Hi everyone,

You’re about to read a guest post from Global Equity Briefing. The author, Ray Myers, shares our passion for researching companies in search of interesting investments. And beyond that, Ray is a great person.

Be sure to subscribe to Global Equity Briefing, and enjoy his guest post!

Hello, The Dutch Investors readers!

I am Ray Myers, author of the Global Equity Briefing Substack! Before we dive deeper into Volkswagen and Amazon, let me tell you a little bit about myself.

I am a 29-year-old finance and investing enthusiast living in the Netherlands. During the day, I work as a Treasury Analyst for a large multinational services company based in Amsterdam. I moved from my home country of Latvia to the Netherlands with the intent of pursuing an education in finance and have remained there ever since.

During the Game Stop mania of 2021, I decided to join Twitter as it seemed that’s where interesting finance discourse took place. While reading the tweets of various creators, I came across this exciting platform called Substack.

It instantly became one of my favorite places for finding thought-provoking articles on business, politics, news, and, of course, investing. Last November, as I was reading a company deep dive, a realization hit me, I can do this! That day I stayed up late and began preparations to launch my own Substack.

I created the Global Equity Briefing Substack in February of 2024, with the goal of researching interesting companies in various industries and geographies. I felt that many investing Substacks were too US-centric and decided that my newsletter will have a global focus. That doesn’t mean that I will never research US companies, I have, and I certainly will! However, I intend to spend a significant amount of time on interesting European, South American, and Asian companies.

Currently, I have 2 types of articles on Global Equity Briefing.

Briefing is a 2,500-word article on a topic of my choosing. For instance, in April, I wrote a briefing on “State of the Streaming Wars”. In this article, I explore what caused Netflix stock to fall over 70% and its eventual recovery.

» Read “State of the Streaming Wars”

Deep Dive is an 8,000+ word look into the business of a particular company where I try to cover the most important aspects of their business. Furthermore, I analyze their finances and build a valuation model to see what needs to happen for investors to come out on top.

My last report was on Mercado Libre, a $100B Latin American e-commerce, logistics, and financial technology company. The company is expanding aggressively and could become one of the biggest companies in the region!

» Free Deep Dive: Mercado Libre

As part of this guest article, I am going to explain why I am bearish Volkswagen and bullish Amazon.

1. Bearish: Volkswagen

Let’s start with the basics.

Volkswagen is an iconic German automobile manufacturer based in Wolfsburg.

With 9.4M cars sold in 2023, Volkswagen is the world’s second-largest automobile manufacturer by volume, behind Toyota.

Their stock has fallen over 50% in the last three years, and I find it highly unlikely it’s going to recover anytime soon.

Here are a few reasons why!

1.1 EV Transition

Whatever the mainstream media would like you to believe, the EV transition is in full swing. While the growth of EV sales has slowed down in Europe and the US, the market is still growing, additionally, EV sales are growing quickly in China. EV sales in Europe’s top 5 markets grew 11%, while the US EV sales grew 14% in Q2.

The legacy auto manufacturers are shooting themselves in the foot by slowing down their EV ambitions!

New entrants in the industry, such as Tesla, BYD, NIO, Rivian, and others, are releasing EVs, learning the ropes and improving.

Tesla’s factory in VW’s home turf of Berlin, Germany, is manufacturing 375K vehicles a year. Recently, Tesla received all approvals to begin stage one of its expansion, with the goal of manufacturing over a million vehicles a year.

It takes Tesla 10 hours to make a Model Y, whilst it takes VW 30 hours to make a vehicle at its Wolfsburg plant!

While Tesla and Chinese competitors can beat VW on price, other competitors beat VW on models and features.

1.2 Collapsing Sales in China

China is the most important market for VW. They were one of the first Western automotive brands to enter the market in the 1980s. Since then, the company has grown immensely, becoming one of the most popular automobile brands in China. In 2023 VW sold 3.2 million automobiles there, 34% of its global sales.

It seems their fairy tale story in China has come to an end. In Q2 of 2024, VW’s global vehicle sales fell by 3.8%, but it was disproportionally driven by a 20% fall in China.

VW China EV sales grew by 21%, while the total Chinese EV market expanded by 35%.

