“Ferrari, Italian excellence that makes the world dream.”

Founded: 1947

Sector: Automotive

Ferrari first caught my attention due to its impressive profit margins. The stock appeared on my radar after I noticed that Guy Spier held a significant position in the company. U pon further investigation, Ferrari passed my “quality checklist,” prompting me to delve deeper.

1) Business model

Ferrari is known for selling luxury cars with a premium reputation. People don't just buy a Ferrari for transportation; they buy it for the status, the thrill of a real sports car, and the prestigious brand. Ferrari limits its annual production, creating scarcity and allowing them to continually raise prices. Owning a Ferrari is mostly for millionaires, making it less cyclical than other automakers because this market doesn't mind paying a premium.

Ferrari's revenue mainly comes from car sales (85%), with the rest from its Formula 1 engines and lifestyle products under the Ferrari brand, including theme parks like the one in Abu Dhabi.

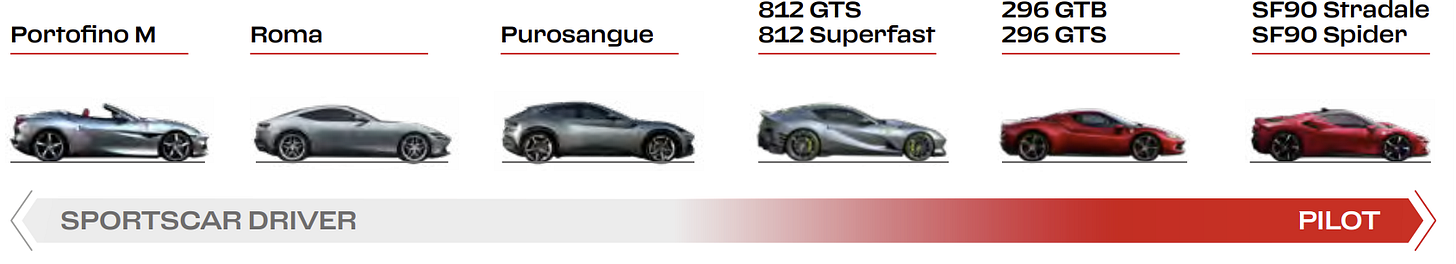

Ferrari offers four car categories: Range, Special Series, Icona, and Supercar, with the Range category making up about 96% of its production. These cars target two types of customers: the "Sports Car Driver" who enjoys stylish, versatile driving, and the "Pilot" who craves high performance and extreme driving experiences.

