5 Companies Without a Moat

We often talk about investing in companies with a moat, but are there businesses without one?

Invert. Always invert.

What is a moat?

As investors, we are always looking for companies with strong moats. How about we switch it around and look at businesses that have no (or at least a very weak) moat.

A competitive advantage is something that makes your business stand out from the competition. Like the water-filled moats that surrounded medieval castles, an economic moat serves as a defense against the invasion of competitors. It can be a unique product or service, a superior customer experience, or a lower-cost structure. Without a competitive advantage, success may be difficult to achieve. If you don't have a competitive advantage, you are likely to be priced out of the market or lose customers to competitors who do. In the long run, it is not sustainable to compete without a competitive advantage. This concept is very important to understand for investors.

What moats are there?

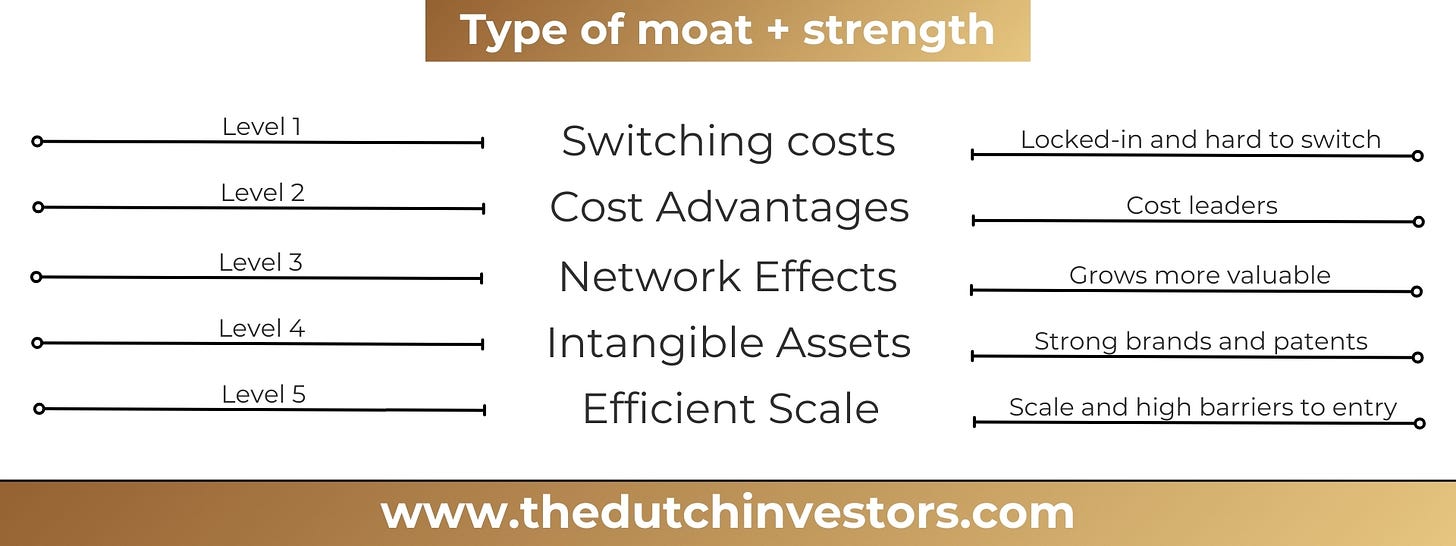

Economic moats come in various forms, each providing unique competitive advantages:

Switching Costs: Switching costs represent the collection of obstacles, both financial and non-financial, that a customer encounters when they decide to switch from a product or service to a competitor's offering.

Cost Advantages: Some companies have a secret weapon: the ability to produce goods or services at a significantly lower cost than competitors. This cost advantage can be due to economies of scale, efficient operations, or proprietary technology. With lower costs, these companies can undercut competitors on price or enjoy higher profit margins.

Network Effects: A network effect is a phenomenon where the value of a product or service increases exponentially as more people use it. This positive feedback loop, where growth leads to greater value, which then fuels further growth, is one of the most powerful and sustainable economic moats a company can possess.

Intangible Assets: Intangible assets form a powerful type of economic moat in the business world. Unlike tangible assets such as factories or equipment, they lack physical form yet hold tremendous value.

Efficient Scale: The efficient scale moat arises when a business operates in a market where the ideal size can only support one or a few dominant players. This creates a natural barrier to entry, deterring new competitors and protecting the incumbent's market share.

