Diageo - Premium Research Report - Sneak Peek

Our fundamental analysis of Diageo. The biggest spirits company in the world.

“Celebrating life, every day, everywhere.”

Diageo

This research report is a sneak peek of the entire fundamental analysis. If you want to read the entire research report, check out our premium reports.

Introduction of the company

History

The company

The business model

The sector and industry

1) Introduction to Diageo

Celebrating life, every day, everywhere

1.1 Introduction and its history

Diageo was created in 1997 through a merger between the beer brand Guinness and Grand Metropolitan plc. At the time, the two companies saw good opportunities to achieve economies of scale where their product portfolios complemented each other well. Diageo has now grown into the world market leader in 'spirits': alcoholic drinks other than beer and wine. The statistics don't lie, because Diageo is the global number one in Scotch whiskey, tequila, vodka, gin, rum, and liquor. The company has more than 200 brands, has more than 100 production locations, and sells its drinks in more than 180 countries. Some well-known brands are Guinness, Johnnie Walker, Smirnoff, Baileys and Captain Morgan. Diageo employs approximately 30.000 employees worldwide.

Despite its size, Diageo controls only 4.7% of the fragmented Total Beverage Alcohol (TBA) market. An average turnover growth of 7.4% over the previous seven years shows that there is significant growth potential. Diageo aims to increase its TBA market share to 6.0% by 2030.

Diageo's portfolio mainly consists of premium brands. The company has focused on this in recent years, resulting in a 17% increase in turnover from premium brands since 2017. The company plans to further enhance its focus on premium products in the future.

A variety of Diageo brands are highlighted here. About 63% of Diageo's turnover comes from the premium segment and above (priced over $25 per 70 cl), while the remaining 37% comes from standard and 'value' products (priced under $25 per 70 cl).

In the revenue model, we further discuss the 'premiumization' trend and explore how Diageo generates its income.

2) The Company

Jack-of-all-trades

2.1 The business model

Diageo makes money by selling bottled drinks to customers, primarily through wholesalers and distributors. These distributors then resell the drinks to restaurants, cafés, bars, and supermarkets, where consumers finally encounter Diageo's brands. In many regions, Diageo owns the distributor, such as its 'In Market Companies' (IMCs) in North-East and South Europe. In France, distribution is handled through a joint venture with Moët-Hennessy, in which Diageo owns a 34% stake, eliminating an intermediary and increasing profits. Diageo also sells directly to supermarket chains, online customers, and individual stores, as is the case with Guinness in Ireland.

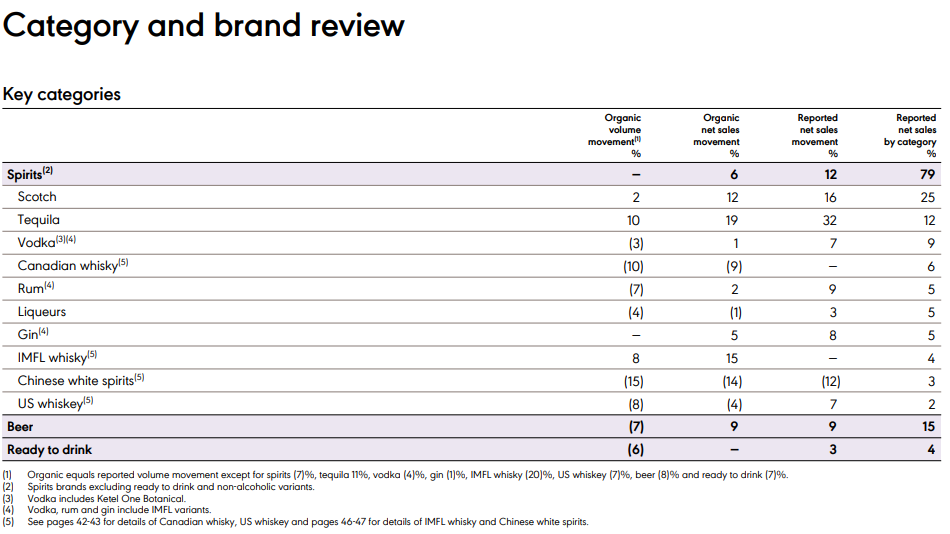

Diageo's drinks division, excluding beer, accounts for 79% of its revenue. This includes 31% from Scotch Whiskey, 15% from Tequila, 12% from Vodka, and 11% from International Whiskey brands. The beer segment, mostly Guinness, makes up 15% of total turnover. Ready-to-drink products, like mixed drinks and cocktails, account for 4%. Non-alcoholic drinks and other activities, such as brewery visits and souvenir sales, make up the remaining 2%. In 2017–2018, 480.000 people visited Diageo distilleries.

Below is an overview of these categories with their market shares.

