Last week, Dino Polska published their 2024 annual report. Chances are you’ve already seen the headline numbers on social media:

Revenue: PLN 29.3 billion or €6.85 billion (+14.1% YoY)

Like-for-like sales growth: +5.3% (driven entirely by volume because prices declined)

EBITDA: PLN 2.3 billion or €537.5 million (+3.8%)

EBITDA margin: Down from 8.7% to 7.9% due to cost pressures

Net profit: PLN 1.5 billion or €350.6 million (+7.1% YoY)

Operating margin: Declined from 7.3% to 6.5%

2024 was a tough year for Dino Polska. The Polish supermarket sector has been dealing with aggressive price wars, and margins have been under pressure across the board. This competitive pressure comes especially from major discount chains like Biedronka and Lidl, who are constantly vying for market share, as well as other competitors such as Aldi and Kaufland.

But even in this environment, Dino held its ground because of their exceptional profit margins compared to competitors:

3 points you may have missed in Dino’s annual report

The numbers above are important, but they’re just the output. As an investor, you want to zoom in on how the business actually works to understand what’s driving those results. That’s how you start forming a view on future revenue and profit. The points below will help you do that.

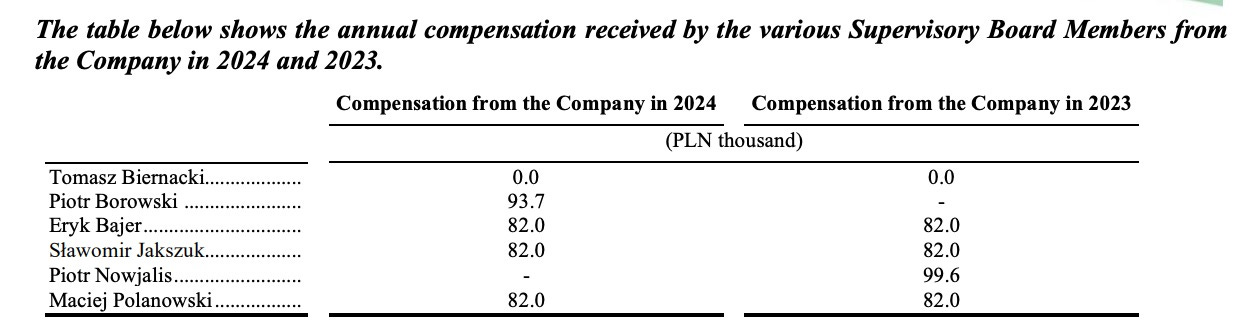

1. Management compensation didn’t increase in 2024

This is rare. In a year when inflation offered every excuse to raise salaries, Dino’s management team didn’t take more.

The numbers above show that Dino’s management is conservative and aware that 2024 was a tough year. In a low-margin industry like grocery retail, disciplined management can make or break your investment. Cost control has to be part of the company’s DNA. Some might say small details like this don’t matter much. But we believe they do.

2. Employee turnover was 21% and 13% excluding early leavers

When you exclude employees who left within their first three months, Dino’s turnover drops to 13%. That’s excellent compared to Costco’s 8% who are (arguably) the best-in-class. But for a supermarket chain, 13% is honestly quite low. Walmart, for instance, doesn’t report exact figures, but their turnover is estimated to be around 70%. In that context, Dino stands out positively.

3. Net debt decreased by 80%

This one really stood out to us. Dino’s net debt decreased by 80%, from PLN 954.8 million (€233 million) to just PLN 195.8 million (€46 million). That’s a noticeable reduction, especially considering this happened during a challenging year when the company kept growing its store base. Meanwhile, Jerónimo Martins (owner of Biedronka, Dino’s biggest competitor) increased its debt by 47% in 2024.

This, again, shows that Din’s management is disciplined and conservative, a characteristic we like to see in management.

Closing thoughts

Even though Dino Polska had a tough year, they managed to put up good results. Thereby, our original thesis remains unchanged.

Curious about our thesis? Check out the podcast analysis or our previous articles on Dino Polska:

You are welcome to share your thoughts about Dino Polska below.

Have a wonderful day.

The Dutch Investors

That was the supervisory board’s compensation you saw. The management board’s pay is what actually went up.