8 Quotes that will teach you about Copart

Fascinating quotes that prove the power of salvage auction-beast Copart

During our Copart analysis, we stumbled upon many interesting quotes about the competitive advantages that Copart possesses. Guided by these quotes, we help you understand the true moat that Copart built in the last decades. By far, most quotes are from the book ‘Junk to Gold’, written by Copart’s founder.

If you’re unfamiliar with Copart’s business model, here is a brief introduction into their business model. Insured cars are struck by traffic incidents and natural disasters, such as hurricanes. In many instances, the car, that becomes a salvage car, can’t drive on its own anymore. It needs to be toweled away and stored. Also, insurance companies might want to sell the car (especially when it is a total loss).

Copart is the owner of the land underneath the salvage yard, the toweling trucks and the world’s biggest auction platform that offers wrecked cars. The company basically takes the whole process off the insurers’ plate. This is a highly lucrative business.

Copart’s founder, Willis Johnson, learned a lot about doing business from his father. Although he couldn’t read, he knew how to do business and what the rules of the game were. One of the quotes Willis Johnson Sr. often used was:

“Take care of your pennies, and your dollars will take care of itself.”

Although he was never involved in Copart’s business, that quote served as one of Copart’s foundations. By keeping operational costs under control and utilizing scale advantages, the company became more and more powerful. Willis Johnson looked back by stating:

“(…) small amounts of money can add up to either big profits or big losses. You can’t ignore the small expenses or the small amounts of money unaccounted for if you hope to succeed at the end of the day.”

While convincing an investment banker to help Copart going public in 1994, Willis Johnson tried to explain the need for Copart as simple as:

“If insurance companies don’t write insurance policies on cars, then they’re out of business. If manufacturers don’t make cars, then they’re out of business. They’re always gonna make cars, and they’re always gonna insure them. We’re the guy in between.”

To finish it off, Johnson said:

“As long as we’ve got the land in the right place to put the cars on, we can’t fail.”

In that regard, especially when taking into account the NIMBY (Not In My Backyard) effect, Copart is like a railroad company. You can’t operate a train without having railroad permission, and there are no alternatives. Well, the same applies to Copart: insurance companies can’t store their salvage cars and put them for sale efficiently without Copart. Willis Johnson preferred to use another metaphor:

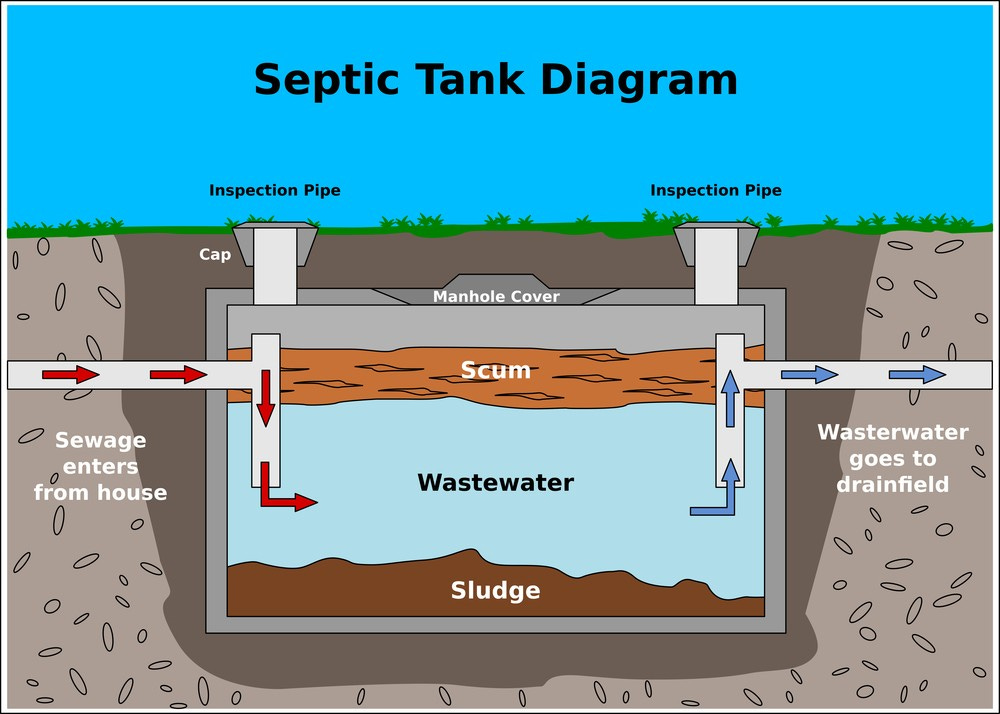

“We are like the septic tanks of the sewer system. You can’t have the system without us.”

While one main competitive advantage is just to have a lot of land to operate their salvage business on, making toweling from the accident to their land cheaper, another ‘invisible’ advantage is their extreme focus on the customer (mostly insurance company). Where one of the biggest competitors, IAA, solely focused on making the car suppliers the cash cow, Copart focused on the demand side. And it’s not only talk, it’s the art of making your words count:

“Do the right thing. Through the [Katrina Hurricane] ordeal, Copart did not pass any of its added costs on to its customers. Copart chose to absorb costs because it was the right thing to do. Copart also absorbed costs because it wanted to prove to its customers it was not just a vendor but a business partner they could rely on even at the worst possible time.”

When your partner (Copart in this case) is willing to make these kinds of sacrifices, that builds tremendous trust and long-term partnerships. If you don’t want to assume it based on Copart’s CEO, here is what a former IAA VP admitted:

“IAA focused more on vehicle sellers, while Copart recognized that buyers were the ones paying the bills. They focused on creating tools to make bidding easy, leading to large amounts of competition. Copart provided services for buyers, ensuring high returns for insurance companies.” - In Practise

In its lifetime, Copart only has had three CEOs. The current and third CEO is Jeffrey Liaw, and we found a fascinating quote from him, which reminds us of Willis Johnson Sr. (first quote from this article). It is as follows:

“We are committed to delivering the very best possible net returns to our clients by investing in the land we’ve already talked about, by investing in the digital auction platform and by making our partners, our clients, faster, more accurate and more efficient at what they do. (…). If we take care of those particular objectives, if we are exceptional along those dimensions, the stock price will take care of itself.”

And with that quote, the circle from both this article and the Copart story is complete.

For more quotes, insights and valuable information about Copart, we definitely recommend reading our latest deep dive available for TDI Premium members!

The benefits of TDI Premium:

📘 A deep dive every two weeks, including a written report and podcast

📊 TDI Dashboard with 50+ companies analyzed already

📈 24/7 live access to our personal portfolios

🛒 Updates on every buy & sell we make

We look forward to welcome you soon!

Have a wonderful day and happy investing.

The Dutch Investors