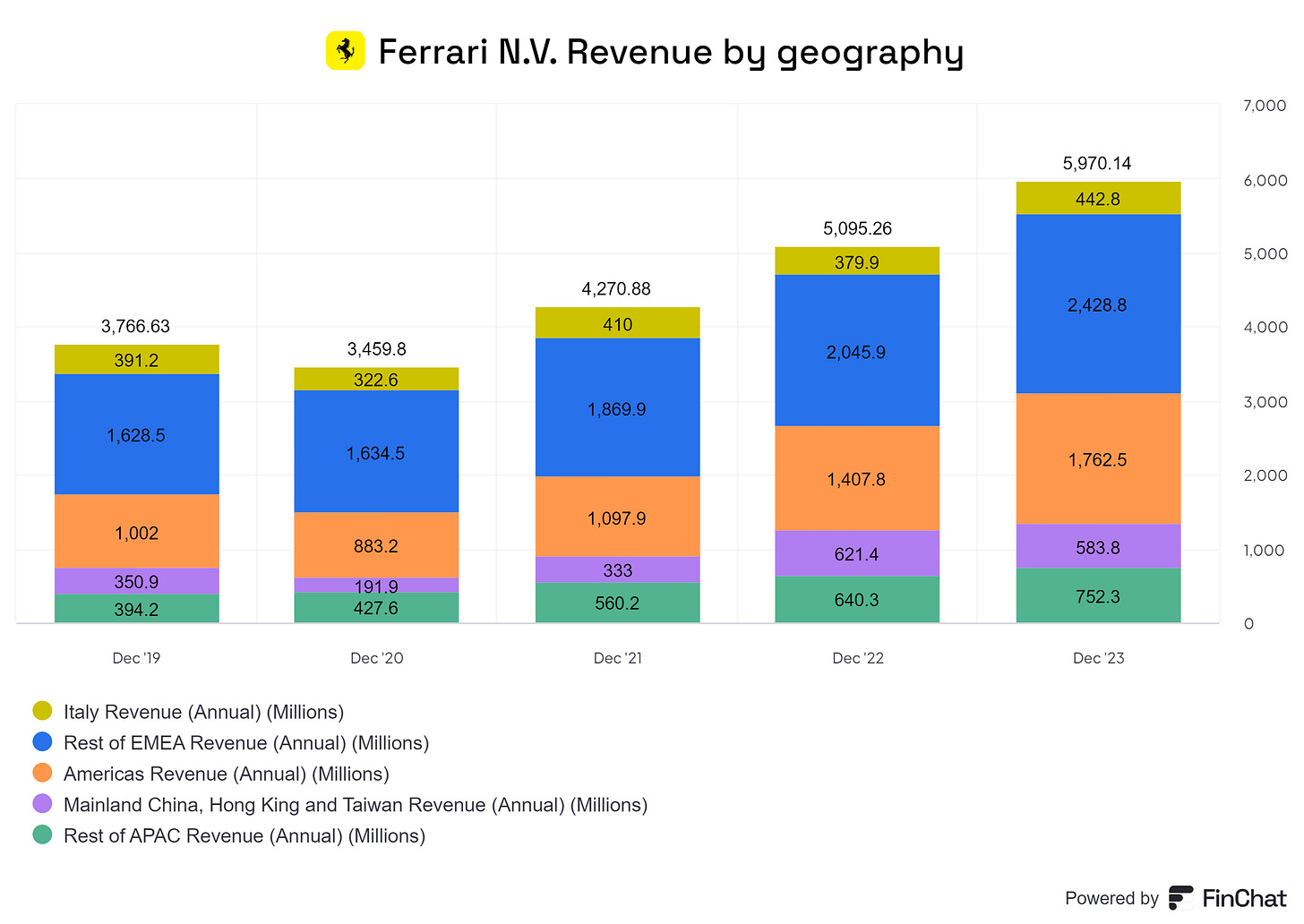

Geographically, 7% comes from Italy, 41% of sales come from Europe, the Middle East, and Africa, 30% from the Americas, 10% from China (including Hong Kong and Taiwan), and 12% from other Asian-Pacific regions.

Some History

Ferrari's journey began in 1929 with the Scuderia Ferrari racing team, which became Ferrari S.p.A in 1947 when they launched their first car, the 125 S, quickly making a mark in racing. Ferrari went public in 1960, was part of Fiat for over 50 years, and became independent in 2016.

Production and Expansion

All Ferrari cars are crafted in Italy, with factories in Maranello and Modena operating near full capacity to produce around 14.000 units annually. Ferrari is expanding, building a new factory in Maranello for electric supercars and innovative powertrains, planning to launch its first fully electric supercar in 2025.

Owning a Ferrari is a commitment to exclusivity, often involving long waits and stringent buying processes that make joining this “cool club” challenging. This scarcity boosts demand, with dealers sometimes perceived as dismissive due to the overwhelming interest in their limited supply of cars.

2) Management

Benedetto Vigna, Ferrari’s CEO since September 2021, previously worked at STMicroelectronics. He currently holds about €2 million in Ferrari shares, which seems low given his base salary of €1.5 million. This limited ownership doesn't fully align his interests with shareholders, but since he’s been with the company for less than two years, his holdings will likely grow. Meanwhile, Board Chairman John Elkann holds over 10 times his base salary in shares. Most of Ferrari’s management team has only been with the company for a few years, so it remains to be seen how they will lead it long-term.

