Booking Holdings - Research Report - Part 1

Understanding the competitive landscape and booking holdings business models.

"To make it easier for everyone to experience the world.”

Booking Holdings

This research report is divided into three sections. This is part 1 of 3. In this segment, we will explore:

Introduction of the company

History

The company

The business model

The sector and industry

The competitive advantage

The moat

1) Introduction of Booking Holdings

The world’s largest online travel powerhouse

1.1 Introduction

Booking Holdings is a company that owns several subsidiaries like Booking.com, Rentalcars.com, Priceline, Agoda, OpenTable, and KAYAK. According to the European Commission, it's the world's largest online travel agency (OTA), with a dominant 60% market share in Europe. Booking.com, its biggest platform, started as a Dutch startup in Amsterdam in 1996, founded by Geert-Jan Bruinsma.

In the last year (February '23 to February '24), Booking Holdings sold over a billion room nights (1.05 billion), which is much more than its competitors: Airbnb (488 million) and Expedia (351 million).

To be clear, Booking Holdings, or Booking, is the parent company, while Booking.com is the hotel booking platform it owns. Like Prosus, Booking Holdings manages multiple businesses under one roof, and its key focus is on Booking.com, which this analysis will spotlight.

The analysis will frequently refer to The Machine, a book that breaks down how Booking.com became so successful. This huge company was bought by Priceline.com in 2005, which later rebranded itself as Booking Holdings in 2018.

2) The company

2.1 The revenue model

Booking holdings revenue breakdown simplified:

1. Agency:

This revenue comes from travel-related transactions where Booking Holdings doesn't handle payments directly. Instead, they send invoices to service providers after the trip. Customers pay the hotel directly when checking in, and the hotel then pays Booking a commission about a month after checkout.

2. Merchants

Booking Holdings gets a cut of each transaction, mostly from bookings on Booking.com. Customers pay Booking directly, which then pays the hotel after subtracting its commission. This model is profitable because it allows Booking to earn interest on the money held before transferring it, and makes it easier to upsell other services.

3. Advertisements and Other

KAYAK earns money by referring users to travel websites and through ads. OpenTable makes revenue by providing restaurant services and subscriptions.

Growth trends

After the COVID-19 pandemic, Booking Holdings bounced back with significant growth—up 61% in 2021 and 56% in 2022. Before COVID, growth averaged 14% annually. Although 2023 is expected to slow to 25%, that's still strong compared to the past. Inflation positively impacts Booking because it takes a percentage of room rates. With room prices going up, revenue does too. People also traveled more post-pandemic, which helped. The graph shows the pandemic's impact and quick recovery while revealing that merchant revenue is becoming a bigger slice of the pie.

(Hotel) nights

By 2023, Booking Holdings had booked over a billion hotel nights, with Booking.com being the focal point. According to their annual report, "online accommodation reservation services" make up about 90% of the company's revenue.

Booking.com links travelers with a variety of accommodation options, from hotels and villas to hostels and B&Bs. They thrive on network effects, as shown in the image below.

At the end of 2023, Booking.com was connected to 3.375 million properties, which was a 25% increase from the previous year. This included 475,000 hotels, motels, and resorts, plus 2.9 million homes and apartments. How does this stack up against competitors? By the end of 2022, Airbnb had 6.6 million active listings. The main difference is how they count: Airbnb counts rooms, while Booking counts entire places, which usually have about 2.8 rooms each. So, Booking actually rents out more rooms than Airbnb.

Using online travel agencies (OTAs) like Booking.com is great for hotels because they often have a lot of empty rooms — around 70 out of every 100 rooms. Since their costs for buildings and staff don't change much, filling rooms is crucial, and OTAs help a lot with that.

Price parity clause

The price parity clause means hotels can't advertise a lower price on their own websites than what they offer on Booking.com or any other OTA. It's unclear if hotels offer lower prices on different booking sites due to either:

less reliance on Booking.com or

better profits and services elsewhere.

However, countries like Germany, Austria, Sweden, Belgium, Italy, and France don't allow this clause, so hotels in these places can charge less on their own sites.

Even though the parity clause isn't illegal everywhere, lowering the price on your own site below Booking's can lead to penalties, such as being buried deep in search results, making your hotel hard to find.

Car rental bonus

Rentalcars.com, a part of Booking.com, offers car rentals at over 52.000 locations worldwide. Financial details were last reported in 2017, before being acquired by Priceline Group, now known as Booking Holdings (see chart 2).

