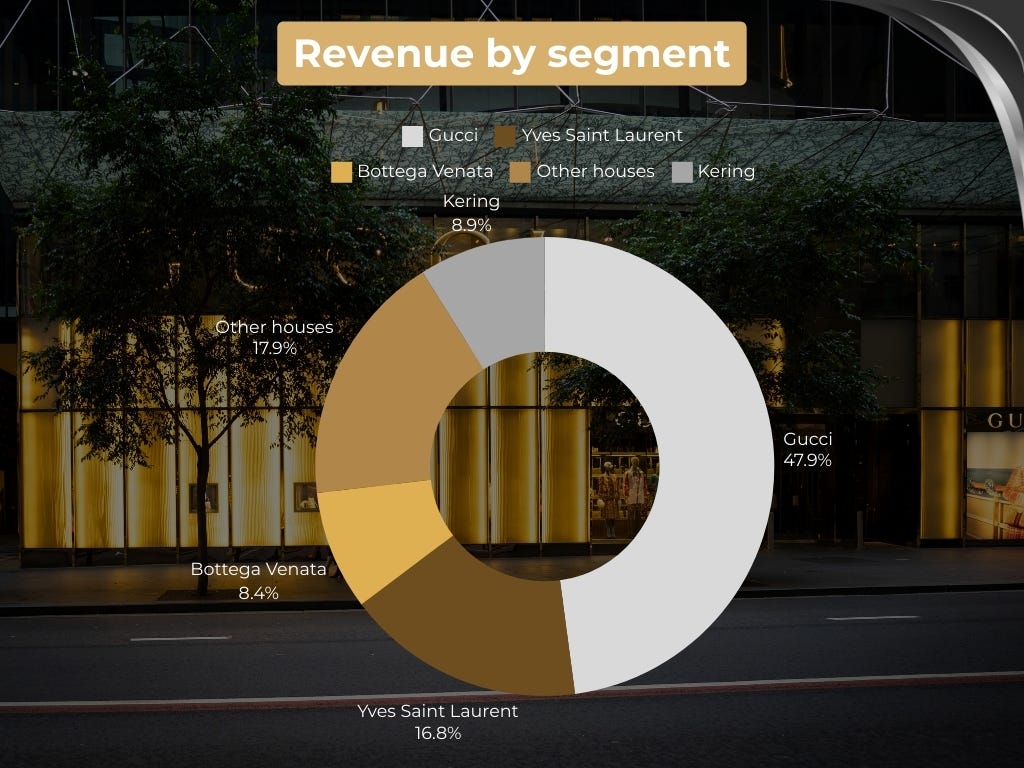

The brands under Kering are familiar to many, but Gucci is the true star. This company accounts for more than half of Kering's total revenue. Looking at the EBITDA data provided by Kering for each brand, it's clear that Gucci's contribution is even greater. In 2022, over 65% of Kering's operating profit came from Gucci. Other notable brands include Yves Saint Laurent, Bottega Veneta, and Balenciaga. Kering operates a total of 1,700 stores in prime locations where it sells luxury products, as well as through online sales on its own websites.

Looking at the geographical spread of revenue, there's a good distribution. More than half of Kering's revenue in 2022 came from Western Europe, the U.S., and Canada. The Asia-Pacific region accounted for 33% of revenue. It's worth noting that China had a disappointing year due to strict COVID-19 lockdowns and mandatory store closures. First-quarter 2023 figures show that the Asia-Pacific region accounted for 40% of revenue, quite different from 2022. This reflects the significant impact of China on the results.

Kering’s management

As mentioned earlier, François-Henri Pinault, the founder's son, is Kering's CEO and director. I still find this combination strange.

The board of directors is important for keeping management aligned with established goals. On the other hand, there's a case for Pinault holding both roles since his family owns 42% of the shares through their family fund Artémis. When a family is so invested in a business, they naturally maintain tight control. It's often a good sign that the family holds a large stake, as management is more likely to think long-term and prioritize success.

Kering's CFO is Jean-Marc Duplaix, who has held the role since 2012. He also served on Puma's board until 2019, where Kering previously had an 86% stake. Since 2018, Kering has significantly reduced its stake in Puma in the aftermath of the shift to luxury. Currently, Kering holds about 4% of Puma.