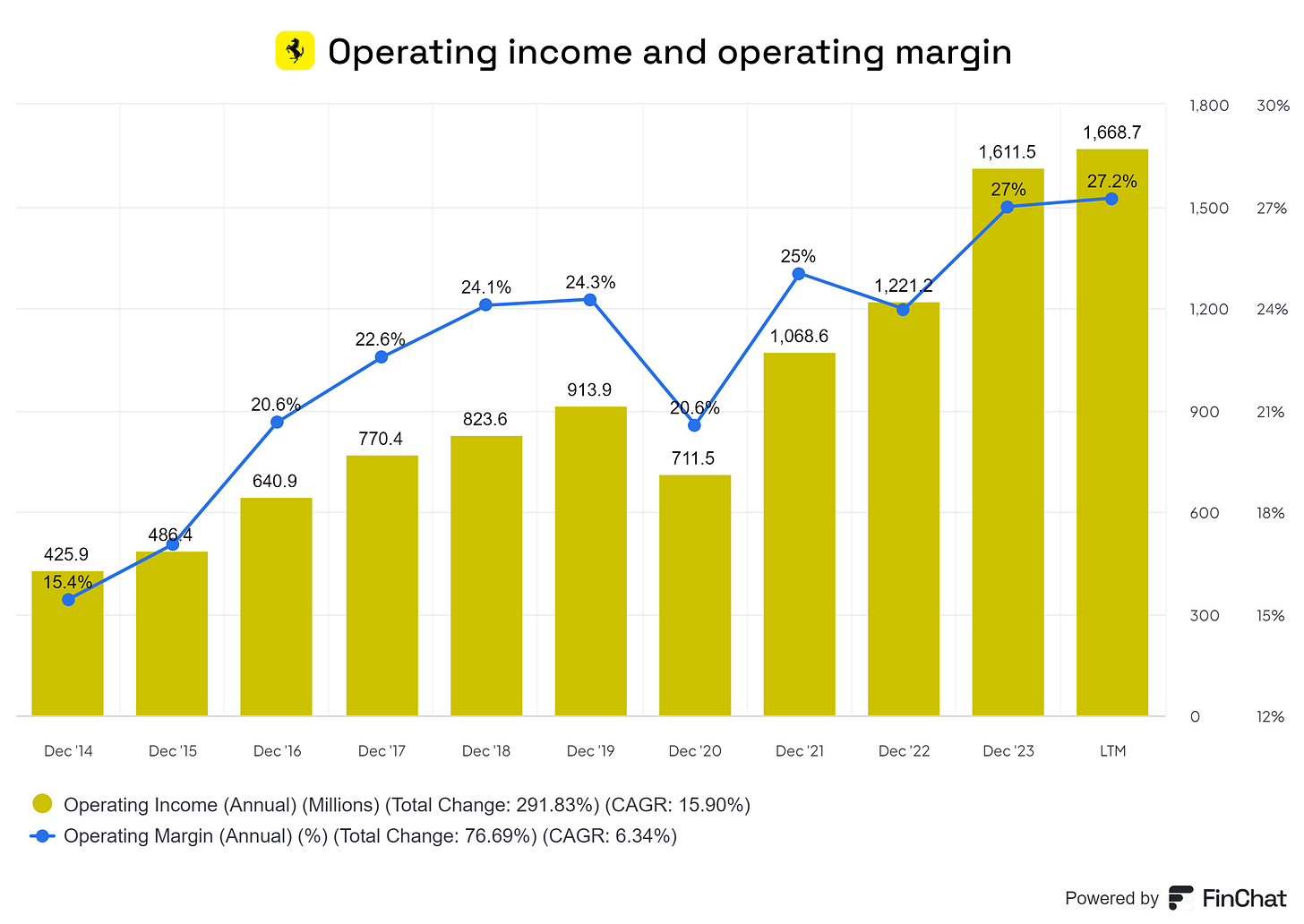

In LTM (last twelve months), Ferrari generated €1.67 billion in operating income.

Incentives

Management is rewarded based on Total Shareholder Return (TSR), comparing Ferrari’s performance to companies like LVMH, Aston Martin, Kering, and Burberry. While it’s good to beat these peers, I think management should be rewarded only for operational results, not stock performance, which is often influenced by market sentiment and economic changes. Not a huge fan of the incentive.