Booking Holdings itself provides the following data about the car rental segment (chart 3).

Financial data indicates that Rentalcars.com had a net margin of around 6% in the past. By teaming up with Booking.com and reaching millions more users, it should gain more leverage and realistically achieve a margin of at least 10%.

If we assume a conservative 10% growth for car rentals (given that Rentalcars.com previously saw 20% growth) and apply a 10% margin and an exit multiple of 15, Rentalcars.com could be worth $3.2 billion by the end of 2023.

Airline tickets

In addition to accommodations and rental cars, Booking also offers airline tickets. Booking provides the following data about this (see chart 4).

Booking also deals with airline tickets, besides rooms and cars. They haven't specifically broken down how much they make or lose from these services, but it's thought that these don't really impact Booking Holdings' overall results yet.

Handling payments in-house

Around 2019, Booking started to handle payments on their own. According to the book The Machine (2021), setting up this process was a lot tougher and more annoying than the company's leaders expected.

“It became a process that would prove longer, more difficult, and more frustrating than anyone at the top of the company thought possible.”

By 2020, they were just about to make enough money to cover the costs of this new system. In early 2021, Daniel Marovitz set up a fintech branch to focus on payments.

Managing payments themselves helps Booking cut down on fees to other companies and improve the experience for both travelers and property providers, who also pay Booking for these additional services. This is also a key part of their strategy for offering what they call the 'Connected Trip'.

However, the third quarter of 2023 brought some challenges with delayed payments to partners due to a system upgrade in early July. The CEO, Fogel, acknowledged these delays during an earnings call, saying they've fixed the issues and cleared the payment backlog.

Despite these bumps, the volume of payments processed by Booking is growing, although they didn't share specific percentages in their latest report like they usually do.

The connected trip

When you think about travel, imagine being able to handle everything from booking your hotel, catching a flight, renting a car, and planning museum visits all on one site like Booking.com. This approach is really taking off, even though Booking.com still mainly focuses on hotel stays.

Some email providers don’t support long mails. Want to read the entire research report?

2.2 Sector and industry

Total Addressable Market (TAM)

Airbnb sees a huge potential market—worth about $3.4 trillion. This includes $1.8 trillion for short stays, $210 billion for longer ones, and $1.4 trillion for activities like tours and museum visits. The trend these days is all about spending money on memorable experiences rather than just buying stuff. Studies show that people, especially millennials, prefer spending on experiences they can cherish. Americans spend roughly 10% of their income on travel, and the Dutch spend 10-15% on their vacations.

The market for online travel bookings was valued at around $519 billion in 2021 and is expected to grow by 9% annually up to 2030. This growth is mainly due to more people booking online and focusing more on experiences.

Booking competitors

Airbnb is a big name in the same space as Booking, and they basically offer the same things at similar prices. Both are well-known and run loyalty programs. However, Airbnb charges service fees to customers and commission fees to hosts, which balances the benefits between travelers and hosts better than Booking, which mainly charges the property owners. While Airbnb offers compensation for property damage, Booking.com doesn’t, which might not make a big difference to travelers.

Despite being direct competitors, neither is likely to start a price war since it would hurt both. But if it comes to that, Booking's bigger financial cushion of $12 billion could give them an edge over Airbnb's $6.9 billion.

Trip.com, another competitor, dominates in China and offers a range of services. However, it’s less known in Europe, making it a smaller threat to Booking Holdings there. Booking Holdings even invested in Trip.com a few years ago, making direct competition even less likely.

Sun, the CEO of trip.com, said the following about Booking:

“Booking, on the other hand, is a global brand and in hotels, they are just so far ahead of anybody else. I think it will be very difficult for anybody to come close to them. Ctrip can do well because we focus on the Asia region and we also provide such a comprehensive product suite to the customers, which neither Booking nor Expedia does.” In“Booking does the hotel so well,I think they built a wonderful platform for the hotel business and they are doing it wonderfully. Nobody can really compete with Booking. We have very high respect for the Booking team.”.

It's quite unusual for a CEO to praise a competitor, but this admiration reinforces Booking.com's strong market position.