As Gucci accounts for more than 48% of Kering's total revenue, it's crucial to consider who's in charge of the brand. The CEO is important, but the creative director, who oversees collections, branding, etc., plays a key role. Alessandro Michele held this position for seven years but resigned last year due to "conflicting perspectives." Recently, Gucci CEO Marco Bizzari agreed to step down as of September 23, 2023. Kering's long-serving managing director, Jean-François Palus, will become Gucci's CEO during a "transition period" to strengthen the brand. After overseeing Kering's mergers and acquisitions, Jean-François Palus became Group CFO in 2005. He seems to have years of experience with Kering.

Afterward, a new CEO will be hired, and Palus will resume focusing on his role as managing director.

Gucci hasn't bounced back as quickly as rivals like LVMH since the pandemic. Before COVID-19, Kering often had a higher valuation than LVMH. This changed after 2020 when LVMH rebounded with massive growth while Kering struggled due to Gucci's poor performance.

On one hand, the significant management changes show Kering is doing everything possible to revitalize itself. But on the other hand, they could indicate chaos and bring uncertainty. It remains to be seen how the new people will perform in their roles.

Aside from fixed salaries, management receives annual and multi-year variable bonuses. Combined, these bonuses can be up to 2.5 times the fixed salary.

The variable bonuses depend on both financial and non-financial targets. Here's the breakdown:

Annual variable bonus

35% based on recurring operating income

35% based on free cash flow

10% based on sustainability

10% based on compliance

10% based on organization and talent management

Long term incentives (LTI)

40% based on recurring operating income

40% based on free cash flow

10% based on women's participation in management roles

10% based on promoting biodiversity

For financial targets, the full 100% (in shares) is awarded when a growth of more than 5% is achieved compared to the average of the previous three years. It's good that free cash flow is a major criterion since it's a better measure than profits, indicating the actual cash flowing into the company over time. However, achieving over 5% recurring revenue growth compared to the prior three-year average is an easy target.

From 2015 to 2022, the CAGR of recurring revenue was 20%. In 2021, recurring revenue increased by 60% over 2020. So, it's clear that this goal is too simple for management. It's worth noting that "recurring operating income" does not mean recurring profit, as it's adjusted for one-off income and expenses.

Competitive advantage

It's challenging to pinpoint a specific competitive advantage for a holding company like Kering since each brand may have different or no advantages. While it's positive that Kering is a family business that often pursues long-term vision, it's not a competitive advantage. Therefore, it's helpful to assess the moats of various brands, focusing on Gucci, Yves Saint Laurent, and Bottega Veneta, which together account for 90% of Kering's profit.

Gucci

As noted, Gucci is crucial to Kering. A lot hinges on how you view Gucci as a brand. Founded in 1921 in Florence, Italy, Gucci has built a fantastic brand over the years. Currently, it's one of the most valuable luxury fashion brands (ranked 4th by Statista), behind Louis Vuitton, Hermès, and Chanel.

In 2022, Gucci achieved an operating profit margin of 35.6%. It excels in Asia, especially China, which accounted for 36% of its 2022 revenue, despite COVID-19 lockdowns and store closures.

