Do you remember the 2021-2022 SPAC (Special Purpose Acquisition Company) bubble? Fast growing businesses went public through the stock market for exceptional high valuations. Virgin Galactic, Lordstown Motors and Tattooed Chef might be familiar to you. Back then, those companies were trading at crazy valuations. Now, they are either bankrupt or a fraction of the value compared to then.

I have to admit it. I am guilty as well and bought some SPAC companies during these times. Looking back, that was a big mistake from me (could write a whole article about it). Once I realized that, I sold all my ‘crappy’ positions, including all my SPAC stocks. All, except the company we will discuss in this article: Hims.

Why was Hims founded?

Hims was founded in 2017 by Andrew Dudum, who still runs the company as CEO. His mission is to make health accesible for everyone at a reasonable price. The American healthcare system is very inefficient. For many people, healthcare has become unaffordable, with a doctor's visit costing at least $50. Americans in some areas have to travel up to two hours to reach the nearest doctor. If you compare the current healthcare process to that of a hundred years ago, there has been little change; you call a doctor to make an appointment, maybe you can go the next day, you travel to the doctor, wait in the waiting room, have a conversation with the doctor, receive a prescription, and then go to the pharmacy where you have to wait again (if you're lucky, the medications are in stock). What actually happened, is that many people find Hims because they are ashamed to visit the doctor (hair loss, sexual disfunction etc.).

So, what is the solution of Hims?

Hims simplifies the process and makes it affordable by offering telehealth. They aim to become the world’s most trusted health & wellness brand. For $20-$30 per month, an individual can schedule as many doctor's appointments per week as they want and have medications delivered to their homes. Nationally, many certified doctors are affiliated with Hims, and appointments take place online through the Hims platform. Customers can chat and send photos to doctors, who can assist them quickly and efficiently. Prescriptions can be delivered through the customer’s home (mostly within 24 hours). All of this takes place in the Hims app.

Additionally, Hims offers a wide range of care products for both men (forhims.com) and women (forhers.com). These include medications for issues like hair loss, mental health, erectile dysfunction, and contraception—often topics people feel embarrassed about, leading them to prefer handling them online. Vitamins and other products are also offered. Personalization is one of the key strenghts of Hims, at least that is how they position themselves. Based on AI and doctor’s appointments, customized threatments can be offered to customers.

A quick side note from here. Hims is a small portion of our analyst Mathijs’ portfolio. If you want to enjoy the full portfolio’s of all our investors, along with much more benefits:

How does Hims make money?

Hims’ approach is to remove barriers and provide access to better health that is easy, personalized and convenient. The picture below captures some solutions that Hims offers for both personalized, as well as non-personalized treatments. Losing hair, depression, anxiety and sexual disfunction are huge markets that Hims is addressing.

More than 90% of Hims’ revenue is recurring. This number is based on customers that agreed to be billed at a defined cadence.

Simply put: customers pay a periodic amount of money in exchange for (personalized) treatments, the access to a medical expert and home delivery.

The lose weight category is a relatively new and strong growth engine for Hims after receiving approvals to distribute the weight-loss medicines of Eli Lilly and Novo Nordisk. Using these kinds of treatments is getting normalized and gains in popularity.

How does Hims compare to its competitors?