Examples of Companies with Weak Moats

In order to succeed in the market, every company needs to have a competitive advantage. Without it, they will not be able to attract customers, make profits, or keep their operations going. Yet, what really distinguishes a company in terms of long-term viability and market dominance is the strength and size of its competitive advantage.

Identifying companies with weak defenses involves looking at various factors that make them vulnerable in competitive markets. These are important factors to think about: easy entry, weak customer loyalty, products becoming more generic, lack of innovation or uniqueness, fast technological progress, and changes in regulations.

1. Groupon (GRPN)

Groupon's business model revolves around providing daily deals to consumers, which was initially groundbreaking but soon became easily imitable. New competitors can easily offer similar discount services with minimal startup costs, which negatively impacts the business. In addition, customer loyalty is minimal. Consumers tend to choose the platform that currently has the best deals. Groupon's market value has sharply declined since 2011 due to the lack of differentiation and the ease of replicating their deals by others.

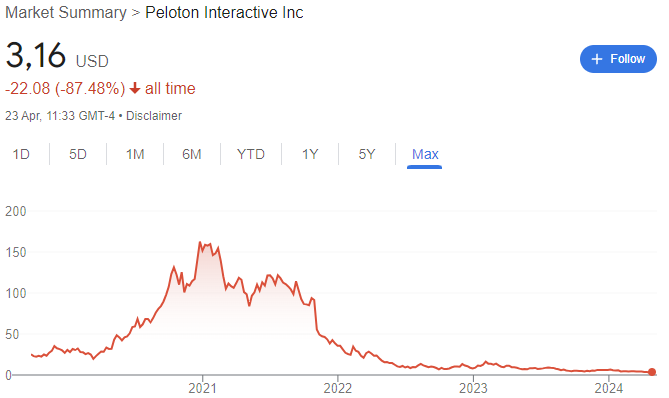

2. Peloton Interactive (PTON)

Peloton initially captivated markets with its high-end home exercise equipment and subscription-based fitness classes, which gained a huge following during the COVID-19 pandemic. However, the uniqueness of its product is its primary weakness; the technology and concept of connected fitness are not proprietary and are easily duplicated. The influx of competitors offering similar products at lower prices has significantly impacted Peloton’s market position. Additionally, the post-pandemic reopening has led to decreased demand for home workout equipment, further eroding Peloton's competitive edge.

3. GoPro (GPRO)

Just like we mentioned before, GoPro is dealing with challenges because competitors can easily copy and improve their technology. There are many new options in the action camera market that offer comparable or better features at affordable prices. In addition, the advancement of smartphone cameras has made standalone action cameras less attractive to the average consumer. Despite its strong brand, GoPro has struggled to maintain its market share against these pressures.

4. TomTom (TOM2)

TomTom, once a leader in GPS technology for automobiles, has seen its competitive edge dwindle with the advent of smartphone GPS applications like Google Maps and Apple Maps. These apps offer similar or better navigation services for free, drastically reducing the demand for standalone GPS devices. TomTom has attempted to pivot towards automotive built-in systems and sports watches, but these markets are also highly competitive with numerous well-established players. The company’s reliance on hardware in an era where software solutions are dominant has further weakened its moat

5. Cinemark Holdings & AMC

The shift to streaming services like Netflix, Amazon Prime Video, and Disney+ has had a significant impact on the movie theater industry, which Cinemark and AMC both operate in. These platforms offer consumers the convenience of watching movies and shows from home, reducing the unique value proposition of traditional cinemas. Additionally, the industry has low differentiation in the services offered, with most theaters showing the same films and relying heavily on concessions for profit. The COVID-19 pandemic exacerbated this situation by accelerating consumer habits towards home entertainment, and the recovery for theaters has been slow, indicating a weakened competitive moat in the face of digital transformation

Conclusion on Weak Moats

Each of these companies shows how external industry shifts, technological advancements, and changes in consumer behavior can significantly weaken their competitive moats. Their struggles highlight the importance of adapting to rapidly changing market conditions to maintain a sustainable competitive advantage.

Companies with weak or non-existent moats face significant challenges in sustaining long-term profitability and defending their market positions. As the aforementioned examples show, such businesses frequently operate in sectors where customer loyalty is low and the goods or services they provide are simple to copy or replace. Investors and managers in these companies need to always look for new strategies to build and strengthen their advantages or focus on specific areas where they can have stronger defenses against competition.