Booking Holdings - Research Report - Part 2

Understanding the numbers and management behind Booking Holdings

"To make it easier for everyone to experience the world.”

Booking Holdings

This research report is divided into three sections. This is part 2 of 3. In this segment, we will explore:

The financials

Key financial figures

The balance sheet

Capital allocation

Management

Incentives

Price - practise research

Different situations explained

4) The financials of Booking Holdings

Flying through the numbers

4.1 Financial key figures

Revenue growth

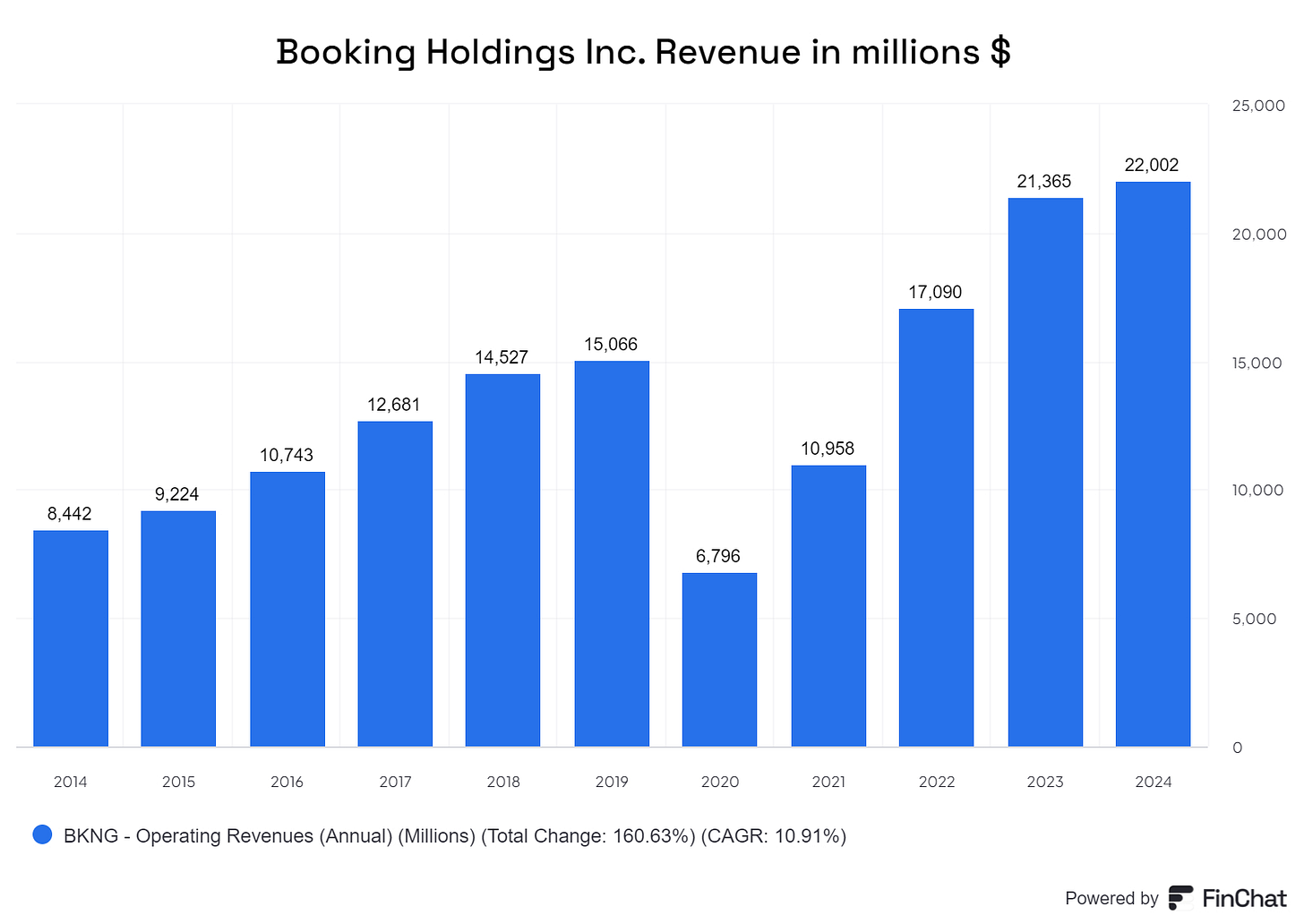

Revenue stabilized at 12–15% before dropping during the pandemic, when closed borders made travel difficult. Growth has since picked up as people travel more to make up for lost time. However, growth is expected to slow in the coming years due to the travel industry's cyclical nature.