Then back to the spirits division. We have talked about market shares, but another important question is, 'Which of these categories is intended to grow fastest'? Below is an overview of Diageo's expectations per category. The question is whether these are realistic. Below, we will discuss the different categories and formulate an answer to them. The categories Scotch, Tequila, Vodka, and Beer will be covered in detail.

Scotch whiskeys are a worldwide phenomenon. Like Champagne, Scotch is also protected against imitation, misuse or other practices that could mislead consumers into mistaking a drink for Scotch. In order to actually call your whiskey Scotch, you must meet several conditions, including:

The whiskey must be made in Scotland.

It is made from just three ingredients: water, yeast and grains.

The whiskey must be matured in oak barrels for at least three years.

No less than 77% of the export value of food and drink in Scotland consists of Scotch whiskey.

Diageo's Scotch branch will account for no less than 40% of the global Scotch market share in 2023. As seen, the category is also the largest for Diageo itself, with 25% of the share in turnover and no less than a third of Diageo's gross profit. CEO Debra Crew has already indicated that the Scotch category achieves very good margins. She did not indicate exactly how much, but she believes the gross profit margin is well above Diageo's average.

Johnnie Walker, founded in 1820, is the absolute leader within this segment of Diageo. It is the world market leader in Scotch and, based on volume, 2.5 times the number two in the industry; Ballantine's (owned by competitor Pernod Ricard). If we look further at the largest Scotch brands, we see two more Diageo companies in the top ten. These are Black & White (number five) and J&B (number eight).

Mexico is the birthplace of tequila, but its popularity is growing in Western countries. In 2023, tequila made up 12% of Diageo's turnover. This segment shows potential for significant growth due to efforts to expand its market presence. Traditionally seen as a party drink, tequila is now appreciated for its rich history and unique taste, achieved through detailed production processes. True tequila must be distilled from at least 51% agave in one of five designated regions in Mexico, aligning with the premium trend.

Diageo has strengthened its tequila portfolio through organic growth and acquisitions, achieving a 19% increase in 2023. The company is now the world market leader in tequila. Notable brands include Don Julio, acquired from Casa Cuervo in 2015, and Casamigos, co-created by George Clooney. Don Julio is priced at €60 per bottle in the Netherlands, while Casamigos starts at €66 and is the fastest-growing brand in the US. In 2021, Diageo invested $500 million to expand tequila production facilities in Mexico, highlighting their commitment to this segment's growth.

Vodka makes up 9% of Diageo's total turnover. In 2023, organic growth in this segment was only 1%. Unlike Scotch whiskey and tequila, which are region-specific, vodka is produced on every continent, allowing Diageo to be closer to its customers. Smirnoff is Diageo's most popular vodka brand and the best-selling vodka worldwide. Founded in Russia in 1864, Smirnoff's long heritage plays a crucial role in its appeal. In 2023, Smirnoff grew by 8%, while sales of Diageo's luxury vodka, Ciroc, dropped by 23%, likely due to a shift toward premium tequila. Another well-known Diageo vodka brand is Ketel One.

Guinness is Diageo's flagship beer, significantly overshadowing its other beer brands in terms of turnover. Founded in 1759 in Ireland, Guinness is incredibly popular, with over 10 million glasses consumed daily worldwide, equating to 1.8 billion pints annually. The production process involves 280 quality checks, ensuring the consistent taste. Guinness was the best-selling beer in Britain in 2023, growing organically by 16%, and is now available in more than 100 countries. Guinness contributes nearly 15% to Diageo's total sales.

Premiumization

Then back to a topic that has already been covered a few times in this analysis: 'premiumization'. This word is often used in presentations, annual reports and earnings calls. Diageo is strongly committed to this, as can also be seen below.

Diageo focuses heavily on premiumization. In 2017, 10% of its turnover came from the 'Value' segment, but this decreased to 8% by 2023. The 'Standard' segment ($15 - $25) also saw a significant decline. In contrast, the 'Super premium+' segment (bottles costing more than $40) grew by 11 basis points. Brands like Smirnoff fall into the 'Value' segment, while others are positioned in higher segments.

Geographical distribution

Diageo's sales are geographically diverse. Nearly 40% of its turnover comes from the US and Canada. A smaller portion comes from Asia, where local competitors are particularly strong in China. The geographical distribution of turnover appears to mitigate risk effectively.

This is a sneak peek of the entire fundamental research report.

2.2 Sector & Industry

Alcohol market overview

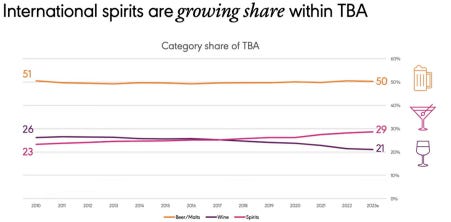

The alcohol market is highly fragmented, with low barriers to entry for new drinks and beers. Diageo charges the Total Beverage Alcohol (TBA) metric, covering all types of alcohol. Currently, Diageo holds about 4.7% of this market. It’s debatable whether including all alcohol types as the reference market is fair. While beer and wine can substitute for spirits, the entire alcohol market might not be the best comparison due to the limits on how much market share spirits can capture. For example, beer has maintained a 50% market share for thirteen years, while spirits have gained significantly over wine but face a growth limit.

