An unknown American mid-cap with limitless growth potential

Introducing you to Advanced Drainage Systems

This article introduces you to a promising company that you probably have never heard of before. Unfortunately, this opportunity arises from a concerning trend: the rapid increase in large-scale weather and climate disasters. According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, compared to an annual average of 9 from 1980 to 2020.

The increasing frequency of storms and hurricanes isn’t the only challenge we’re facing; the quality of our soil is also getting worse and worse. This will only increase the number of droughts and floods. Even though we’re opportunists, it’s clear these problems won’t resolve themselves anytime soon.

In the eye of the storm

Amid these challenges is a company uniquely positioned to address them: Advanced Drainage Systems (ADS). After a quick review of the company, we couldn’t help but feel enthusiastic. Here’s why:

ADS is a market leader

ADS has a single focus on a growing problem

Government investments are flooding into the industry

Its core product—hard plastics—is steadily gaining market share over other materials

ADS is actively consolidating the market

The market is able to grow for decades

ADS has a PE of 19

But before you rush to log into your brokerage account, let’s start with the basics:

What does ADS actually do?

ADS is a stormwater management company. They manage the entire journey of stormwater, from the moment rain touches the ground to when it returns to lakes and streams. Along the way, the water passes through several phases:

Capture >> Conveyance >> Storage >> Treatment

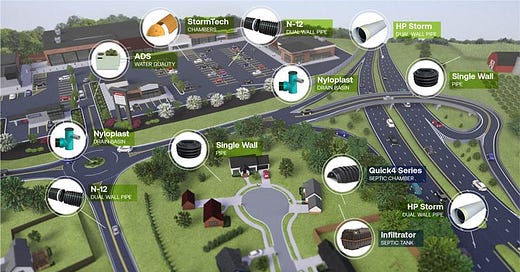

ADS provides solutions across all stages of stormwater management. Their product lineup includes:

High-density polyethylene (HDPE) pipes (54% of revenue)

Septic tanks and chambers (16% of revenue)

Allied products (23% of revenue)

International segment (7% of revenue)

These products are often sold individually for residential projects (33% of revenue) and non-residential developments (44% of revenue). To give you a clearer picture of ADS’s offerings, here’s how their infrastructure (7% of revenue) solutions look like:

The many opportunities that will help ADS grow

ADS has numerous opportunities that make it almost impossible for ADS not to grow in the upcoming decade:

Water management is becoming a larger priority: With the rise of extreme weather conditions, problems caused by flooding will only intensify.

ADS is consolidating the market with its acquisitions: Given the company’s track record, we believe the likelihood of ADS increasing its market share far outweighs the risk of ADS losing market share.

Growing HDPE market share: The advantages of HDPE—including its lighter weight, faster installation, lower cost, and greater resilience—make it a strong competitor against traditional materials like concrete and steel. Over the past three decades, HDPE’s market share has grown by approximately 10 percentage points per decade.

Expanding state and local regulatory approvals: Regulatory approvals continue to open up new opportunities in existing and new geographic markets.

Have we bought the shares?

No, we have not. During our in-depth research for TDI-Premium members, we discovered something that was so unacceptable that it withheld one of us from investing in ADS. Surprisingly, it’s not even related to the moat.

Although we didn’t purchase the shares, we hope this article has achieved its goal of introducing you to a new company that may be worth doing further research into. For TDI-Premium members, we provide in-depth analyses of the following aspects:

What share of profits is reinvested in the business, and how efficiently is that capital being deployed?

Are management’s interests aligned with yours as a shareholder?

Is stock-based compensation diluting you too much?

What returns can you expect based on a realistic scenario analysis?

TDI-Premium members didn’t just gain access to the ADS analysis; they also enjoy 30+ other equally detailed analyses. Joining TDI-Premium will help you rapidly expand your investing universe.

Have a wonderful day and happy investing.

The Dutch Investors.

WMS is the ticker for this one, didn't see it in the write up. Nice chart on it, very oversold on dailies and ready to push up again.

A roll-up in a commodity business...what could go wrong? :-)