This means that as VW’s internal combustion sales in China fall off a cliff, the company is unable to replace them with EVs!

VW is rapidly losing its total automobile and EV market share in China!

The total ICE market declined by 21% in China. China is shifting rapidly towards a 100% EV market and VW is ill-prepared to keep its current volumes.

The Chinese automobile buyer desires highly modern features such as great automobile software with supreme interconnectivity and other functions, stylish interior design, and supported and autonomous driving. VW lags in all these features and is seen as a stale old brand.

Local EV brands offer vehicles that are not only cheaper but, in many aspects, superior to VW. The competition in China is fierce, and although VW is taking steps to compete, such as cutting prices and promising various improvements to its line-up, I doubt the company can stop its decline.

Once the EV transition is complete, VW will be a much smaller company in China!

1.3 Unions and Shareholder Base

To increase competitiveness, VW is undergoing what the company calls a “performance program”. The goal is to reduce development time for new vehicles, achieve up to EUR 10B in cost savings by 2026, and reach a 6.5% profit margin. The company is failing miserably to meet these objectives. Profit margins decreased each quarter in 2024 and were 4.5%, 3.9%, and 1.7%, respectively.

In August, the German newspaper Handelsblatt reported that the company is on track to miss the stated savings goal by EUR 2B to 3B. I believe unions and the shareholder base are one of the biggest bottlenecks to achieving these objectives.

EV manufacturing is less mechanical, requiring between 30% to 40% fewer moving parts. Additionally, EVs don’t need as much regular maintenance and spare parts to keep them running. This means that one EV creates fewer jobs for the German economy than one ICE vehicle.

IG Metal Union is the largest trade union in Germany, representing over 2 million employees. The union is extremely powerful, with many politicians available on speed dial. Over the years IG has negotiated extremely strong contracts with VW.

Furthermore, 20% of VW voting shares are held by the German state of Lower Saxony. Both the union and the government are in denial about the reality and will not support the aggressive layoffs and efficiency improvements that are required for VW to become competitive.

Over a hundred thousand people in the state are employed by VW, with tens of thousands of additional people working in various adjacent industries. Lower Saxony is not interested in having tens of thousands of newly unemployed people. Politicians are short-term-minded creatures who only worry about the next election. Union leaders have similar objectives, they want more members and better contracts to get reelected.

On 17. October Reuters reported that talks between the IG and VW are not going well. VW spokesperson said "Significant cost reductions are necessary in order to remain competitive," the union responded that if plants are closed the union will show "massive resistance on all fronts and at all levels".

On 28. October Reuters reported that VW intends to close 3 factories and fire 10s of thousands of employees, the union promised strikes and massive action!

Additionally, 17% of voting rights are held by Qatar, a state whose primary economic activity is the sale of carbon fuels. For obvious reasons, Qatar is not going to support any measures that might decrease its Oil and Gas revenues. A harder push from VW towards EVs would accelerate the transition of the industry. Falling ICE sales would reduce demand for carbon fuels. Qatar wants VW to sell ICE vehicles for as long as possible.

1.4 Conclusion

In conclusion, a weak German economy and a difficult business environment in Europe, coupled with the changing industry, have put VW in a difficult position. To become competitive VW must go through massive restructuring that would entail firing hundreds of thousands of employees in Germany and abroad.

Pressure from governments and unions in Germany and abroad will make it extremely difficult for the company to take the necessary steps.

For these reasons, I find it highly likely that in 10 years VW will be a much smaller company than it is today.

2. Bullish: Amazon

Amazon is a Seattle-based global e-commerce, logistics, media, and technology company. After becoming the largest e-commerce business in North America, the company has expanded to over 20 countries.

Although, with a $2T market cap Amazon is one of the largest companies in the world, I believe it is significantly undervalued!

Here are a few reasons why!

2.1 Logistics Moat

Logistics is an important moat that protects Amazon from competitors!

In its mature markets of the US, Canada, and Western Europe, Amazon can deliver packages at speeds and quality consistently exceeding what other competitors can offer. For instance, last month, the item I wanted to purchase was slightly cheaper at some small, obscure e-commerce shop that I had never heard of. As there was no urgency, I decided to purchase it there and save a few EUR. I was aware it wouldn’t be delivered the next day, however, I didn’t expect it would take 2 weeks.