In 2022, the TBA market was valued at $406 billion, with spirits comprising about 29% ($117 billion). The market grew by 10% in 2023, making the spirits market worth $129 billion. Excluding Guinness's revenue, Diageo’s share in the spirits market is around 14.2%. This larger share implies less potential for growth.

Competitors and market position

Diageo's geographic diversification is robust, with a solid base in developed markets and strong presence in emerging markets like Africa and South America. Key competitors include Brown-Forman and Pernod Ricard:

Pernod Ricard: Focuses heavily on Asia, the US, China, India, and Global Travel Retail (e.g., duty-free shops). Major brands include Absolut Vodka, Jameson, and Ballantine's, with over 30% of their 2023 volumes coming from these brands. Pernod Ricard is also pursuing premiumization.

Brown-Forman: Primarily generates revenue from whiskey, especially Jack Daniel's, with a strong focus on American whiskeys. Unlike Diageo’s diverse portfolio, Brown-Forman's revenue is over 90% from whiskey.

Diageo’s broad product range and strategic market positioning make it more comparable to Pernod Ricard. However, the overall market remains fragmented, with many active players.

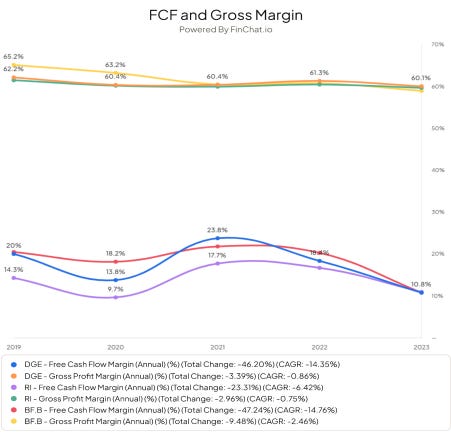

The graph below is very interesting. Although we can discuss differences down to tenths of a percent, the three companies show minimal differences in gross profit margin and free cash flow margin. Despite geographical differences, similar patterns emerge in these trends.

In terms of size, it’s notable that in 2023, Diageo’s market capitalization and turnover are larger than Pernod Ricard and Brown-Forman combined. However, Diageo does not seem to benefit significantly from economies of scale when considering the margins. According to Statista, the global spirits market is expected to grow by approximately 6.5% over the next five years. This growth would be favorable for Diageo and its peers.

What is driving this growth?

Premiumization: There has been a longstanding trend of consumers shifting towards premium brands in the spirits market. Instead of the cheapest vodka, consumers often choose brands like Smirnoff, Absolut, or even Grey Goose or Belvedere. While this trend weakened slightly at the end of 2022, following the end of the COVID-19 pandemic, it remains strong. Emily Neill, COO of Research at IWSR, states, "In the longer term, the premiumization trend looks to be structural in many parts of the beverage alcohol market – and it is likely to withstand shorter-term economic and geopolitical turbulence, as it has done in the past." Premium drinks are often seen as an affordable luxury, making this market less sensitive to economic fluctuations compared to brands like Hugo Boss or Kering.

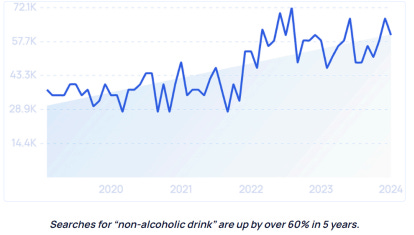

Moderation: On average, people worldwide are drinking less alcohol. For example, Generation Z in America drinks 20% less alcohol than millennials did at the same age. This trend correlates with an increase in non-alcoholic beverage sales. The drinks industry, including Diageo, is responding by offering non-alcoholic options like Guinness 0.0 and non-alcoholic gin.

Premiumization and moderation will likely lead to reduced alcohol volume for beverage producers, particularly in Western countries. Therefore, it is increasingly important to establish strong, distinctive brands in the market. Next, we will examine how and whether Diageo distinguishes itself.

Become a premium member and get access to the entire fundamental research report, including:

H3 - The competitive advantage

H4 - Management

4.1 Incentives

4.2 Skin in the game

H5 - The finances

5.1 Financial key figures

5.2 Capital allocation

5.3 ROIC

5.4 Debt analysis

5.5 Financial objectives

H6 - Risks and opportunities

6.1 Opportunities

6.2 Risks

H7 - Valuation

7.1 Ratios compared to the past

7.2 Scenario analysis

H8 - Conclusion

8.1 Conclusion

8.2 Score