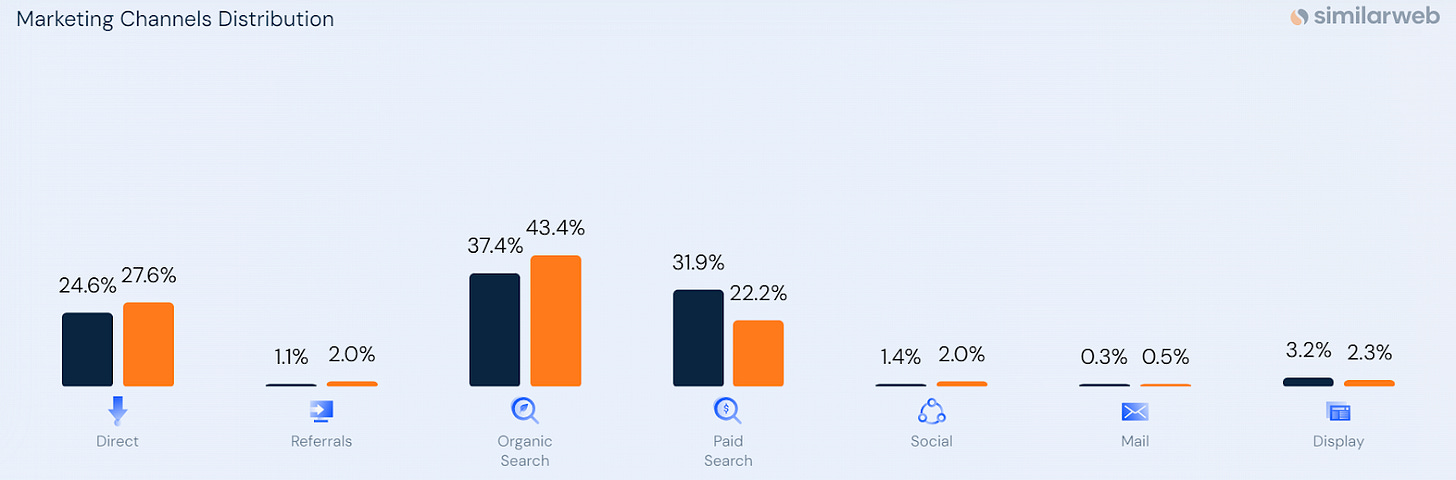

Gucci's moat is its strong brand, which gives it significant pricing power. Gucci has always been known for quality and status and protects its brand strength by selling directly to customers via its own stores in the most luxurious locations. In these stores, it can best represent the brand. Ninety-one percent of revenue comes through direct channels, and the remaining 9% is through a select group of retailers like De Bijenkorf in the Netherlands.

Gucci never offers discounts through its own channels and doesn't participate in events like Black Friday. However, some retailers authorized to sell Gucci do offer discounts (check bloomingdale.com, lyst.com, and The Outnet). This could damage the brand and reduce exclusivity over time, as people with less money can more easily buy Gucci products. Louis Vuitton remains more exclusive, working with only one retail partner that is not allowed to sell at a discount. Though Gucci bags still cost €2,000–3,000, these discounts are worth monitoring.

First-half figures show Gucci's revenue declined by 1% in 2023 compared to the same period in 2022, and operating profit margins dropped by 4%, despite significant price hikes. In contrast, LVMH's fashion and leather goods division grew by 20% in the same period, starting from a stronger base.

Yves Saint Laurent

YSL is a relatively young brand compared to its competitors, founded in Paris in 1962 by Yves Saint Laurent. It's the second-largest part of Kering and is growing the fastest. In 2022, YSL's revenue grew by 31% over 2021, while operating margins rose to 43%. In the first half of 2023, YSL grew by 6% compared to the same period in 2022. While Gucci is struggling to maintain margins, YSL has been increasing them in recent years.

YSL's margins, though not as high as Gucci's, remain strong, with a 30.5% operating margin in H1 2023. Its margins are gradually approaching those of Gucci. YSL uses more partners than Gucci, giving it less control over customer experience, leading

to fewer direct sales. The ratio is 80% direct to 20% partners. YSL's Asian revenue is also much lower than Gucci's, accounting for 30% of sales (excluding Japan), compared to Gucci's 42%. YSL is especially strong in Western Europe.

Yves Saint Laurent was progressive, normalizing clothing for women that wasn't common at the time, such as wide-legged pants and "free the nipple" outfits. He was also one of the first designers to have women of color model his clothing (according to Vogue). These actions and trendsetting have strengthened the brand, driving growth and margins in recent years. In 2019, the operating margin was 25.9%, showing YSL can significantly raise prices and grow profits.

Bottega Veneta

Like Gucci, this luxury brand originated in Italy. Notably, its operating margins are far below those of Gucci and YSL. In the first half of 2023, Bottega Veneta had an operating margin of 20.3%, with steady revenue and a slight profit increase from the previous year.

Bottega Veneta excels in leather goods like bags, shoes, and sandals, which make up 77% of its revenue. It's not easy for outsiders to identify Bottega Veneta's products by appearance alone, unlike Gucci and YSL.

From the graph below, you can see that Bottega Veneta isn't as strong a brand as Gucci or YSL, with fewer people finding the online store directly or through organic search. Naturally, this requires a larger marketing budget to attract customers.