3) Competitive advantage

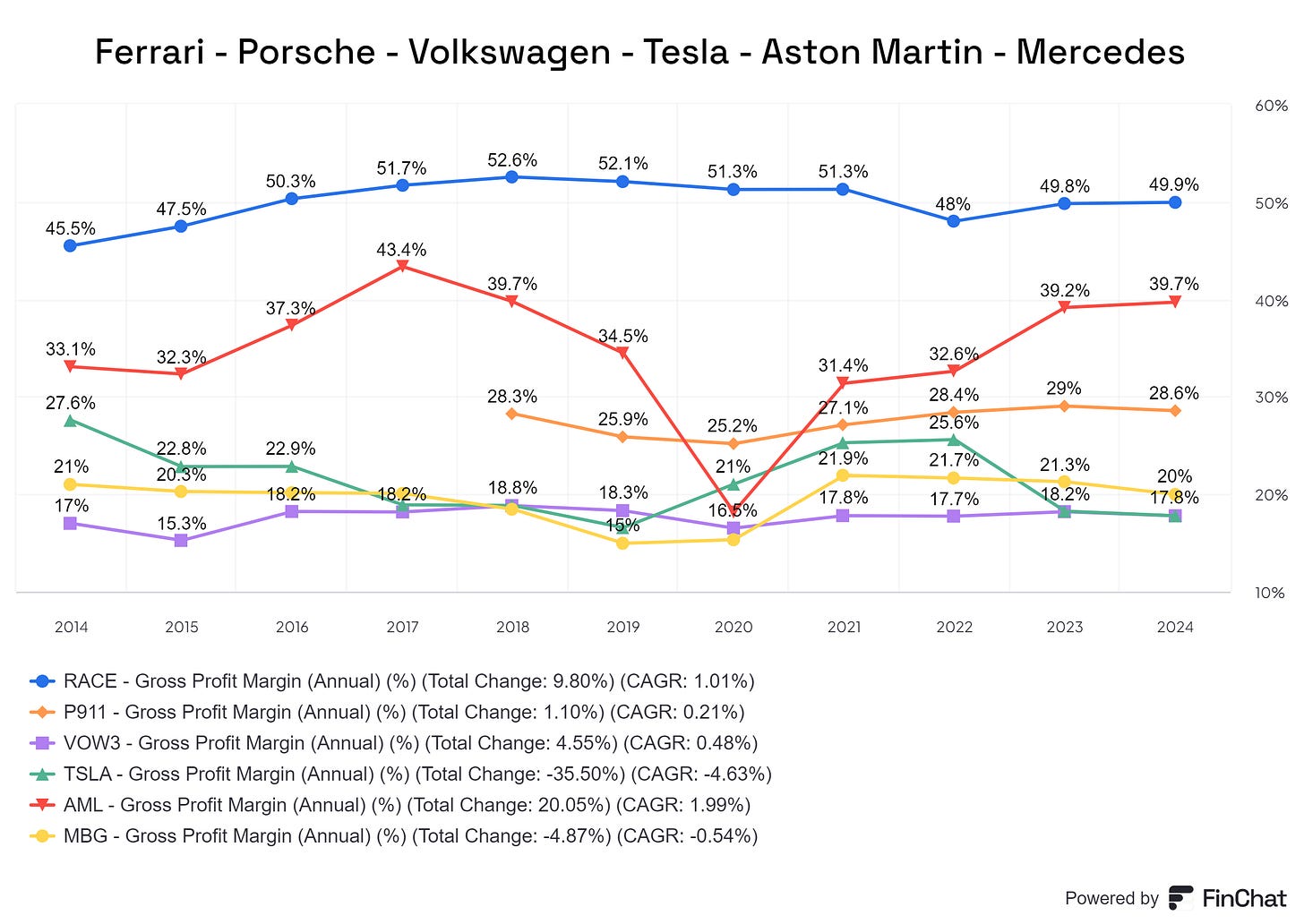

Ferrari’s competitive advantage is clear, otherwise, it wouldn't achieve a 50% gross profit margin (see chart 3). Even when compared to other, more premium brands, such as: Porsche, Aston Martin and Mercedes, Ferrari beats them significantly on gross margin.

The Ferrari brand is widely recognized, with a strong global image. If you ask someone to name a fast sports car, they’re likely to say Ferrari. It’s a universal status symbol, and owning one shows wealth, making it appealing to those who can afford it.

Ferrari also limits production to maintain exclusivity and drive up prices. Loyal customers typically get priority access to special models, which increase in value right after purchase. Ferrari also sets minimum holding periods for these cars.

