Booking Holdings - Research Report - Part 3

Valuing the online travel agency and our conclusion on Booking Holdings

"To make it easier for everyone to experience the world.”

Booking Holdings

This research report is divided into three sections. This is part 3 of 3. In this segment, we will explore:

The valuation

FCF yield valuation

Scenario analysis

Another scenario

Risks and opportunities

Risks

Opportunities

Conclusion

Conclusion on Booking Holdings

Score

7) The valuation

Whats the travel agency worth?

7.1 Free cash flow valuation

Let's analyze Booking Holdings' financial health, focusing on free cash flow (FCF), which shows how much cash the company has left after covering its expenses.

In 2023, Booking generated about $175 in free cash flow per share, with its stock priced at roughly $3800, giving it a 4.6% FCF yield. While this suggests the stock is expensive, Booking Holdings expects to grow. It projects an annual revenue increase of 8% and aims to raise earnings and FCF per share by up to 15% through strategies like share buybacks and investments in marketing and tech. If the company maintains a 12% annual growth rate over the next five years, its free cash flow per share could reach around $308 by 2028. That would increase the FCF yield to nearly 9%, making the stock more attractive.

7.2 Scenario analysis

Scenario analysis is used to predict potential financial outcomes under different conditions by estimating future sales growth and net profits, then determining an “exit multiple” to estimate the company's value when it's time to sell.

To do this, start by using past data to predict future sales growth, considering trends and the industry's behavior. Estimate net profit margins by evaluating the company's cost management and operational efficiency. Finally, select an exit multiple by comparing it with similar companies or industry averages. This approach helps investors understand the potential outcomes for a company under different economic conditions and strategic choices, which is especially helpful in rapidly changing industries. If the stock price continues to rise, the potential total return will decrease.

7.3 Another scenario

The travel industry's ups and downs make predicting future cash flow and profits tough, particularly for Booking Holdings. Despite this challenge, it's reasonable to expect that Booking's cash flow will be higher in 10 years if economic trends hold steady.

The 2021 Tourism Trend Report by Statistics Netherlands notes that the tourism sector is growing at about 5% annually, excluding 2020 due to the pandemic. Booking Holdings aims to beat that, targeting 7-8% annual revenue growth. Management has an even more ambitious goal of at least 8% annual revenue growth and a minimum of 15% growth in earnings per share (EPS).

If Booking can keep up a 15% EPS growth rate over the next decade without adding significant debt, this could directly reflect shareholder returns. This outlook is promising for investors as long as Booking maintains its strategic focus and economic conditions stay favorable.

8) Risks and Opportunities

Bumpy rides or golden tickets?

8.1 Risks

Cyclical market: The travel industry is cyclical. If fewer bookings occur, it leads to lower room prices, hurting revenue and profitability. While inflation was favorable in 2022-2023, a downturn could negatively impact valuation and intrinsic value.

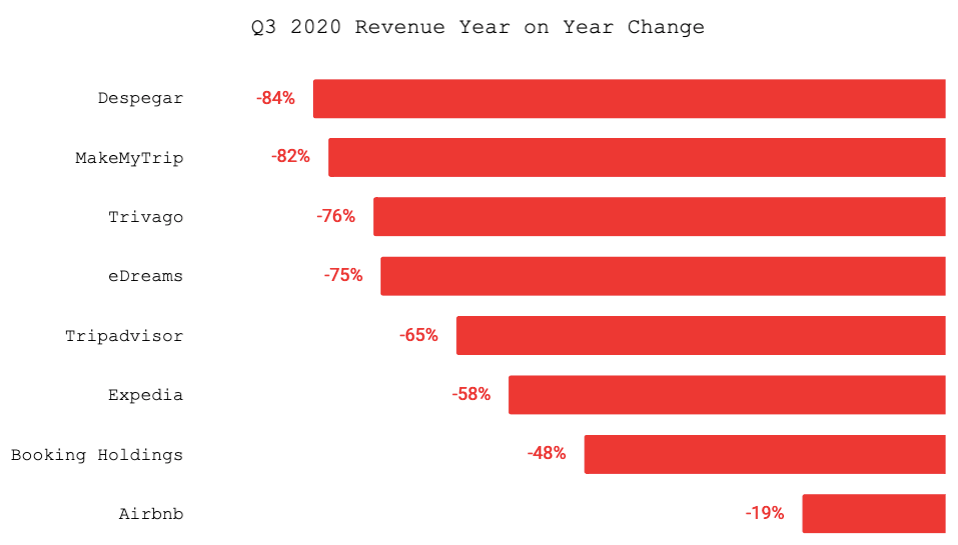

Pandemic threat: Just as other companies struggle during travel restrictions (refer to the image below), Booking's revenue also suffers significantly during closures like pandemics or travel bans.

Regulatory challenges: Booking faces challenges from countries and regulatory bodies like the European Commission. For instance, Spain's competition authority is threatening a $530 million fine in 2024, and there are moves to ban the price parity clause which could weaken Booking.com's competitive edge. Additionally, the European Commission blocked Booking's attempt to acquire Flugo Group Holdings (eTraveli) for $1.7 billion, stalling a part of their business model focused on acquisitions.

Competition from Airbnb: According to Skift's interview with Airbnb CEO Brian Chesky, hotel prices have risen by 10% globally, while Airbnb's prices have dropped by 1% as of July last year. This trend could make Airbnb a more attractive option compared to traditional hotels, challenging Booking.com’s market share.

Customer loyalty: If competitors offer similar booking services at lower prices, Booking.com could lose customers. Maintaining customer loyalty is crucial but challenging.

8.2 Opportunities

Expanding into experiences: According to Steve Kaufer, former CEO of TripAdvisor, margins on "experiences" like tours and activities are comparable to those on hotels. While the market for experiences is smaller than lodging, Booking.com could significantly increase its value by adding these to their Connected Trip offerings.

Reducing marketing costs: As stated by Glenn Fogel, marketing costs are expected to decrease, enhancing profit margins. The shift toward digital bookings supports this trend, making operations smoother and more profitable.

9) Conclusion

9.1 Conclusion

Booking.com is a top player in the travel industry, praised for its dependability and extensive choices. It gains advantages from network effects and scaling up, which reduces costs and boosts efficiency as the company expands. Even though its stock price has risen significantly, experts see a potential for about a 10% return each year. The company is also known for taking good care of its shareholders.

With the travel industry booming and hotel rates remaining high, Booking.com's future looks promising. Yet, if the stock price falls without a real drop in the company's value, it could be a great chance to buy shares. To stay informed, watch the number of visitors to their site, check their financial performance, and keep an eye on the number of places listed on Booking, as these factors will help you understand the potential risks and opportunities ahead.