Bottega Veneta vs. Gucci

Bottega Veneta vs. YSL

Although Bottega Veneta is strong with these margins, it's unclear if a moat exists. In the valuation, it seems sensible to separate the three mentioned brands to arrive at a fair value of the company through a sum-of-the-parts analysis. This approach would also include the other brands within the company.

Kering’s financials

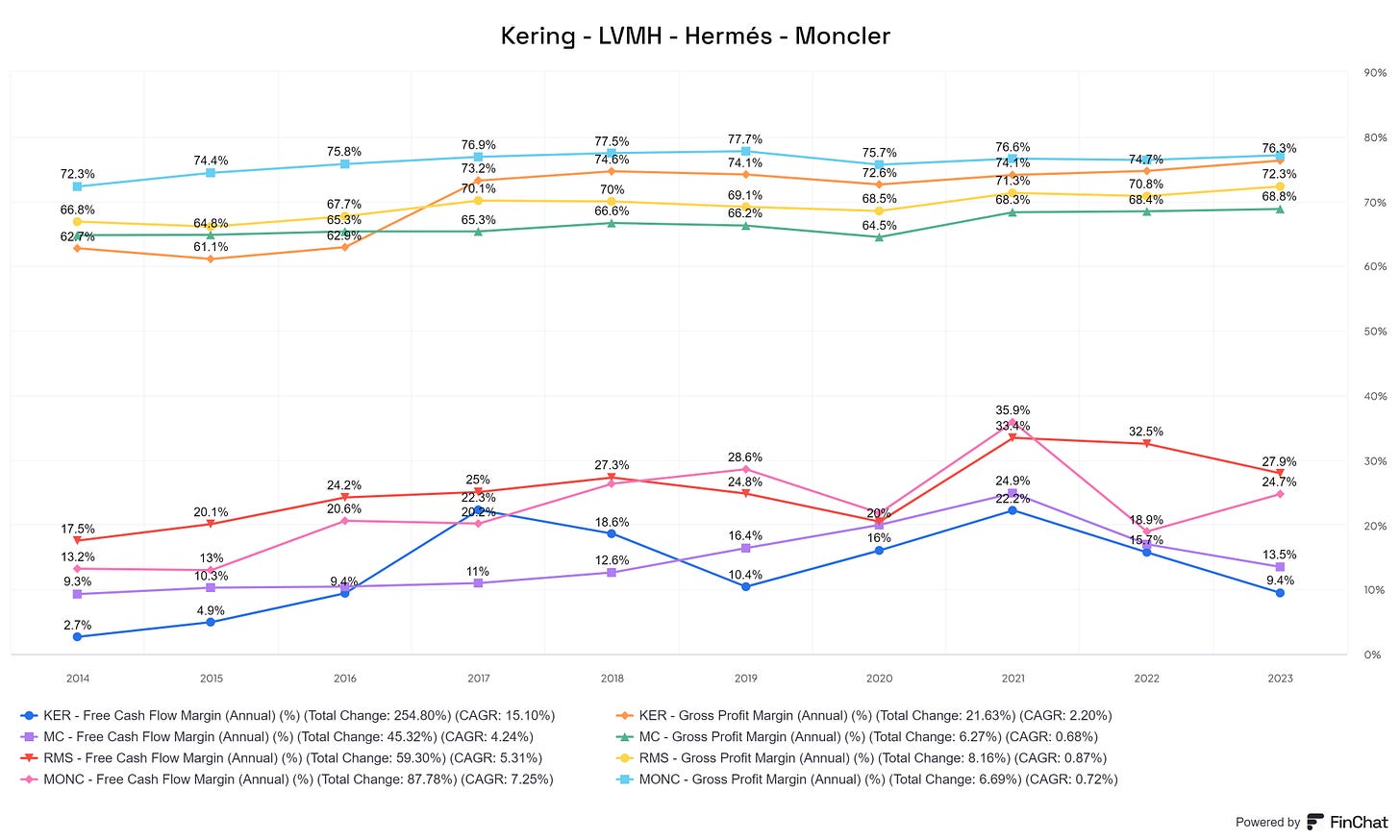

In 2022, Kering earned over €20 billion in revenue, up 15% from the previous year. The company had a net profit margin of almost 18%, slightly lower than in 2021. The FCF conversion (the portion of net profit converted into free cash flow available to shareholders) is generally strong. Over the last five years, the average FCF conversion was 91%.