Search engines like Google and Baidu are also competitors since they let you find accommodations directly. More people are leaving reviews on Google, and even though Booking.com pays Google a lot to boost its visibility, Google is still aiming to carve out its own space in the OTA market with Google Travel. By displaying the cheapest (often sponsored) options to customers, Google is acting as a middleman. Similarly, Tripadvisor and Trivago offer comparable services.

Hotel chains like Marriott and Hilton, especially strong in the U.S., offer a different challenge. They attract customers directly with loyalty programs that provide discounts or cheap memberships. By the end of 2023, Hilton's loyalty program had 180 million members (up 19% year over year), while Marriott had 196 million members (up 10.7% year over year).

Tui, which directly owns 300–400 hotels, isn't a pure online travel agency like Booking. Instead, it's more of a mix between a hotel chain and a travel agency, so it doesn't directly compete with Booking in the same way.

3) The competitive advantage

How does Booking defend itself?

3.1 The moat

Booking Holdings gains significant advantages from this network effect, as highlighted in the image below.

Booking.com is extremely popular for hotel bookings because it connects countless accommodations with travelers worldwide. People often start their search there, knowing they'll find a vast selection. As more hotels sign up and more travelers search, the platform becomes even more valuable, not just locally but globally. This reach makes it hard for competitors to keep up.

Besides this network effect, Booking.com also has a strong brand that attracts users. By late 2023, around half of Booking's reservations will likely be made through its app. Getting people to use the app reduces reliance on Google, saving on marketing costs and improving the user experience. Thanks to economies of scale, they can maintain and improve the app and website efficiently, something individual hotels can't afford due to limited resources and expertise.

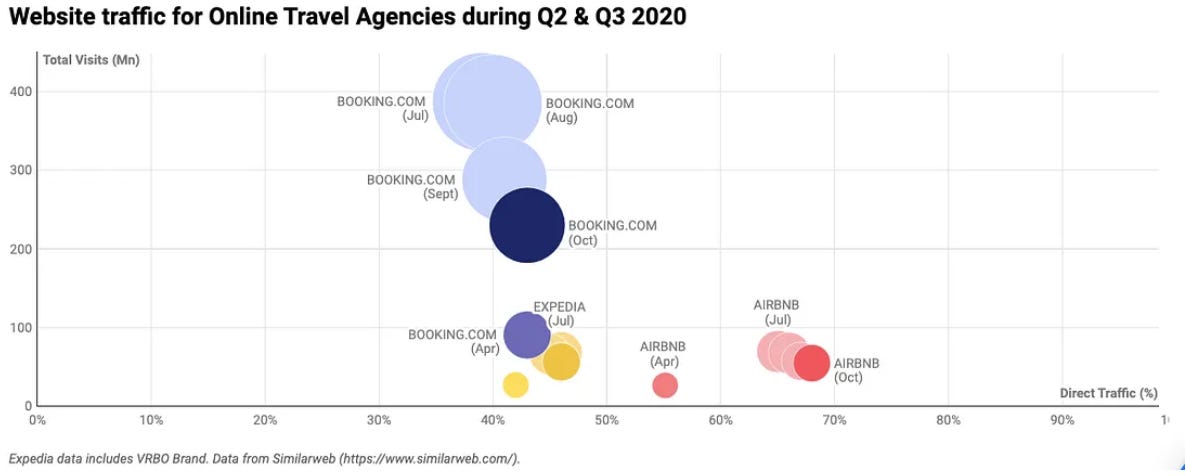

Booking.com spent $6 billion on marketing in 2022 and $6.8 billion in 2023, building strong brand recognition. However, Airbnb has an even stronger brand, as shown by its higher rate of direct traffic. This allows Airbnb to rely less on paid marketing like Google Ads. Though Booking.com has more total visitors, Airbnb attracts a larger share directly, which is a cheaper way to draw in customers.

The image below demonstrates that while Booking and Airbnb had some overlap in 2020, they generally did not provide the same accommodations. This distinction highlights the different strengths of each platform, catering to varied traveler preferences and showcasing the unique listings that set them apart.

Booking.com holds an advantage over hotels with its price parity clause. In some countries, this rule prevents hotels from offering lower prices on their own websites than what they list on Booking.com, allowing the platform to always feature the lowest prices.

Another edge is the Genius loyalty program. Once you activate your account, you're instantly at Genius Level 1, which gives you a 10% discount. These discounts help retain customers and offer more perks as they advance through the levels.

Part 2 is coming out tomorrow!