4) Financials

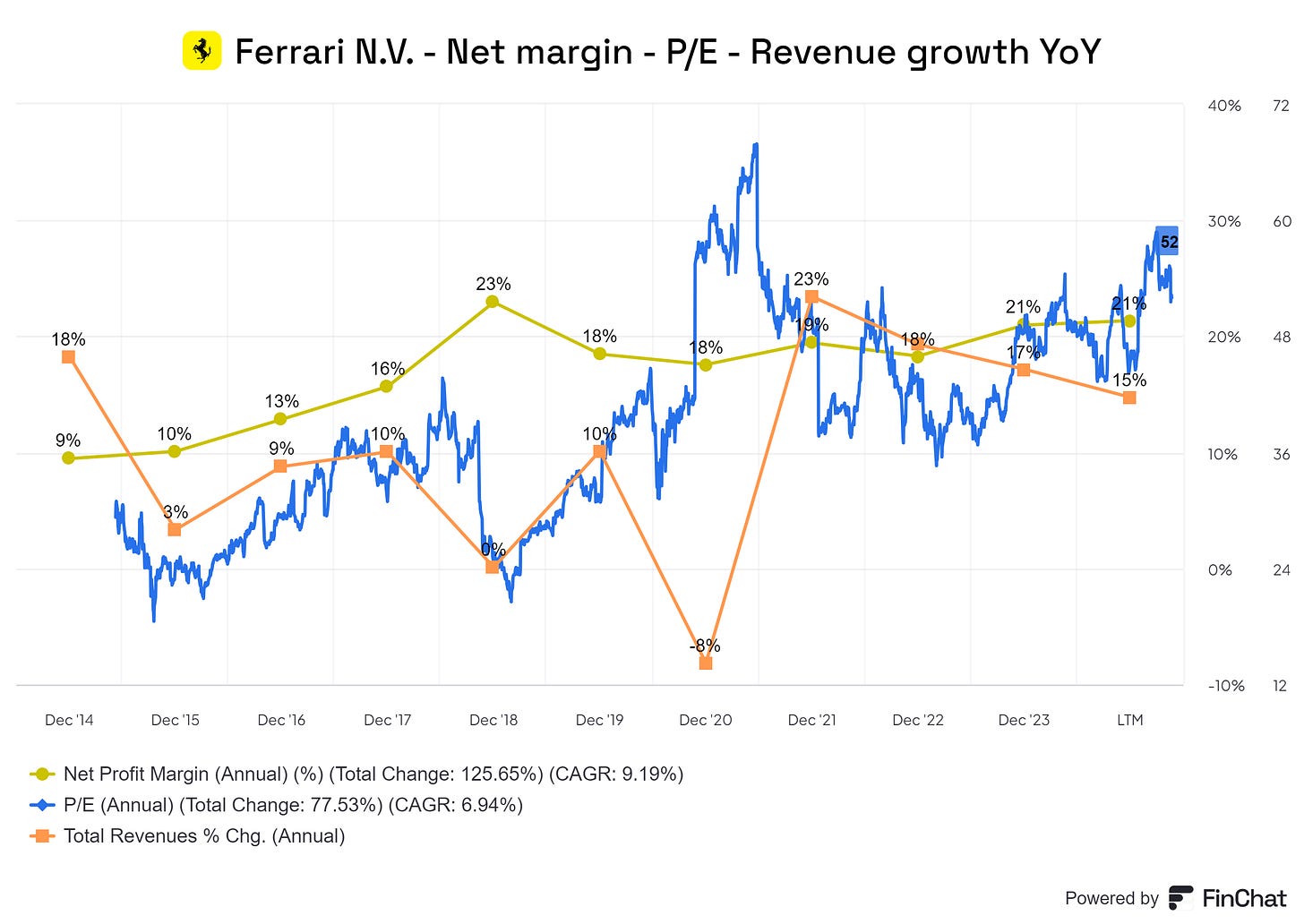

Ferrari’s finances are strong. Ferrari has manageable debt of $2.45 billion. I'm not worried though, they can easily meet obligations thanks to a €1.4 billion cash reserve, and it’s free cash flow of $1.4 billion (LTM). Its gross profit margin has stayed around 50% for a decade, and its current net profit margin is 21%. This demonstrates Ferrari’s competitive advantage, since other automakers report much lower margins.