In the first half of 2023, net profit margin fell slightly to 17.5%.

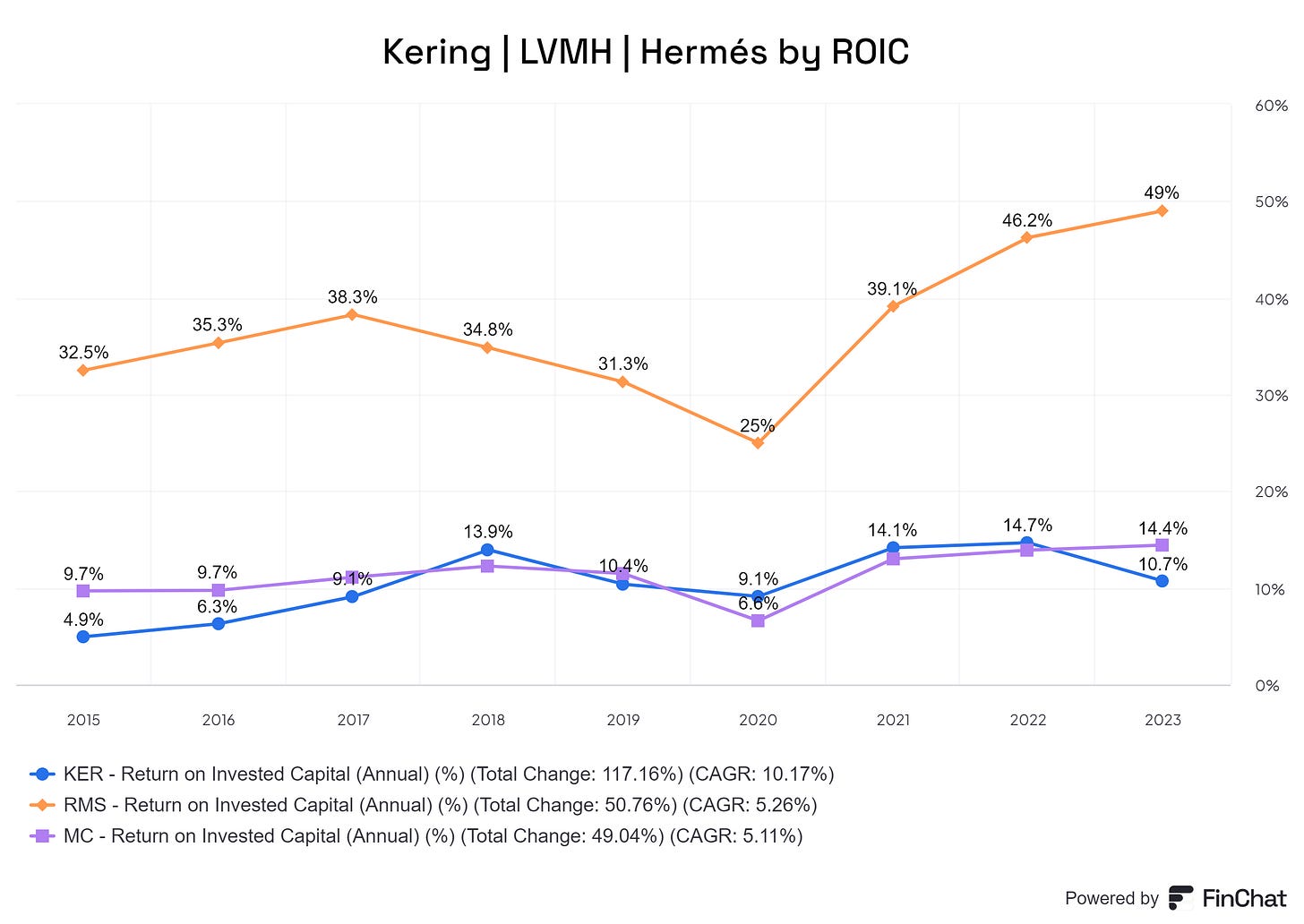

Kering's ROIC (10.7) is declining, and not as impressive when compared to competitors. Over the past 10 years, it has averaged 10% ROIC. The sharp increase in 2018 was due to divesting some poorly performing brands and partially reducing its Puma stake, bringing in a large cash inflow. Since then, ROIC has stayed above 10%.