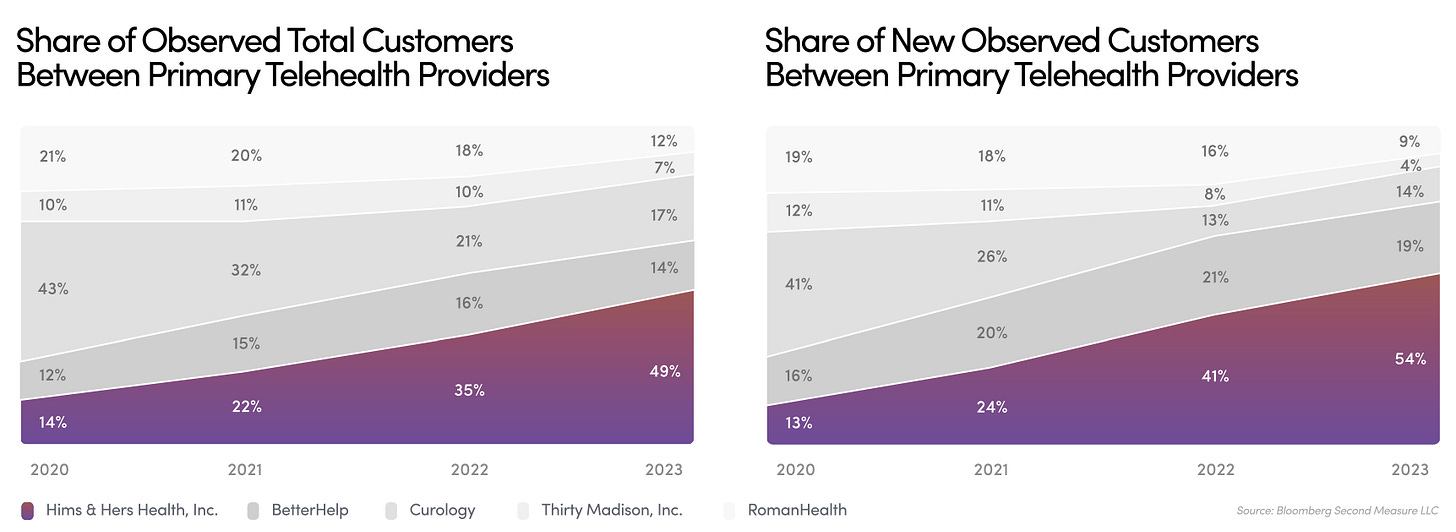

Hims is widening the gap between them and its competitors in telehealth. Of the selected primary telehealth providers, Hims has a 49% market share. This number is increasing, given the fact that 54% of new customers choose Hims as their first telehealth partner (Bloomberg Second Measure). Most of the competition is focused on just one segment (for example hair loss), while Hims is offering broader treatment and health solutions.

What about growth?

Hims had 1.9 million subscribers in the end of Q2 2024. This is 43% more than in the same period one year ago. Compared to Q2 2022, this is an increase of more than 150% in subscribers!

It’s even more interesting to see that their revenue is outpacing the number of subscribers. The revenue in the second quarter was up 52% compared to a year before. This basically means Hims is able to constantly implement new business cases and that customers are willing to pay more for added or improved services.

Margins

Gross margins of Hims are constantly moving between 80-83%. Since Q1 2023, the number never dropped under 80%.

Net profit margin wise, Hims realized a 4% margin. This seems low, but this metric is increasing rapidly quarter after quarter. An important metric for Hims is the adjusted EBITDA margin (which excludes stock based compensation). We don’t understand why you would exclude those costs, because the costs are real. An adjusted EBITDA margin of 10-11% is expected for the full year.

What you can see in the above picture as well, is the ‘payback period <1 year’. This calculation is based on the quarterly marketing expenses to attract new customers divided by the online gross profit that these customers realized in that quarter. So, let’s look at the actual capital allocation of Hims.

How efficient does Hims allocate capital?

Knowing that Hims’ payback period is most of the times within a year, we should see a strong ROIC as well. Hims wasn’t profitable bottomline before 2024. We can however, make assumptions about the ROIC of Hims. Let’s take H1 2024.

Hims is a debt-free company, with only around $10 million in lease liabilities. Therefore, they do not pay any interest. In fact, they are earning interest with their big pile of cash and money in short-term investments.

The net profit of Hims in H1 2024 was $24.4 million. Hims is growing profitability every quarter, but let’s assume that this number will hit $50 million in the full year 2024.

The invested capital is 118.5 (equity) + 9.8 (lease liabilities) + 57 (ST payables) - 129 (cash position) = $56.3 million. ROIC therefore will be a remarkable 50/56.3 = 88.9%

You could argue that a part of the marketing expenses should be activated on the balance sheet, because it helps to built a sustainable brand. Then ROIC will decline and net profit will grow.

Owner-Operater running the business

The owner and founder of Hims is Andrew Dudum. This is not the first company that he started, since he is also co-founder of Atomic, where he helps businesses to scale and go-to market. That’s not it, because he also co-founded Ever.com, an iOS productivity app that’s available in around 100 countries. As you can see, he is a real entrepreneur and likes building businesses.

Dudum owns more than 10 million shares, with a total current worth of around $190 million. The stock price does fluctuate quite a bit, so it could be different by the time you’re reading this post.

Looking at the management team, it’s good to see many coming from companies that operate digitally, like Uber, Google and Zulily.

Enough opportunities for Hims, looking at the projected growth.

The question is, what are the risks?

Hims is a rapid growing business in a rapid growing - and changing - market. This brings many risks, such as disruption and investing in the wrong ideas.

Big firms, like Amazon with One Medical, are also active in telehealth. Amazon can offer interesting subscriptions combined with their Prime model. Besides, they have a big cash pile that they can use to improve the platform and spend on marketing.

There is regulatory risk. Technology developments are going more rapidly than legislation changes.

Valuation

From 2018-2023, Hims grew revenues at a 95% CAGR. Although impressive, it’s unlikely that Hims can continue growing at this pace.

With rolling out new treatments and services, getting more approvals and gaining more market share, I think Hims is able to grow at 35% per year for the next five years. Based on a net profit margin of 6%, an exit multiple of 25 and the current amount of shares outstanding, one can expect around 10% annual return.

So you can make your own assumptions, I also added a bear- and bull case. In my opinion, the bear scenario is very unrealistic, because Hims is already realizing 4% net profit margins.

Conclusion

In my opinion, Hims is a highly profitable and fast growing company that is definitely worth researching more. The company is building a brand, realizes high margins and enjoys a big TAM while gaining more market share. The fact that founder Andrew Dudum leads the business while owning a significant amount of shares, comforts me as well. We of The Dutch Investors will write a deep dive analysis for members, coming out in January 2025.

"receiving approvals to distribute the weight-loss medicines of Eli Lilly and Novo Nordisk"

I'm pretty sure that's just not true.

How exactly are copy of drugs being approved by FDA in USA? Each version of the drug should receive its own approval. How is this different than selling chinese knockoffs of licensed products? Why does each pharma company need trials and FDA approval for their version of the drug but copies made in a random lab don't. Am I missing something?