Convenience and speed are very important factors for customer decision-making, even when purchasing items that are not urgently needed. For this reason, Amazon has spent heavily on establishing the best logistics and delivery network.

Excluding AWS, since 2019 Amazon has spent over $200B on capex!

Amazon now manages 651 million sq ft of warehouse and logistics space. The company is expanding every year, I don’t see any competitors being able to challenge them.

2.2 E-commerce 3P Sales

Apart from selling items directly to customers, Amazon lets businesses sell on their platform and charges various fees for using it. As Amazon continues to grow, the company adds additional services available to its merchants.

First, Amazon started collecting a % fee to access the platform. Then it began offering logistics services and now charges merchants fees for storing and delivering packages. I have no doubt that in a few years, the company will be offering additional services to merchants.

Additionally, as global e-commerce penetration grows, Amazon expands to new geographies, and its media business flourishes, platforms attractiveness to merchants and companies increases.

Thus, 3P sales are likely to continue growing at a healthy cadence!

2.3 Advertising

In LTM of Q2 2024, Amazon earned $51B from selling advertising. Yes, you read that correctly, this is an extremely huge business!

Since 2019, Amazon has grown its advertising business by 306%, quadrupling in just four and a half years!

Whenever a customer searches on Amazon, a sponsored product is usually the first item. These are very high-intent searches, a person searching “perfume” is more likely to purchase a perfume than a person walking past a perfume poster at the bus stop. The amount a business is willing to pay for advertising depends on the expected revenue generated from said advertising. Dior would be willing to pay a pretty penny to be the first prominently displayed perfume on Amazon, as that would generate significant sales.

Furthermore, Prime Video, Amazon’s highly popular streaming service, has recently started showing advertising. With its recent NFL, NBA, and NASCAR deals, the company has become a large bidder on live sports events. Live sports bring millions of viewers that Amazon will gladly service with lots of advertising.

I find it quite likely Amazon will earn $100B from advertising in just a few years!

As Amazon’s e-commerce platform grows and Prime Video becomes more popular, the company’s advertising sales are likely to continue growing for many years!

2.4 AWS

AWS provides Cloud computing infrastructure services. Large and small businesses used to have their own physical servers in the basement of their offices. Nowadays, that is increasingly becoming a relic of the past. Amazon builds large data centers and rents out its computing capacity. With a 31% market share, AWS is the largest and most profitable player!

