Does Auto Partner have a moat? ($APR.WA)

Or do they just have some (temporary) advantages over competitors?

Last Friday, we published our research report on Auto Partner. It is a Polish distributor of spare parts for lightweight automotive vehicles (cars and motorbikes). The company is outpacing its competitors in both Poland and Europe in revenue, thus gaining market share. Over the past 5 years, Auto Partner grew with an annual revenue CAGR of a stellar 23.5%. Its closest competitor, Inter Cars, grew with 17.2% over that same period. Besides, net profit margins are structurally better compared to competition. How does Auto Partner achieve this?

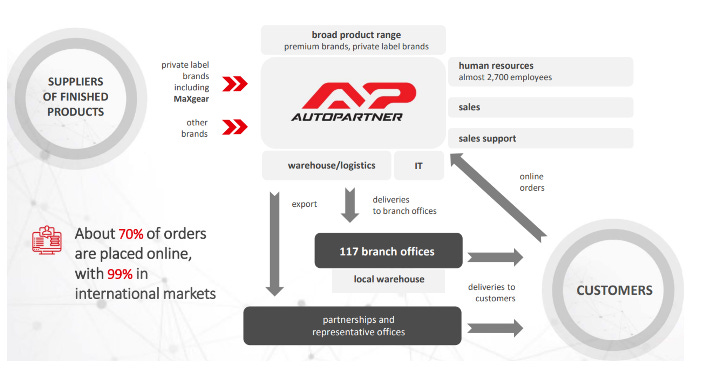

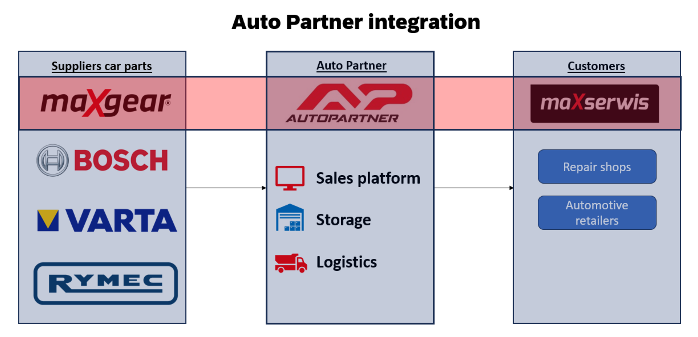

In very short, Auto Partner’s business model works as follows. AP buys products from suppliers, such as Bosch and Varta. They store the products in their warehouses and deliver them to customers whenever they place an order. The order is made online most of the times, by using AP’s sales portal (70%). In Poland, Auto Partner works with local branches to be closer to repair shops and realize frequent deliveries. Outside of Poland, AP delivers to local distributors/partnerships.

Let’s sum up the advantages of Auto Partner:

Auto Partner owns a private label brand called MaXgear, which is populair and rapidly growing as a percentage of total sales. The brand is known for its great price-quality ratio. Inter Cars does not own a private label brand.

Auto Partner is known for their easy-to-use ordering system, which is why so much or their sales is made online. For international sales (the fastest growing segment), this is 99%. This enables them to reduce customer service agents taking orders.

Auto Partner has a connected chain of repair shops, operating under the name of MaXserwis. Mutual benefits are being created by doing this. Inter Cars uses the same strategy, so it’s especially an advantage over smaller competitors.

Auto Partner is known for their fast delivery and efficient logistics. They are able to deliver spare parts 3-5 times a day in Polish areas. That’s very important for repair shops, since it allows them to minimize lead time.

Auto Partner has the lowest relative difference between gross- and net profit margin. This implies their operational efficiency and cost leadership within the industry. This might be their stongest advantage, because it allows them to offer the lowest prices to repair shops.

The big question is; are these advantages sustainable?

For all five mentioned advantages, my honest answer would be “no”. It’s important to note that this is not a rare thing; it’s very hard for distributors to differentiate themselves from competitors. Clearly, Auto Partner is doing many things right, allowing them to consistently beat competition on growth and profitability.

Management plays a big role here with an average tenure of 20 years and a great track record. The founder is still CEO and owns more than 40% of the company. As long as they can keep growing organically in an efficient way, I think Auto Partner can become one of the top tier players in Europe. However, the dependency on operational discipline and good management execution could make them vulnerable in the future.

Do you want to know everything you need to know before making a decision if Auto Partner is interesting for your portfolio? In the full (audio) analysis we’ll cover the entire business model, moat, management incentives, crucial financial metrics, risks & opportunities + we’ll share our expected return based on our research.

Check out our full analysis on The Dutch Investors and join the club! We are happy to welcome you to our platform.

We hope you understand Auto Partner a little better now.

Have a wonderful day and happy investing.

The Dutch Investors

Give me a message kindly to discuss some huge investment opportunities for you