Kering currently has €9.5 billion in long-term debt. Given the company's financial performance, this shouldn't be an issue. The debt can theoretically be paid off within a year and a half of free cash flow ($2 billion) and its current cash position ($4.3 billion)

Capital allocation

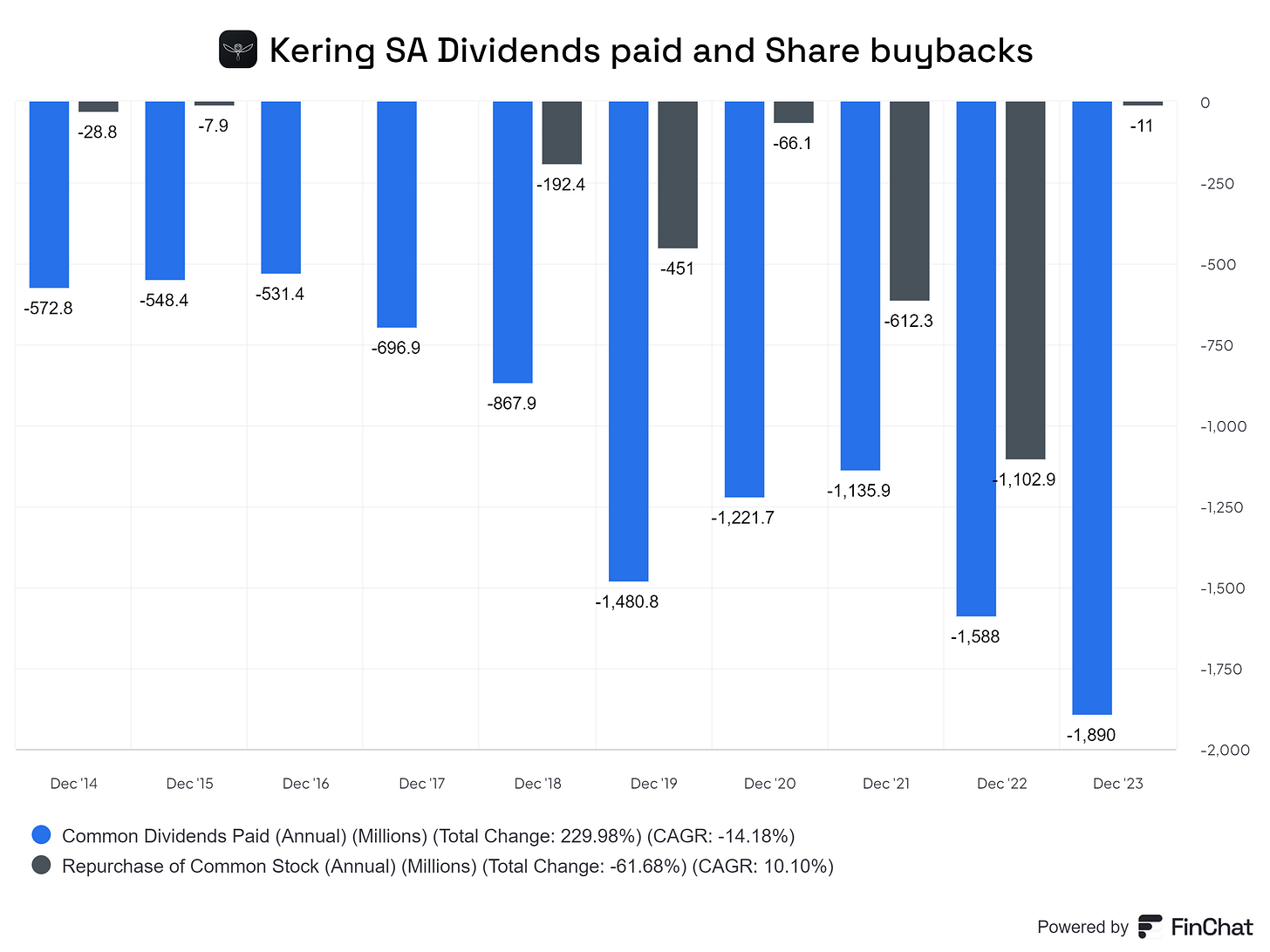

They've gradually increased dividends in recent years but are not hesitant to reduce them when other investment opportunities arise or performance weakens. Dividends were previously lowered in 2008 and 2019. The company distributes dividends twice a year, with a total annual dividend per share of €14.00. The most recent dividend payment was €9.50 on May 2, 2024. Share buybacks have increased since ‘21.