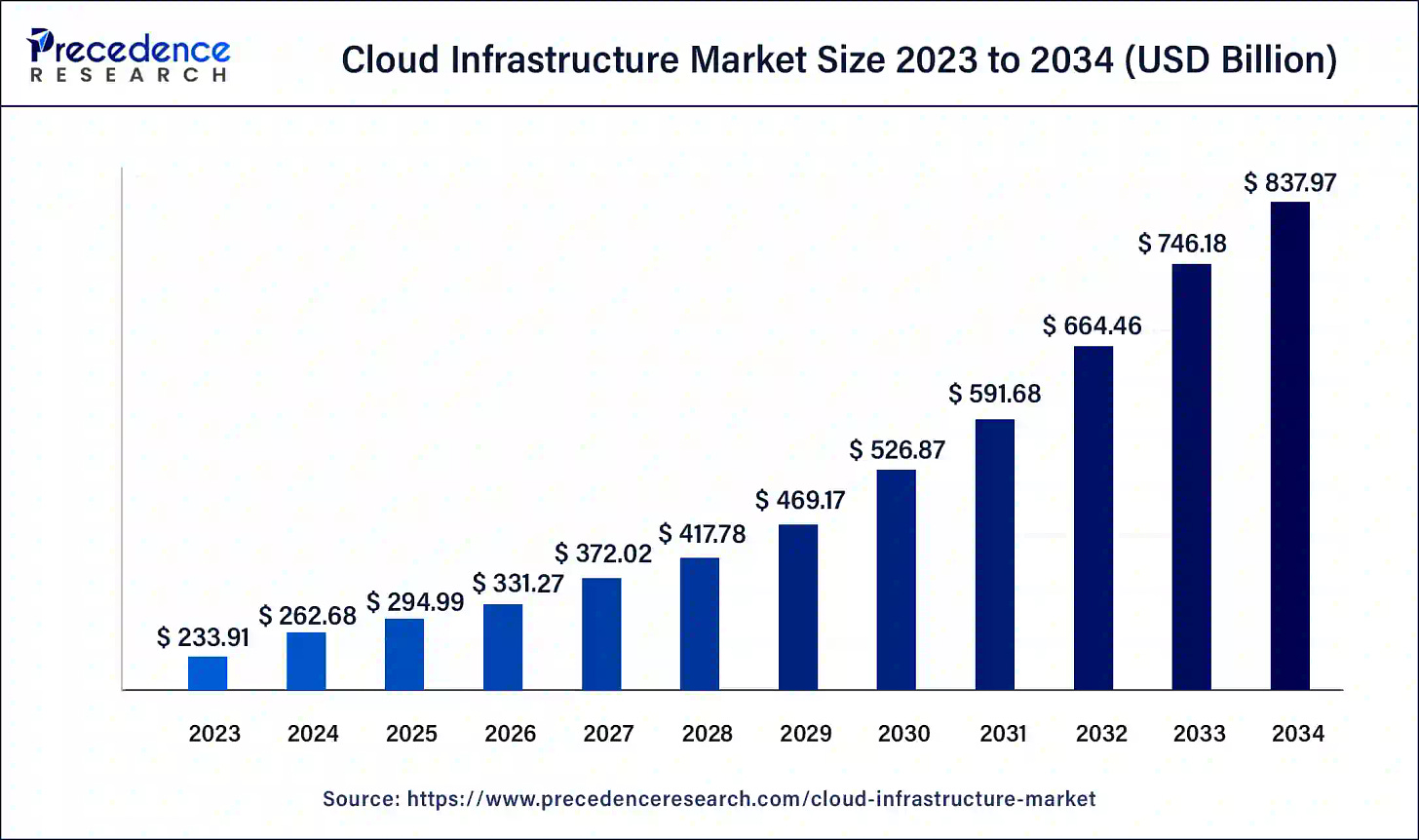

Precedence Research estimates that the cloud infrastructure market will reach $838B by 2034, growing with a CAGR of 12.3%!

Amazon is in a strong market position to remain an industry leader. If their market share decreases to 25%, the revenue would be $210B, compared to $91B in 2023. A 30% EBIT margin would lead to $63B in EBIT.

At 20 times EBIT, this segment alone could be worth $1.3T in 2034!

Not only do I find it extremely likely Amazon will reach these estimates, I see the company exceeding them. AWS is an innovator in the field, just last year, Amazon spent $25B on AWS capex. Apart from just providing cloud infrastructure, AWS will undoubtedly expand its cloud computing offerings, with more services for analytics, security, and more.

2.5 Conclusion

Amazon is trading for a P/E of 45, which I find to be very affordable, considering their growth prospects.

WS estimates that Amazon’s net income will surpass $78B in 2026, an increase of 136% from 2023! That means that Amazon trades for 2026 P/E of 26!

Amazon is currently at a profitability inflection point!

Their logistics business is allowing the company to service customers with a broad selection of products at an unprecedented speed.

As a result, Amazon’s 3P sales are exploding, enabling higher economies of scale to increase margins.

The advertising business is delivering extremely high margin growth, as Prime Video continues delivering strong numbers and more customers use Amazon’s e-commerce platform.

Last but not least, AWS is set to continue to benefit from the world’s economies digitizing!

For these reasons, I believe Amazon is significantly undervalued and presents an attractive investment opportunity for long-term investors.

I hope you enjoyed this guest post! Be sure to subscribe to Global Equity Briefing to benefit from Ray's in-depth research. Only a few go to the lengths he does in his Briefings and Deep Dives.

Additionally, we wrote a guest post on Ray’s Substack!

In this article we share our opinion about why we’re bullish on Dino Polska and bearish on Match Group.

We would like to thank you for reading.

Have a wonderful day and happy investing.

The Dutch Investors

About Qatar: they sell LNG, so they are indeed interested in expanding EV use as LNG is used to produce electricity