Profit growth

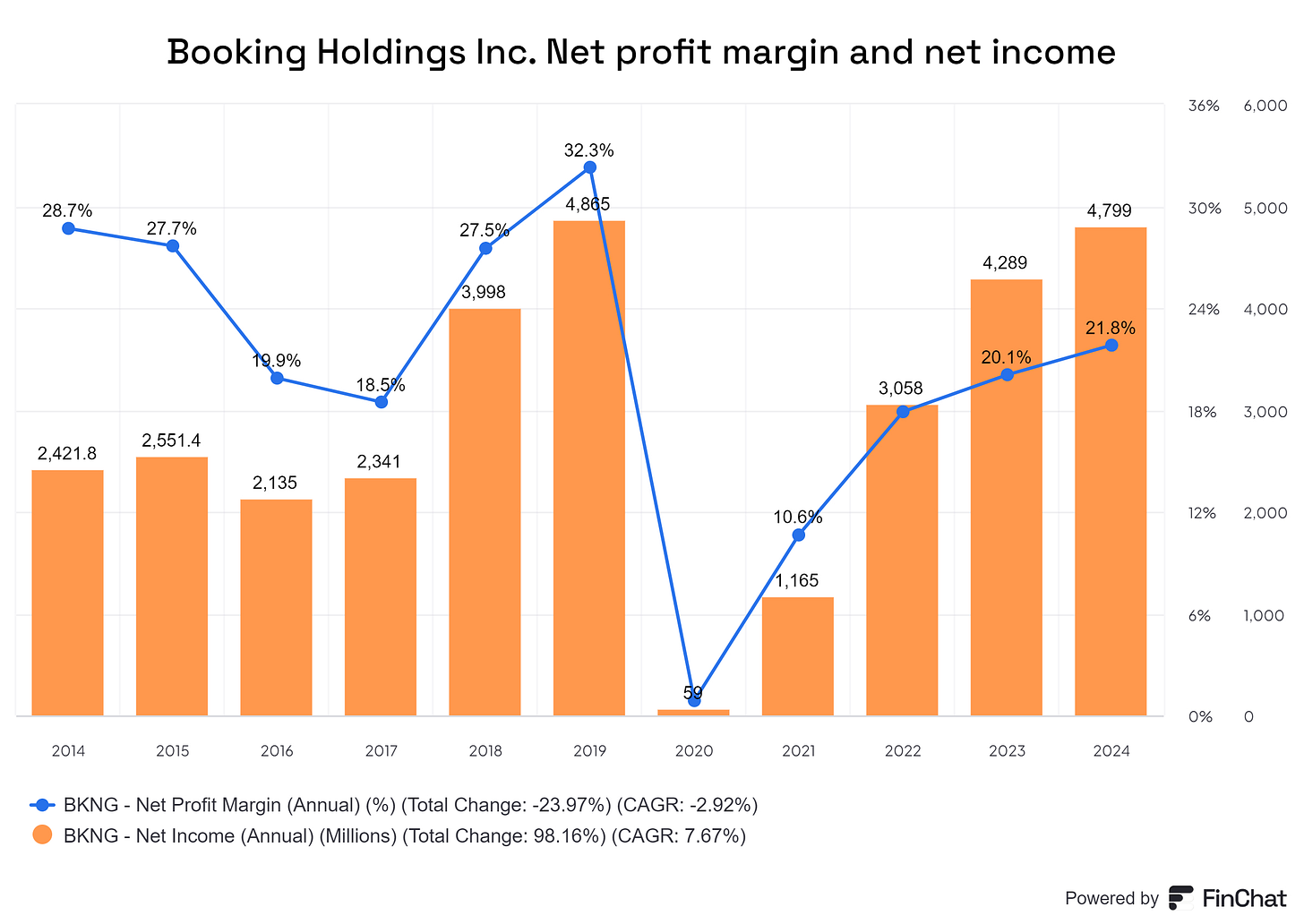

In 2023, Booking Holdings faced $530 million in one-time costs due to an expected fine from the Spanish competition watchdog. Without this, profits would have been $4.8 billion for the year.

Profit margin (%)

Booking Holdings' profits fell from $4.8 billion in 2019 to $59 million in 2020 because COVID-19 drastically impacted travel. With the industry's recovery, profits improved to $1.1 billion in 2021, $3 billion in 2022, and $4.3 billion in 2023 (though this included the $530 million fine). Without this one-time expense, the profit would have reached $4.8 billion, nearly back to pre-pandemic levels.