Kering has increasingly focused on acquisitions. In Q2 2023, it took a stake in Valentino and has the right to expand it to 100%. Besides organic growth, Kering also improves its position by acquiring other luxury brands. This aligns with the consolidation trend in the luxury industry. Tapestry recently acquired Capri, the owner of brands like Versace and Michael Kors. Since little is known about Valentino yet, I can't say much about it in this analysis. In the past, Kering has made good acquisitions and revived brands with its expertise.

Valuation

As previously mentioned, a sum-of-the-parts valuation seems best since each brand deserves a different valuation.

As shown, with a 5% safety margin, Kering's share is undervalued by 12% based on these assumptions. All parts are valued based on a multiple of 2022 net profits. Kering Eyewear is valued at one times revenue, as it's not yet profitable. Kering Eyewear is a unit where all eyewear comes together. I don't understand why they consolidate all eyewear divisions under Kering Eyewear rather than keeping them under their respective brands. Since its establishment in 2015, the division has hardly been profitable. It seems like a prestige project to me, based purely on my feelings rather than facts.

Competition

It can be helpful to compare Kering to its competitors on some key metrics, which could also spark research into other companies.

From the chart above, it's clear that Kering lags behind its competitors on all fronts. Its valuation looks better with a P/E of around 13.5. This analysis has hopefully shown there's a reason for that. Part of the reason is in the chart itself. Where LVMH is the "worst" in some criteria, the difference with Kering is always small. LVMH's significant advantage is its much faster growth than Kering.

Opportunities

Kering, which owns luxury brands like Gucci and Yves Saint Laurent, has promising growth opportunities.

Gucci is thriving in Asia, especially in China, where the growing middle class is eager to buy luxury items. With Gucci already being a strong favorite there, it’s poised for even more success.

Yves Saint Laurent (YSL) dominates the U.S. and Western European markets but is less known in Asia. If YSL can gain similar popularity in Asia as Gucci, it could significantly boost Kering’s growth.

Despite recent fluctuations in the luxury market, the global economy is improving, and inflation is easing, encouraging more luxury spending. As travel picks up post-pandemic, especially in Asia, it’s also boosting tourist shopping at luxury stores.

So, even with economic uncertainties, Kering can still grow by expanding its brands in Asia, tapping into recovering tourism, and adapting to changing luxury shopping trends.

Risks

Kering faces several risks:

Gucci has struggled with growth and maintaining profit margins recently, raising concerns about its future. Can the brand regain its strength? Will management changes help? These uncertainties are worrisome given Gucci’s importance to Kering.

To counter Gucci's slowing growth, Kering's management might look for acquisitions. But if they go too far, they risk making poor choices.

Rival luxury brands could capture more market share as Gucci's progress slows, threatening Kering's revenue growth.

Conclusion on Kering SA

Kering has a rich history that started in 1963 with François Pinault's timber trading venture, evolving significantly over the decades into a luxury fashion powerhouse. The transformation began in earnest in 1999 with a significant stake in Gucci, followed by acquisitions of Yves Saint Laurent and other high-end brands while divesting from other sectors to focus solely on luxury fashion.

Under the leadership of François-Henri Pinault, who took the helm in 2005, Kering has expanded its portfolio to include other luxury names like Balenciaga and Alexander McQueen. The company, significantly influenced by the Pinault family, which holds a substantial ownership stake, now operates around 1,700 stores worldwide and maintains a strong online presence.

Despite challenges such as economic fluctuations and management changes, particularly at Gucci, Kering's dominant brand, the company continues to hold substantial market share. The future of Kering hinges on leveraging its established brands and exploring growth in underrepresented markets, particularly in Asia, to sustain its development in the ever-competitive luxury sector.

DISCLAIMER: This is not investment advice or a recommendation. Think carefully before making any decisions.

Nice write-up. The turnaround of Gucci will be essential to its share prices.