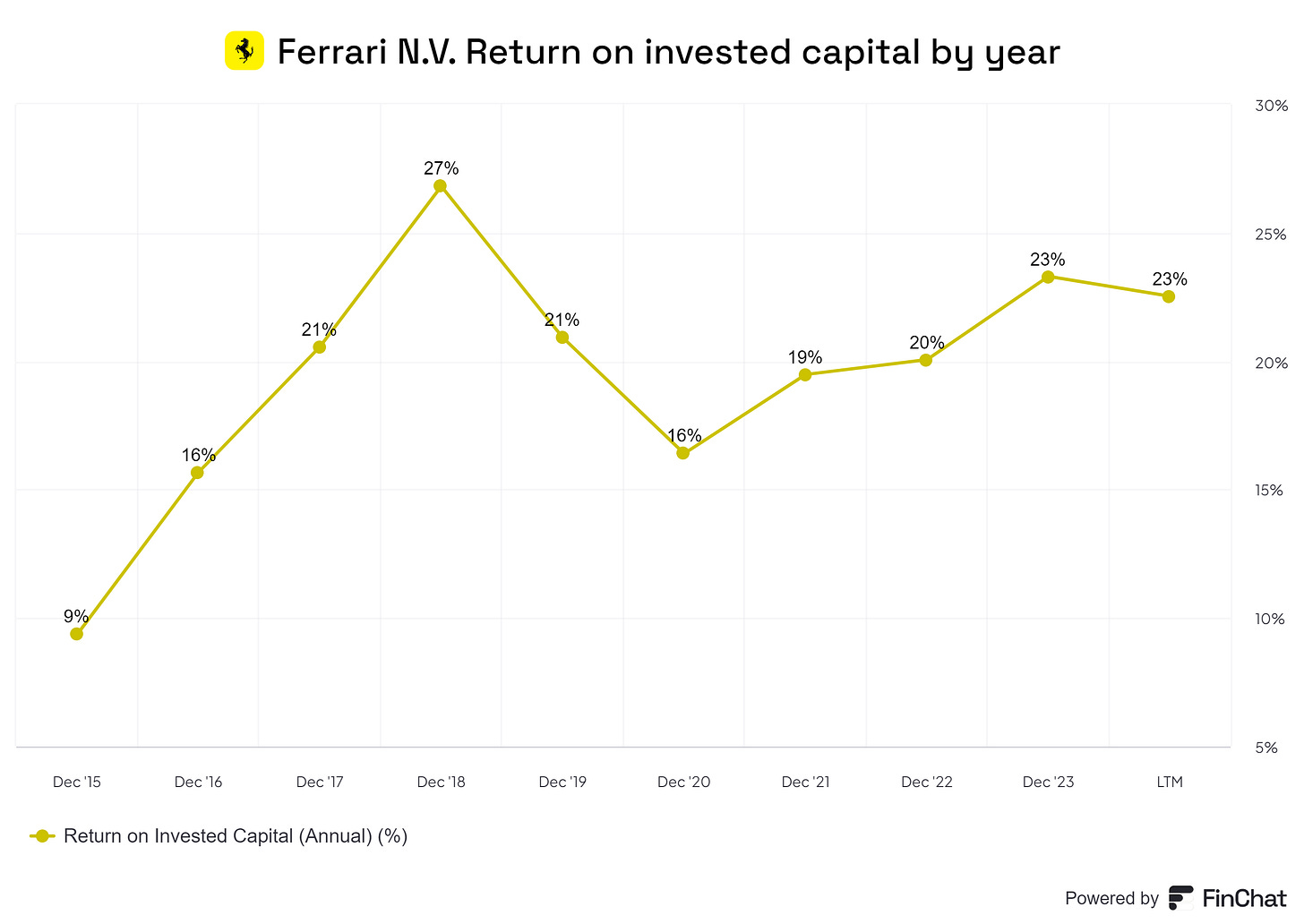

Ferrari maintains a very strong Return on Invested Capital (ROIC) of 23%. In 2022, 25% of operating cash flow was reinvested in factories and equipment, which will likely yield returns of around 17-20%. Despite being in a capital-heavy industry, Ferrari generates substantial free cash flow.

5) Valuation

Using a 5-year forecast, I estimate 10% annual growth. Management predicts 9%, but past results have shown they tend to be conservative. I used a 17% profit margin. Might be a bit ‘too’ conservative, since they haven’t been lower than 18% since 2018. I used a P/E ratio of 25, which seems high but is justified given Ferrari's competitive advantage.

Based on these assumptions, Ferrari is quite overvalued. This scenario give us a CAGR of -8%, even with dividends and buybacks very unattractive.

Conclusion

Ferrari embodies Italian excellence, combining a rich history with a strong brand to create a coveted luxury experience. The company expertly maintains high demand and exclusive pricing through limited production and a loyal customer base.

Financially, Ferrari's margins and return on invested capital outperform other automakers, highlighting its competitive edge. Although the company has manageable debt, its significant cash reserves and solid free cash flow ensure a stable financial outlook.

With new factories and electric vehicle plans, Ferrari aims to remain relevant long-term. However, its stock appears overvalued, and despite predicting 10% annual growth, the high valuation could limit future returns.

In summary, Ferrari boasts an iconic brand and strong financials, but potential investors should be cautious given the current valuation.

DISCLAIMER: This is not investment advice or a recommendation. Think carefully before making any decisions.