Stock-Based Compensation (SBC)

Free cash flow (FCF)

FCF is calculated as net cash from operations minus capital expenditures and SBC.

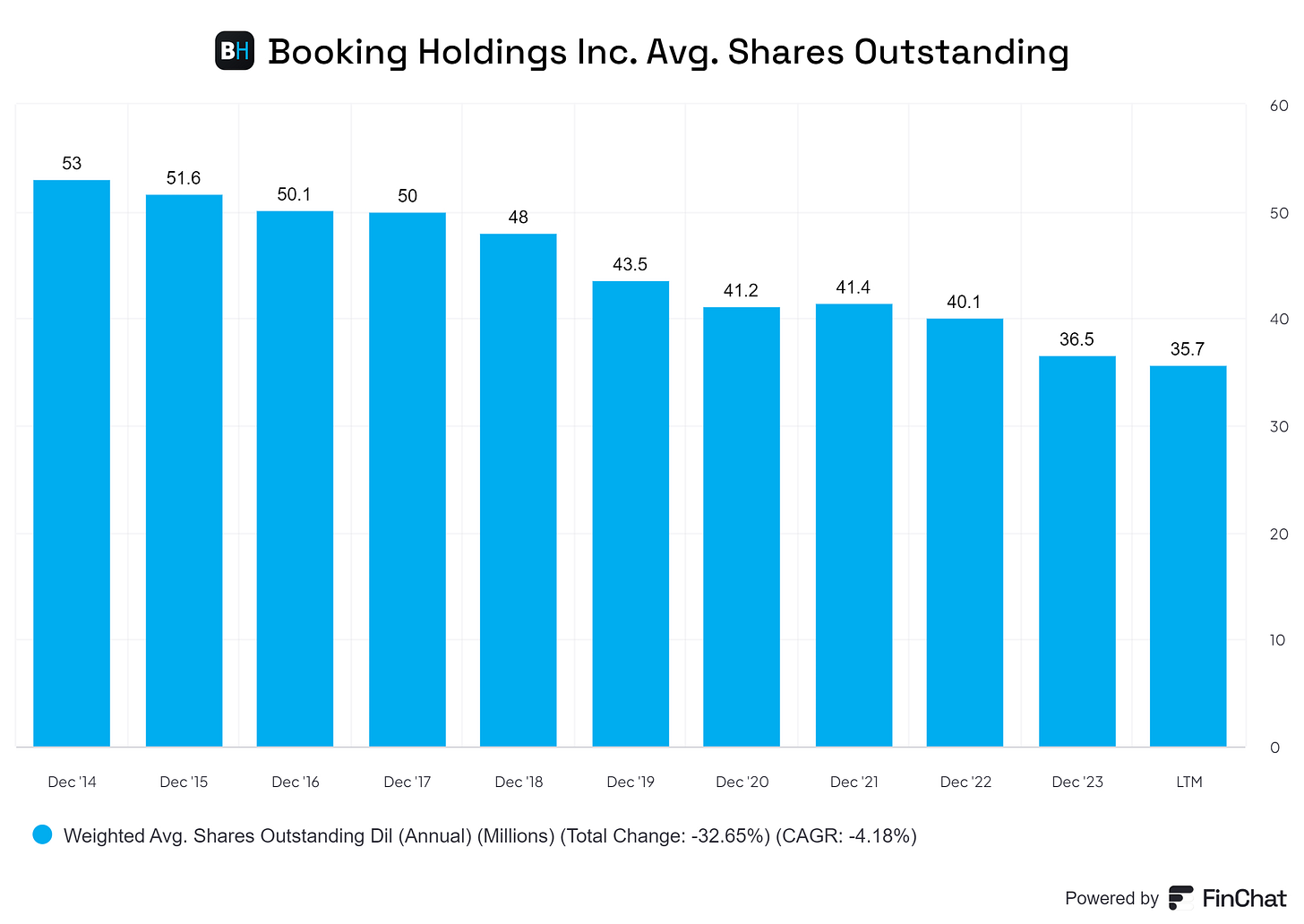

Outstanding Shares

As shown in the table below, Booking Holdings has been buying back shares annually since 2014, reducing the count from 53 million to 35.7 million.

4.2 The balance sheet

Booking Holdings follows a capital-light model, keeping investments low. In 2023, capital expenditures were less than 2% of total revenue. The company reported $24.3 billion in assets at year's end, with $12.1 billion in cash. Debt was at $14.2 billion, but with significant cash reserves and a conservative approach to accounting, Booking is financially strong and capable of meeting its obligations.

