“There are plenty of reasons why a company might choose to unload or otherwise separate itself from the fortunes of the business to be spun off. There is only one reason to pay attention when they do: you make a pile of money investing in spinoffs” - Joel Greenblatt

In his book You Can Be a Stock Market Genius, Joel Greenblatt referred to a study from Penn State showing that stocks of spinoff companies outperformed the S&P 500 by about 10% per year in their first three years of independence.

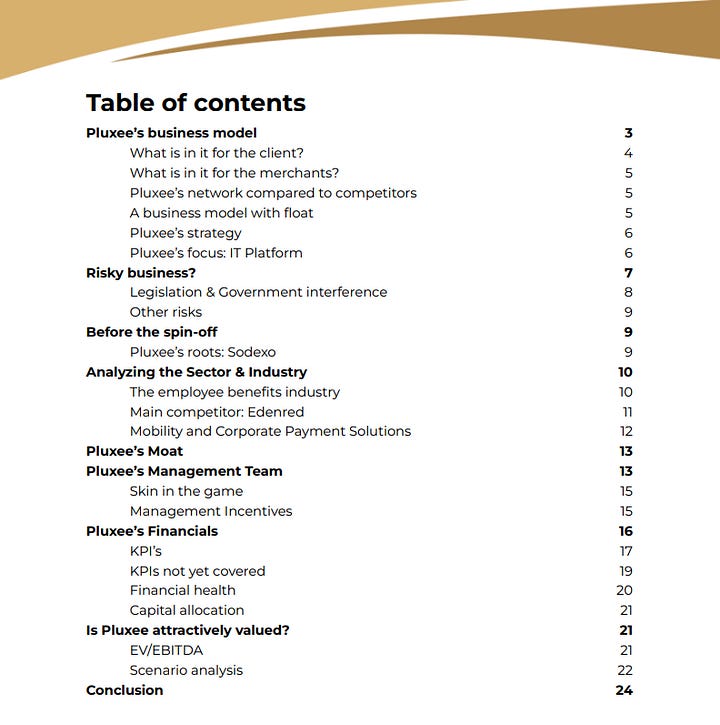

If that intro isn’t already enough reason to take a closer look at Pluxee, a spin-off now trading 36% below its spin-off price, let us give you a few more:

Pluxee is a family-controlled business. The Bellon family, who also control Pluxee’s former parent company Sodexo, still holds 42% of the ordinary shares and 58% of the voting rights.

Pluxee benefits from float. It earns interest on unspent balances held on its platform. In 2024, 13% of revenue came from float, with 100% margins.

Pluxee operates in an oligopolistic industry that’s growing ~8% per year and is inflation resistant.

And best of all: Niklas from Heavy Moat Investments joined us for the premium podcast, where we break the entire Pluxee analysis down in detail.

An employee benefits company?

Depending on where you're from, you may never have heard of an employee benefits company. That’s because Pluxee is mainly active in countries with strong social policies, like Brazil and France.

In these markets, benefits like meal cards, mobility perks, and wellness vouchers are taxed more lightly than salaries. That means employees get more net value, without costing companies more on a gross basis. Take Brazil, for example: local regulation allows employers to provide up to 30% more net value through benefits compared to direct salary.

With the ongoing war for talent, and the timeless desire of businesses to avoid taxes, Pluxee delivers a clear value proposition for all involved parties:

Employers deduct taxes and save on salary costs

Employees get more value through benefits

Merchants get spend-ready customers

And Pluxee? It takes a fee on every transaction + it earns juicy float revenue on unspent balances.

How does it work?

Here’s how it works if you’re an employee using Pluxee:

Your employer funds a Pluxee digital wallet or card on your behalf

You spend the balance at affiliated merchants like restaurants and grocery stores

Pluxee reimburses the merchants, keeping a commission on the transaction

By the way, the days of crumpled meal vouchers at the bottom of your bag are over. Everything now runs through Pluxee’s in-house IT platform. In this app users can check balances, find merchants, and access other benefits. HR departments can track spending, analyze usage, and manage benefits through one dashboard.

But while this platform is a major strength, we view it more as a requirement than a moat. The real moat lies in Pluxee’s two-sided network effect.

The moat: A two-sided network effect

Pluxee’s strength lies in its network:

This two-sided network effect makes it difficult for new entrants to break through. To even be considered by a business, a competitor needs merchant coverage first. And while starting a competitor is easy, scaling the network is extremely difficult.

That’s why we believe Pluxee’s current network will keep most challengers out. That said, Edenred’s (Pluxee’s biggest competitor) network is even larger, making them the current number one. And believe us, they would love to take share from Pluxee.

Is Pluxee perfect?

No, it’s not. No business is. The regulatory risks are real, and they’re one of the reasons Pluxee’s stock price has taken some serious hits. In the premium analysis, we’ll take a closer look at these risks and break down whether the market is overreacting or underestimating the risks.

A special thanks to Niklas from Heavy Moat Investments for pointing out that most screeners misrepresent Pluxee’s cash position. Because of this, Pluxee looks twice as expensive as it actually is. In the premium analysis, we’ll walk you through the balance sheet and show you the real cash position.

If you join the 100 investor who went before you, you’ll also find out if our co-founder Luuk bought shares and get exclusive access to the full 50-minute audio deep dive with Niklas.

We hope this article helped you discover an interesting special situation which is also barely impacted by tariffs.

Have a wonderful day and happy investing.

Heavy Moat Investments & The Dutch Investors.