4.3 Capital allocation

Booking Holdings' free cash flow (FCF) remains consistently high, thanks to deferred payments from growing merchant transactions. The company holds onto customer payments until services, such as hotel stays, are completed, improving its working capital. However, it's important to note that this cash flow reflects operational income rather than profit.

Booking Holdings actively invests in share buybacks, impacting its valuation and reducing the number of outstanding diluted shares. In 2024, they plan to issue dividends of around $1.2 billion (about a 1% payout ratio). Despite this, most of the company's profits and FCF will continue going toward share buybacks.

During the Q4 2023 earnings call, CFO David Goulden highlighted the company's strategic approach to buybacks. They increased purchases when shares were low at the start of the quarter and then adjusted as prices rose. This selective strategy is relatively rare and well-regarded by financial experts.

5) Booking’s Management

CEO: Glenn Fogel

Glenn Fogel has led Booking Holdings as CEO since 2017 after initially joining in 2000. With a Harvard Law School background and experience as an investment banker, he first addressed Booking.com's complacent culture at Hotel van Oranje, where the previous CEO, Gillian Tans, had been dismissed.

Known as "the most frugal CEO ever," Fogel focuses on capital allocation, management oversight, and maintaining a strong company image. In 2021, he earned $54 million and in 2022, $30.8 million, largely through equity. By March 2023, he held shares worth about $71 million.

CFO: David I. Goulden

David Goulden has served as CFO since 2018, bringing prior experience from Dell Technologies and EMC. Over seven years, he's sold more than $35 million worth of Booking Holdings shares. In the Q4 2022 earnings call, he emphasized the importance of share-based compensation (SBC) as a legitimate cost and a strategic tool. In 2022, he earned $12 million, mostly in shares. By March 2023, he held 9,438 shares, worth around $25 million. Both Goulden and Fogel hold substantial equity stakes, signaling significant personal investment in the company. Despite a low 3.1 Glassdoor rating in 2019, Booking.com's rating improved to 4.3 by early 2024, showing a positive change in perception.

5.1 Incentives

According to the 2022 Proxy Statement, management is rewarded for growing revenue and EBITDA while issuing minimal shares and maintaining competitive pricing. Booking Holdings also spends less on SBC compared to its competitors.

5.2 Insider trading

Last year, key executives at Booking Holdings sold about $70 million worth of company stock. Fogel and Goulden sold 500-1.000 shares monthly, valued between $1.25 million and $2 million each month.

6) Price - practice research

Price is crucial when booking a stay since most travelers will choose the lower-priced option if it's available. A practical study was conducted on February 2, 2024, to compare prices across five randomly selected accommodations. The study looked at varying group sizes and travel dates while considering tourist taxes and additional hotel costs (without membership discounts). Here are the five situations examined:

Situation 1: A week-long stay (February 19-25, 2024) for two adults sharing a room at the Civilian Hotel in New York.

Situation 2: A solo trip to City Hub Rotterdam from May 1-7, 2024.

Situation 3: A family vacation to Rome (two adults, two children), staying at Hotel A Peace of Rome from August 12-26, 2024.

Situation 4: Traveling with two companions to Tving, a small Swedish town. This exclusive accommodation is available only through Airbnb, offering a €656 "monthly stay discount."

Situation 5: A two-person booking at the Hilton Hotel in Barcelona from April 2-9, 2024.

6.1 Key findings

Distinct listings across platforms

Many hotels that appear on other booking platforms can't be found on Airbnb, and the same goes for Airbnb's unique accommodations. This shows that different platforms cater to different types of travelers and accommodations, so if you're looking for something specific, it's best to check multiple sources.

Direct booking with Hilton saves money

Booking directly through Hilton's website gave travelers the lowest prices, proving the chain's power in attracting customers. Their loyalty programs and discounts make it worthwhile to book directly, especially for frequent travelers.

Price fluctuations across platforms

Prices often change between booking sites, so it's smart to compare several before finalizing your reservation. Doing so can help you find better deals, save money, or discover exclusive offers.

Booking Holdings companies often have the best deals

In many cases, one of Booking Holdings' companies—like Booking.com or Agoda—provides the lowest prices among online travel agencies. They have a wide selection of accommodations and regularly offer discounts, making them a reliable option.

Booking.com isn't always the cheapest

While Booking.com often provides competitive rates, sometimes other OTAs (Online Travel Agencies) offer better prices. Comparing prices across different platforms ensures you're getting the best deal for your stay.

In part 3 we will look into the valuation and give our conclusion on Booking Holdings.

Part 3 is coming out tomorrow!